Australian Dollar Talking Points

AUD/USD preserves the range-bound price action from earlier this week amid growing hopes for a US-China trade deal, but the monthly opening range keeps the downside targets on the radar as the exchange rate pulls back ahead of the October-high (0.6930).

AUD/USD Exposed to Dovish Guidance as RBA Identifies Roadmap for QE

AUD/USD appears to be stuck in a narrow range as US and China officials hold a call regarding phase one of the trade deal, and headlines surrounding the negotiations may continue to influence the exchange rate as the weakening outlook for global growth puts pressure on the Reserve Bank of Australia (RBA) to further embark on its rate easing cycle.

It remains to be seen if a major announcement will be made before the Trump administration implements additional tariffs on December 15, and the ongoing shift in US trade policy may keep the RBA on its toes as “the risks to the global growth forecasts were still tilted to the downside.”

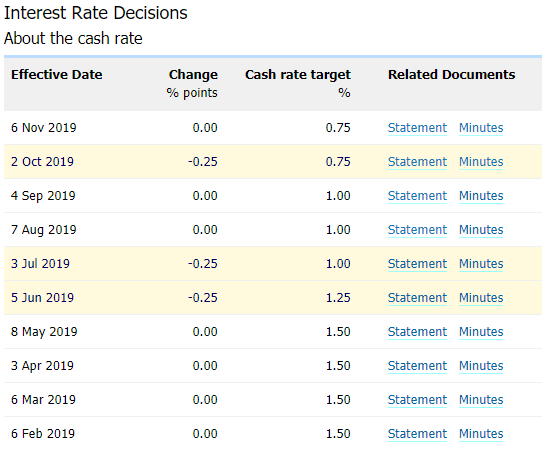

In response, the RBA may continue to endorse a dovish forward guidance as the board stands ready “to ease monetary policy further if needed,” but it seems as though the central bank will stick to the sidelines at its last meeting for 2019 as officials gauge “the effects of the earlier monetary easing.”

Nevertheless, a recent speech by Governor Philip Lowe indicates the central bank will continue to push monetary policy into uncharted territory as the central bank head states that “our current thinking is that QE becomes an option to be considered at a cash rate of 0.25 per cent.”

Governor Lowe followed up the dovish statement by saying that “QE is not on our agenda at this point in time,” but the comments suggest the central bank will continue to insulate the economy with lower interest rates as China, Australia’s largest trading partner, struggles to reach a trade deal with the Trump administration.

With that said, AUD/USD may face a more bearish fate ahead of the next RBA meeting on December 3, and the monthly opening range keeps the downside targets on the radar as the exchange rate pullbacks ahead of the October-high (0.6930).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

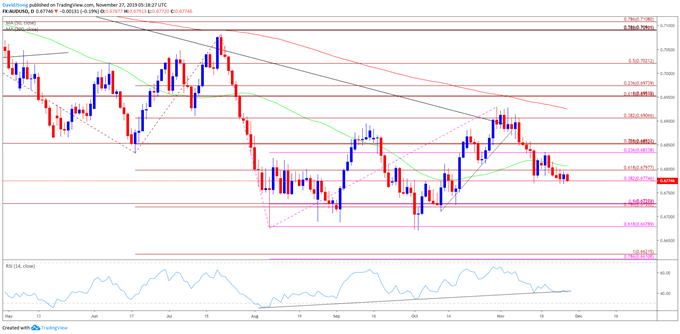

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.6925), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- A similar scenario appears to be taking shape in November as the correction from the yearly low (0.6671) fails to spur a test of the simple moving average, which largely lines up with the Fibonacci overlap around 0.6950 (61.8% expansion) to 0.6970 (23.6% expansion).

- In turn, the monthly opening range raises the scope for a further decline in AUD/USD as the exchange rate changes course ahead of the October-high (0.6930) and snaps the upward trend from the previous month.

- Will keep a close eye on the Relative Strength Index (RSI) as it starts to threaten the upward trend carried over from August, with a break of trendline support offering a bearish signal.

- As a result, lack of momentum to hold above the overlap around 0.6780 (38.2% expansion) to 0.6800 (61.8% expansion) may spur a move towards the 0.6720 (78.6% expansion) to 0.6730 (50% expansion) region, with the next area of interest coming in around 0.6680 (61.8% expansion), which lines up with the yearly low (0.6671).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.