USD/JPY & USD/CHF SLIDE AFTER US INFLATION REPORT, FED CHAIR POWELL ON DECK

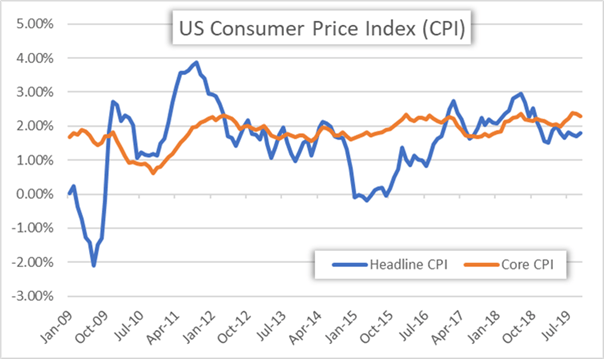

- The US Consumer Price Index (CPI) climbed to 1.8% for October and topped market estimates of 1.7% but core inflation slid modestly to 2.3% from last month’s 2.4% print

- USD/JPY and USD/CHF had mixed reactions to the CPI data as forex traders await the latest commentary from Fed Chair Powell later this afternoon

- Enhance your market knowledge with our free Forecasts & Trading Guides available for download

The headline US CPI figure for October just crossed the wires at a hotter-than-expected 1.8% compared to market estimates looking for a 1.7% reading. However, core CPI – reflecting underlying inflation excluding volatile changes in food and energy prices – softened modestly to 2.3% from 2.4% reported last month.

US CONSUMER PRICE INDEX: HEADLINE CPI & CORE CPI

The mixed CPI report caused USD price action to swing immediately following the release, but the US Dollar is starting to edge lower as forex traders digest the US inflation data.I noted in the US Dollar Price Volatility Report published yesterday that a firm reading on headline US inflation or core CPI could send the US Dollar rocketing higher, though the softening core CPI figure could be dampening prospects for a firming FOMC. This is considering recent remarks from Fed Chair Powell who stated during the October Fed Meeting that the central bank would ‘need to see a really significant rise in inflation’ before considering hiking interest rates.

CHART OF USD/JPY: 5-MINUTE TIME FRAME (NOVEMBER 13, 2019 INTRADAY)

Spot USD/JPY rose slightly from 108.85 to 108.90 immediately following the CPI report, but the interest rate sensitive currency pair subsequently slid to intraday lows.

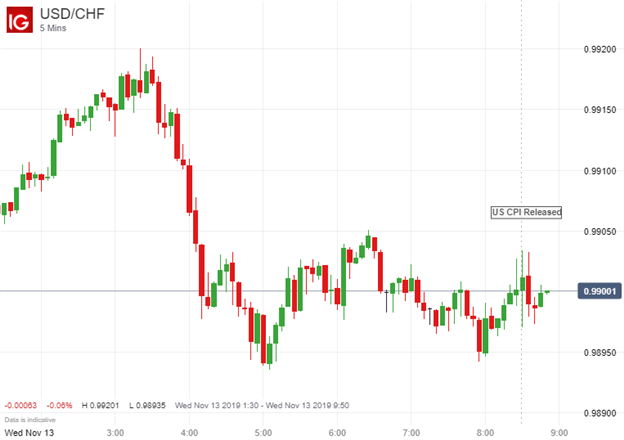

CHART OF USD/CHF: 5-MINUTE TIME FRAME (NOVEMBER 13, 2019 INTRADAY)

Similarly, spot USD/CHF oscillated in response to the latest US inflation data. The US Dollar remains broadly on its back foot with the sentiment-geared Swiss Franc and Japanese Yen gaining ground as risk appetite wanes.

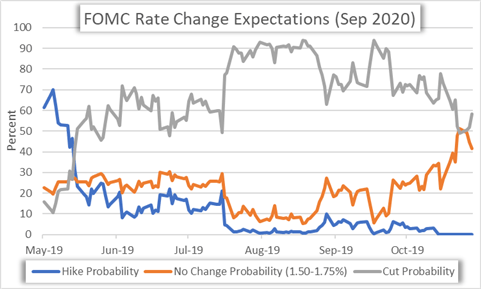

FOMC INTEREST RATE CHANGE PROBABILITIES (SEPTEMBER 2020)

Changes in Fed rate cut expectations was most notable at the central bank’s September 2020 meeting. The probability that the FOMC cuts rates by then rose from 51.9% yesterday to 58.3% following the CPI figures. Markets await a speech from Fed Chair Powell who will address the Congressional Joint Economic Committee today at 16:00 GMT.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight