Canadian Dollar Talking Points

USD/CAD struggles to retain the advance from the start of the week and the exchange rate may continue to give back the rebound from the previous month amid the failed attempt to test the September-high (1.3383).

USD/CAD Rate Forecast: September Range on Radar Ahead of Canada CPI

USD/CAD is back under pressure as ‘phase one’ of the US-China trade deal does little to curb bets for another Federal Reserve rate cut.

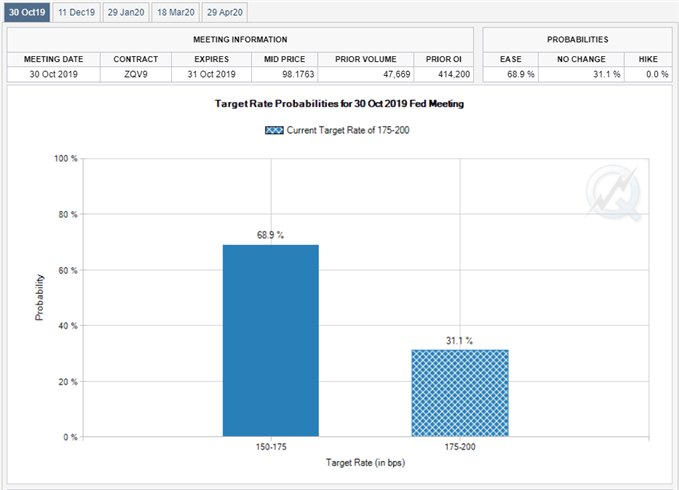

In fact, Fed Fund futures still show a greater than 60% probability for another 25bp reduction on October 30, and the Federal Open Market Committee (FOMC) may take additional steps to combat the risks surrounding the US economy as the central bank plans to purchase $60B/month in Treasury bills starting on October 15.

The unexpected announcement suggests the FOMC will utilize its non-standard measures to support the economic expansion as Fed officials see the benchmark interest rate around 1.50% to 1.75% through 2020.

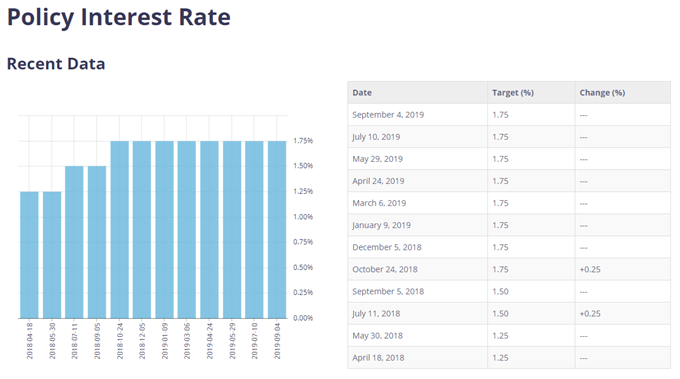

In contrast, the Bank of Canada (BoC) may follow a different path compared to its US counterpart as the economy adds 53.7K jobs in September.

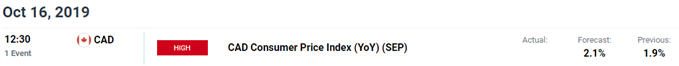

Fresh developments coming out of the Canadian economy may encourage the BoC to retain a wait-and-see approach for monetary policy as updates to the Consumer Price Index (CPI) are anticipated to show the headline reading for inflation climbing to 2.1% from 1.9% per annum in August.

In turn, the BoC may keep the benchmark interest rate on hold at its next meeting on October 30, and Governor Stephen Poloz and Co. appears to be on track to retain the current policy throughout the remainder of the year as “Canada’s economy is operating close to potential and inflation is on target.”

With that said, the diverging paths for monetary policy casts a bearish outlook for USD/CAD, and the exchange rate may continue to give back the advance from the previous month following the failed attempt to test the September-high (1.3383).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for USD/CAD is no longer constructive as it clears the February-low (1.3068), with the break of trendline support fostering a bearish outlook for the exchange rate.

- At the same time, the rebound from the 2019-low (1.3016) appears to have stalled ahead of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), but recent developments in both price and the Relative Strength Index (RSI) warns of range-bound conditions as they break out of the bearish formation from earlier this year.

- As a result, lack of momentum to hold above the Fibonacci overlap around 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement) has spurred a move back towards 1.3220 (50% retracement), with the 1.3120 (61.8% retracement) to 1.3130 (61.8% retracement) region on the radar as it lines up with the September-low (1.3134).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.