Canadian Dollar Talking Points

USDCAD struggles to retain the rebound from earlier this week, but updates to the US Consumer Price Index (CPI) may keep the exchange rate afloat as the figures are anticipated to highlight sticky inflation.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

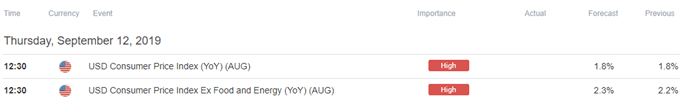

USDCAD has been under pressure following the Bank of Canada (BoC) meeting as the central bank endorses a wait-and-see approach for monetary policy, but developments coming out of the US may sway the near-term outlook for the exchange rate as the CPI is anticipated to hold steady at 1.8% for the second consecutive month.

At the same time, the core rate of inflation is projected to increase to 2.3% from 2.2% in July, and signs of stick price growth may influence the monetary policy outlook as Federal Reserve Chairman Jerome Powell asserts that the economic outlook remains “favorable.”

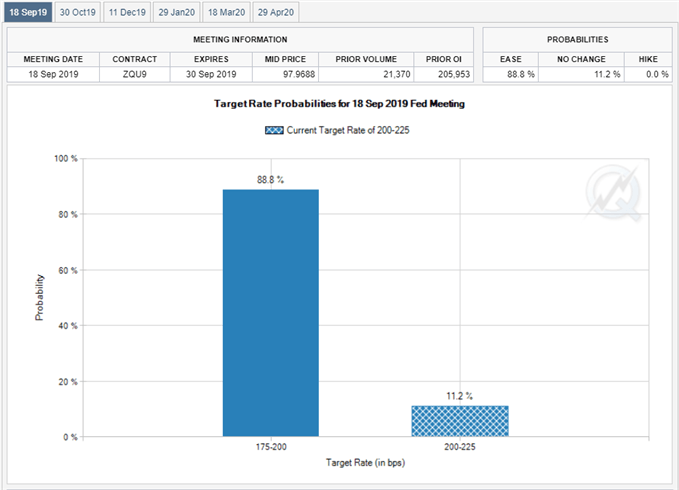

However, it remains to be seen if the Federal Open Market Committee will continue to insulate the US economy as Fed Fund futures still highlight overwhelming expectations for a 25bp reduction on September 18, and the central bank may come under increased pressure to implement a rate easing cycle as President Donald Trump tweets that the “the Federal Reserve should get our interest rates down to zero or less.”

In turn, the FOMC may continue to alter the forward guidance for monetary policy, and market participants are likely to pay increased attention to the Summary of Economic Projections (SEP) as a growing number of Fed officials forecast a lower trajectory for the benchmark interest rate.

With that said, the Canadian Dollar may outperform its US counterpart over the coming days, and the diverging paths for monetary policy may spur a broader shift in USDCAD behavior as the exchange rate snaps the upward trend carried over from the previous year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

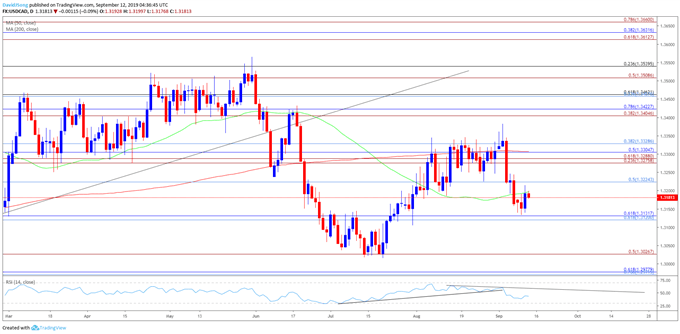

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for USDCAD is no longer constructive as the exchange rate clears the February-low (1.3068), with the break of trendline support fostering a bearish outlook for Dollar Loonie.

- At the same time, the rebound from the 2019-low (1.3016) appears to have stalled ahead of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), with the Relative Strength Index (RSI) offering a bearish signal as the oscillator snaps the bullish formation from July.

- However, the lack of momentum to break/close below the Fibonacci overlap around 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement) may generate range-bound conditions, with a move above 1.3220 (50% retracement) raising the risk for a move back towards the 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement) region.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.