Gold Price Talking Points

The price of gold extends the decline from the monthly-high ($1557) as US Treasury Secretary Steven Mnuchin insists the Trump administration is making “a lot of progress” in negotiating a trade deal with China, and recent price action points to a larger pullback as the precious metal continues to carve a series of lower highs and lows.

Gold Prices Risk Larger Pullback on Hopes for US-China Trade Deal

Gold prices remain under pressure as US Treasury yields recover from yearly lows, and the current environment may continue to drag on the price for bullion as China Premier Li Keqiang states that “we welcome enterprises from all over the world, including the United Sates, to expand economic and trade investment in China for win-win results.”

Signs of a looming US-China trade deal may continue to sap the appeal of gold as Vice Premier Liu He plans to visit the states next month, and it remains to be seen if the Federal Reserve will take additional steps to insulate the economy as President Donald Trump tweets “there is no recession.”

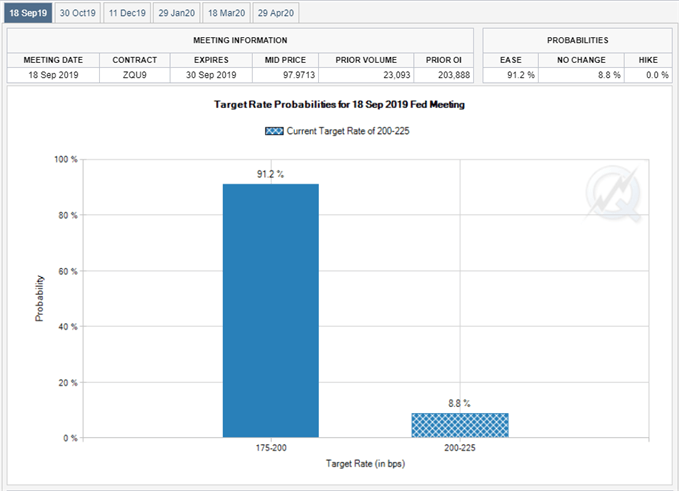

Keep in mind, Fed Fund futures still highlight overwhelming expectations for back-to-back rate cuts even though Chairman Jerome Powell asserts that the economic outlook remains “favorable,” and the ongoing shift in US trade policy may spur a growing dissent within the Federal Open Market Committee (FOMC) as St. Louis Fed President James Bullard, a 2019-voting member, argues that the central bank “should have a robust debate about moving 50 basis points” at its quarterly meeting scheduled for September 18.

With that said, the threat of a policy error may encourage market participants to hedge against fiat currencies, and the weakening outlook for global growth along with the inverting US yield curve are likely to keep gold prices afloat as there appears to be a flight to safety.

However, recent price action points to a larger pullback as the price for gold continues to carve a series of lower highs and lows, with the Relative Strength Index (RSI) snapping the bullish formation from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

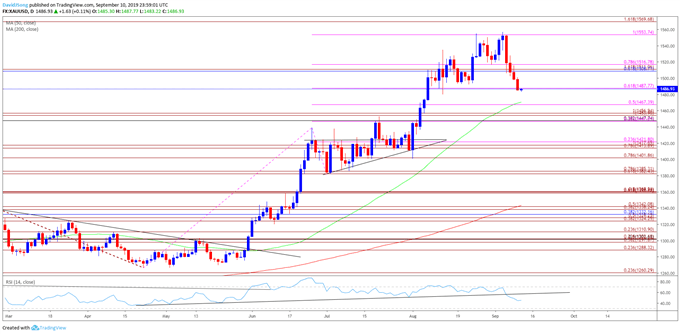

Gold Price Daily Chart

Source: Trading View

- The broader outlook for gold prices remain constructive as both price and the Relative Strength Index (RSI) clear the bearish trends from earlier this year, with the precious metal breaking out of a near-term holding patternfollowing the failed attempt to close below the $1402 (78.6% expansion) region.

- Moreover, gold prices have pushed to a fresh yearly-high ($1557) in September, but recent developments in the RSI suggests the bullish momentum will continue to abate ahead of the Fed meeting as the oscillator fails to preserve the upward trend carried over from April.

- In turn, gold remains at risk for a larger pullback as it carves a series of lower highs and lows following the failed attempt to close above $1554 (100% expansion), with the break/close below $1488 (61.8% expansion) bringing the $1467 (50% expansion) region on the radar.

- Next area of interest comes in around $1467 (50% expansion) followed by the former-resistance zone around $1447 (38.2% expansion) to $1457 (100% expansion).

For more in-depth analysis, check out the 3Q 2019 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.