EUR/USD Rate Talking Points

EURUSD struggles to hold its ground as European Central Bank (ECB) President Mario Draghi endorses dovish forward guidance for monetary policy, but the Federal Reserve interest rate decision may keep the exchange rate afloat if the central bank shows a greater willingness to switch gears over the coming months.

EURUSD Rate Breakout Undermined by Dovish ECB Forward Guidance

EURUSD slips to a fresh weekly-low (1.1181) as ECB President Draghi strikes a caution tone and insists that “in the absence of improvement, such that the sustained return of inflation to our aim is threatened, additional stimulus will be required.”

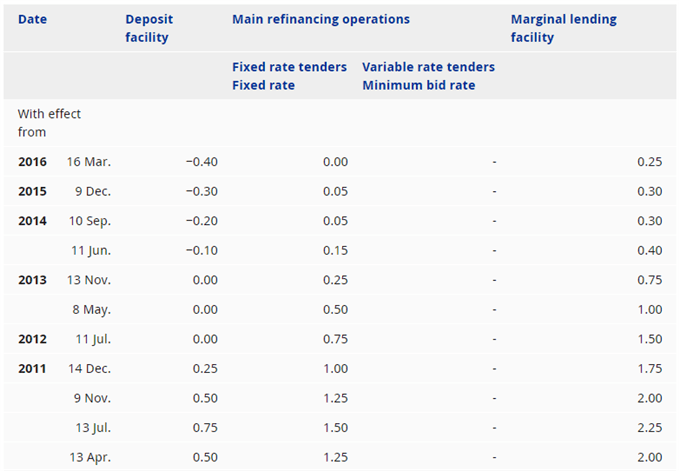

The comments suggest the Governing Council will keep the door open to further insulate the monetary union as “further cuts in policy interest rates and mitigating measures to contain any side effects remain part of our tools.” ECB officials may ultimately deploy more non-standard measures even though the central bank prepares to launch another round of Targeted Long-Term Refinance Operations (TLTRO) in September.

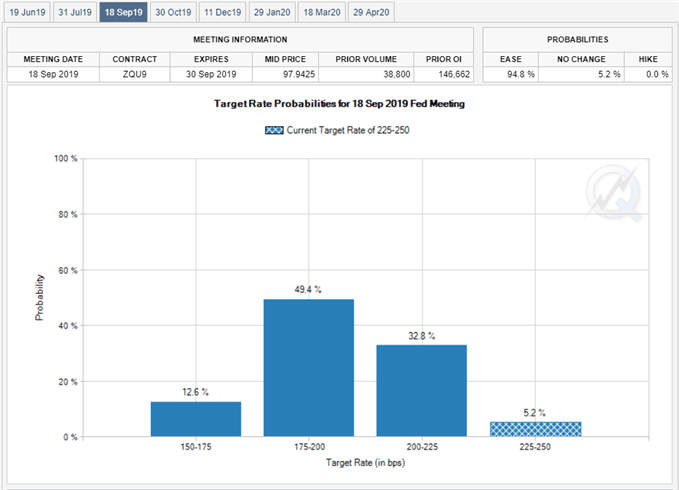

It remains to be seen if the ECB will implement a negative interest rate policy (NIRP) for the Main Refinance Rate, its flagship benchmark for borrowing costs, or reestablish its quantitative easing (QE) program as the central bank struggles to achieve its one and only mandate for price stability. The renewed pledge to support the Euro area economy may keep EURUSD under pressure as the Federal Reserve is expected to keep the benchmark interest rate in its current range of 2.25% to 2.50%.

However, the shift in trade policy may push the FOMC to alter the forward guidance for monetary policy especially as the Trump administration relies on tariffs and sanctions to push its agenda. In turn, updates to the Summary of Economic Projections (SEP) may produce headwinds for the US Dollar should Fed officials forecast a lower trajectory for the benchmark interest rate.

To that end, Fed Fund futures may continue to reflect a greater than 90% probability for September rate cut, with EURUSD at risk of exhibiting a more bullish behavior over the coming days as the exchange rate breaks out of the downward trend from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

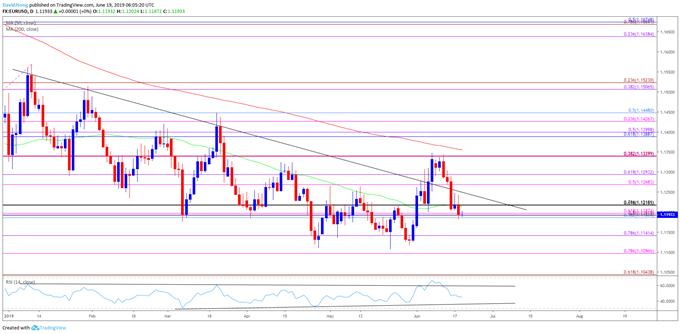

EUR/USD Rate Daily Chart

- Keep in mind, the broader outlook for EURUSD is no longer tilted to the downside as both price and the Relative Strength Index (RSI) break out of the bearish formations from earlier this year.

- With that said, EURUSD stands at risk for a larger correction as the exchange rate clears the April-high (1.1324) after failing to test the 1.1000 (78.6% expansion) handle.

- Need a move back above the 1.1270 (50% expansion) to 1.1290 (61.8% expansion) region to spur a run at the monthly-high (1.1348), with a close above the 1.1340 (38.2% expansion) bringing the 1.1390 (61.8% retracement) to 1.1400 (50% expansion) region on the radar.

- However, lack of momentum to hold above the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) region raises the risk for a move back towards 1.1140 (78.6% expansion).

For more in-depth analysis, check out the 2Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.