Canadian Dollar Talking Points

USDCAD is back under pressure following the Federal Reserve meeting, and the exchange rate appears to be on track to test the monthly-low (1.3238) as it initiates a series of lower highs and lows.

USDCAD Rate Eyes Monthly Low as FOMC Adjusts Interest Rate Forecast

USDCAD extends the decline from earlier this week as the Federal Open Market Committee (FOMC) adjusts the forward guidance for monetary policy, with a growing number of Fed officials showing a greater willingness to switch gears over the coming months.

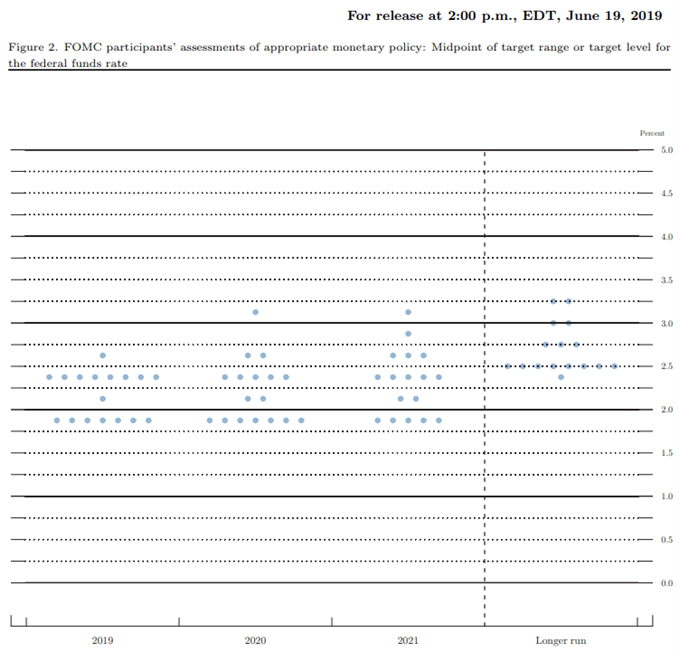

The fresh updates to the Summary of Economic Projections (SEP) indicate there’s a growing dissent in the FOMC as the interest rate dot-plot shows eight Fed officials now projecting a lower trajectory for the benchmark interest rate.

The accompanying statement also suggests the Federal Reserve will abandon the wait-and-see approach for monetary policy as “many FOMC participants now see that the case for somewhat more accommodative policy has strengthened.”

It seems as though it will only be a matter of time before the Fed reverses the four rate hikes from 2018 as the “apparent progress on trade turned to greater uncertainty,” and the ongoing shift in US trade policy may push Chairman Jerome Powell and Co. to insulate the economy as the Trump administration relies on tariffs to push its agenda.

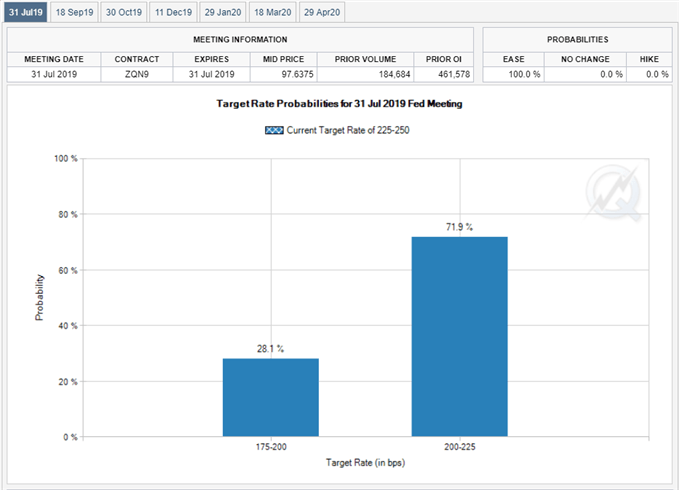

As a result, the US Dollar stands at risk of facing headwinds over the coming months as Fed Fund futures now reflect a greater than 60% probability for a rate cut at the next interest rate decision on July 31.

In contrast, the Bank of Canada (BoC) may face a different fate as the Consumer Price Index (CPI) climbs to 2.4% from 2.0% per annum in April.

Signs of sticky inflation may encourage the BoC to retain the current policy at the next meeting on July 10 as “the slowdown in late 2018 and early 2019 is being followed by a pickup starting in the second quarter.”

In turn, the current environment may keep USDCAD under pressure over the coming days, with the exchange rate at risk of exhibiting a more bearish behavior over the near-term as it snaps the upward trend from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

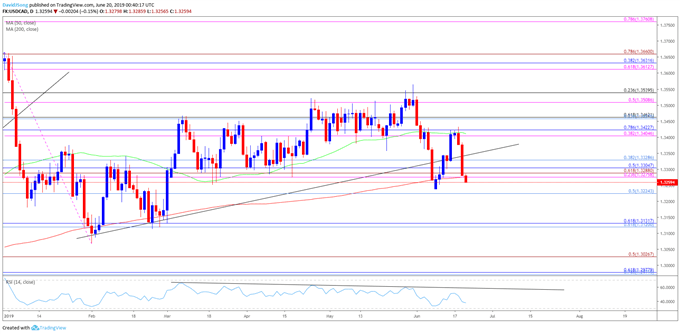

USD/CAD Rate Daily Chart

- Near-term outlook for USDCAD is no longer constructive as the advance from the April-low (1.3274) stalls ahead of the 2019-high (1.3665), with the break of trendline support raising the risk for a further decline in the exchange rate.

- Downside targets are coming back on the radar for USDCAD as the advance from the monthly-low (1.3238) fails to produce a closing price above the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement).

- Lack of momentum to hold above the 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement) region raises the risk for a move towards 1.3220 (50% retracement) as the exchange rate initiates a series of lower highs and lows, with the next downside area of interest coming in around 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.