Canadian Dollar Talking Points

The recent rebound in USDCAD appears to be have stalled following the Federal Open Market Committee (FOMC) interest rate decision, and the failed attempt to test the monthly-high (1.3383) brings the downside targets back on the radar as the Relative Strength Index (RSI) continues to track the bearish formation carried over from August.

USDCAD Rate Rebound Sputters Amid Divided FOMC

USDCAD appears to be stuck in a narrow range amid the growing divide at the Federal Reserve, but it seems as though the central bank will continue to insulate the US economy as a number of Fed officials project a lower trajectory for the benchmark interest rate.

It remains to be seen if the FOMC will reverse the four rate hikes from 2018 as the Summary of Economic Projections (SEP) show the Fed Funds rate around 1.50% to 1.75% ahead of 2020, but it seems as though the central bank will continue to prepare US households and businesses for lower interest rates as St. Louis Fed President James Bullard, a 2019-voting member, insists that “the FOMC may choose to provide additional accommodation going forward.”

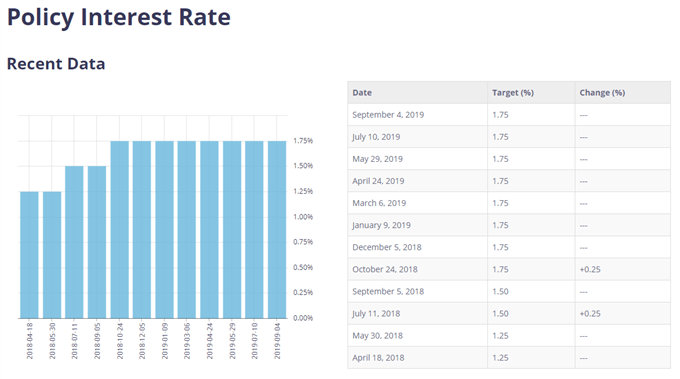

In contrast, the Bank of Canada (BoC) appears to be on track to retain the current policy at the next meeting on October 30 as “Canada’s economy is operating close to potential.”

At the same time, the fresh updates to the Consumer Price Index (CPI) may do little to alter the monetary policy outlook as the gauge for inflation prints at 1.9% in August, with the reading holding near the 2.0% target.

In turn, the BoC may largely endorse a wait-and-see approach throughout the remainder of the year while the FOMC takes steps to “help keep the US economy strong,” and USDCAD may exhibit a more bearish behavior over the coming months amid the diverging paths for monetary policy.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

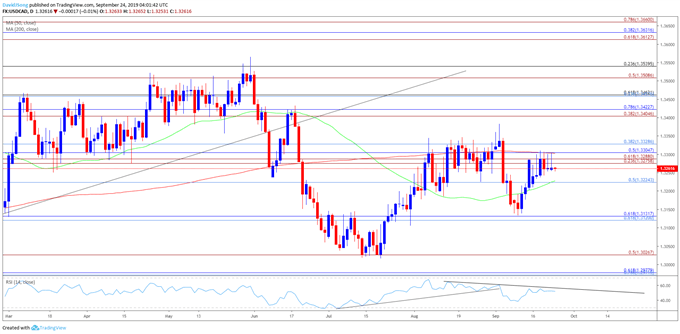

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for USDCAD is no longer constructive as it clears the February-low (1.3068), with the break of trendline support fostering a bearish outlook for the exchange rate.

- At the same time, the rebound from the 2019-low (1.3016) appears to have stalled ahead of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), with the Relative Strength Index (RSI) offering a bearish signal as the oscillator snaps the bullish formation from July.

- More recently, the RSI has started to track the downward trend from August, with USDCAD appears to have marked a failed run at the monthly-high (1.3383) amid the lack of momentum to push back above the Fibonacci overlap around 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement).

- As a result, a break/close below 1.3220 (50% retracement) will bring the downside targets back on the radar, with the first area of interest coming in around 1.3120 (61.8% retracement) to 1.3130 (61.8% retracement) followed by the 1.3030 (50% expansion) region.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.