Australian Dollar Talking Points

The recent breakout in AUDUSD appears to be unfazed by dismal data prints coming out of China, Australia’s largest trading partner, and the exchange rate may stage a larger rebound over the coming days as it carves a series of higher highs and lows.

AUDUSD Rebound Unfazed by Dismal China Trade Balance as PBOC Cuts RRR

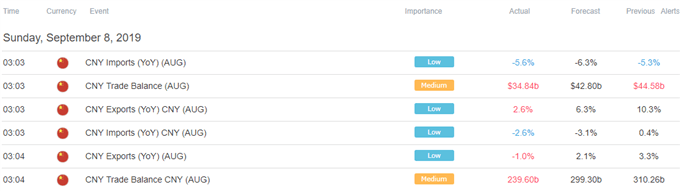

AUDUSD sits near the monthly-high (0.6862) even though China’s Trade Balance surplus narrows to $34.84B from a revised $44.58B in July as the People’s Bank of China (PBoC) plans to lower the reserve requirement ratio (RRR) by 0.5 percentage points starting on September 16.

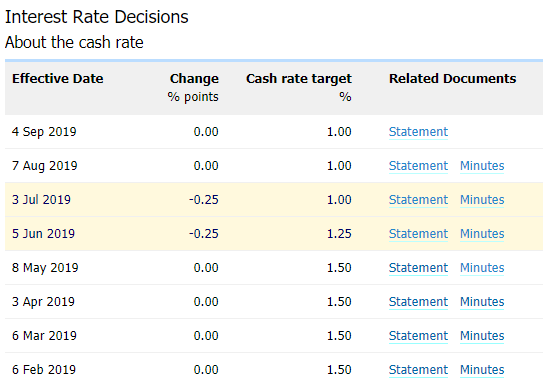

The response by the PBoC may keep the Reserve Bank of Australia (RBA) on the sidelines as Chinese officials plan to implement additional RRR cuts on October 15 and November 15, and Governor Philip Lowe & Co. may stick to the same script at the next meeting on October 1 as “the outlook for the global economy remainsreasonable.”

With that said, it remains to be seen if the US and China will strike a trade deal as Vice Premier Liu He plans to visit the states next month, and the renewed negotiations may keep AUDUSD afloat as President Donald Trump tweets “talks happening, good for all.”

However, little evidence of a looming US-China trade deal may force the RBA to further insulate the economy as “growth in Australia over the first half of this year has been lower than earlier expected,” and the central bank may reiterate its pledge to “ease monetary policy further if needed” amid the weakening outlook for global growth.

In turn, the dovish forward guidance for monetary policy may continue to produce headwinds for the Australian dollar, but recent price action keeps the former-support zone around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) on the radar as the exchange rate preserves the bullish sequence from the previous week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

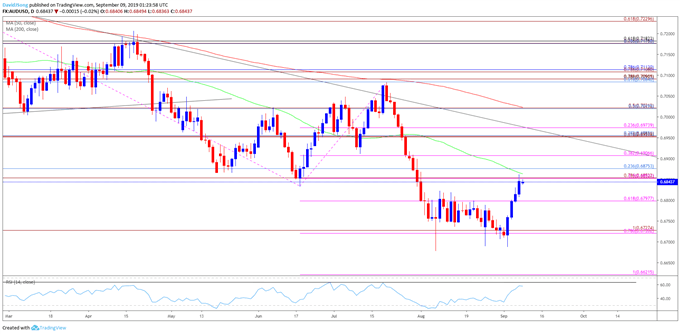

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7023), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- With that said, the broader outlook for AUDUSD remains tilted to the downsideas both price and the Relative Strength Index (RSI) continue to track the bearish formations from late last year.

- However, AUDUSD may stage a larger rebound over the coming days as it breaks out of the range-bound price action from the previous month, with the failed attempt to test the August-low (0.6677) bringing the former-support zone on the radar as the exchange rate carves a series of higher highs and lows.

- Need a close above the 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) region to favor a larger rebound, with the next area of interest coming in around 0.6910 (38.2% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.