Japanese Yen Talking Points

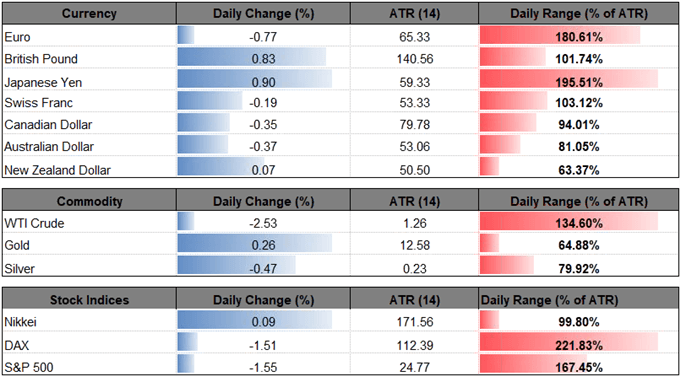

USD/JPY extends the decline following the Federal Reserve meeting even though President Donald Trump asserts that the U.S. and China are ‘getting very close’ to a trade deal, and recent price action raises the risk for a further decline in the dollar-yen exchange rate as both price and the Relative Strength Index (RSI) snap the bullish trends from earlier this year.

Shift in USD/JPYRetail Sentiment Persists Despite Bets for Fed Rate-Cut

USD/JPY trades to a fresh monthly-low (109.74) as the Federal Open Market Committee (FOMC) appears to be on track to abandoned the hiking-cycle, and the ongoing shift in the forward-guidance may continue to drag on the dollar-yen exchange rate as the fresh updates coming out of the central bank spur bets for lower interest rates.

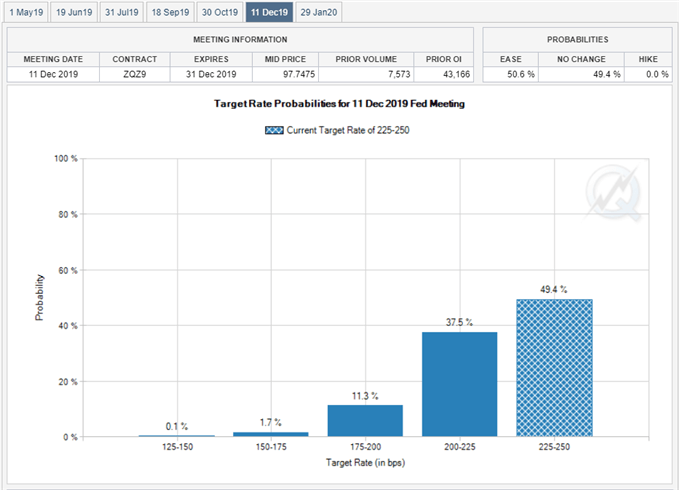

Fed Fund Futures now show market participants pricing a 50% chance for a rate-cut in December even though the FOMC endorses a wait-and-see approach for monetary policy, and developments coming out of the U.S. economy may boost bets for a more accommodative stance as ‘data arriving since September suggest that growth is slowing somewhat more than expected.’ It remains to be seen if Chairman Jerome Powell and Co. will continue to adjust the longer-run interest rate forecast as the central bank plans to wind down the $50B/month in quantitative tightening (QT) by the end of September, but the recent pickup in USD/JPY volatility appears to be shaking up market participation as retail sentiment continues to recover from an extreme reading.

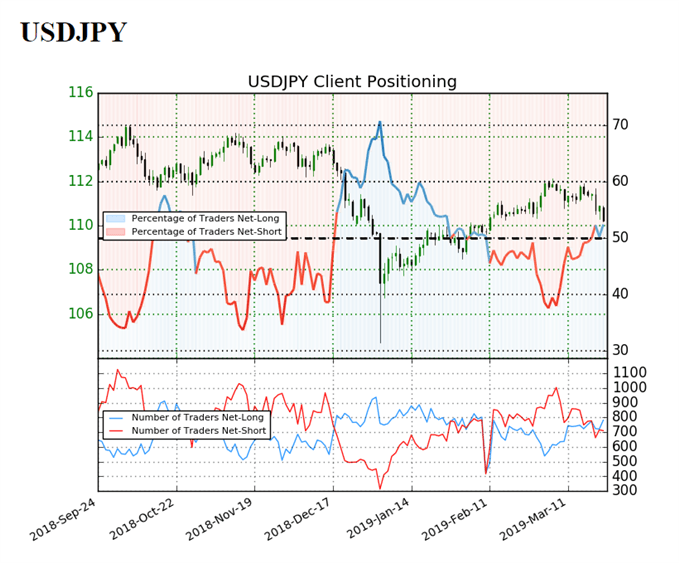

The IG Client Sentiment Report shows 52.4% of traders are now net-long USD/JPY compared to 50.6% earlier this week, with the ratio of traders long to short at 1.1 to 1.The number of traders net-long is 2.9% lower than yesterday and 8.0% higher from last week, while the number of traders net-short is 2.2% higher than yesterday and 17.7% lower from last week.

Keep in mind, traders were net-short since February 27, with the ratio slipping to an extreme reading earlier this month, but the IG Client Sentiment index has recovered since then amid a pickup in net-long interest. The flip in retail sentiment warns of a broader shift in USD/JPY behavior, with recent price action raising the risk for a further decline in the exchange rate as both price and the Relative Strength Index (RSI) snap the bullish trends from earlier this year. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

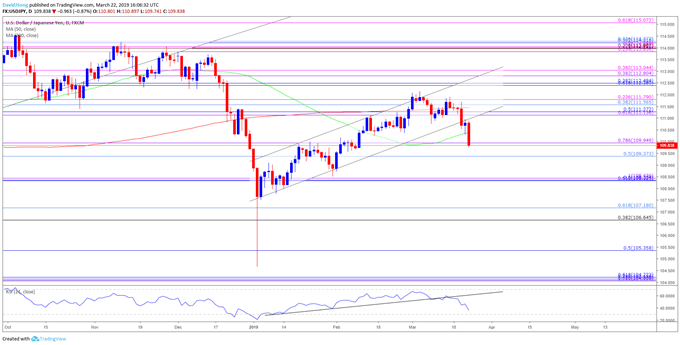

USD/JPY Daily Chart

- The USD/JPY correction following the currency market flash-crash appears to be unraveling as price and the RSI snap the bullish trends from earlier this year, with recent price action raises the risk for a further depreciation in the exchange rate as it extends the series of lower highs & lows from earlier this week.

- Break/close below the Fibonacci overlap around 109.40 (50% retracement) to 110.00 (78.6% expansion) raises the risk for a run at the February-low (108.72), which sits just above the next downside hurdle around 108.30 (61.8% retracement) to 108.40 (100% expansion), with the next area of interest coming in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement).

For more in-depth analysis, check out the Q1 2019 Forecast for the Japanese Yen

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.