Trading the News: U. of Michigan Confidence

A marked rebound in the U. of Michigan Confidence survey may keep EUR/USD under pressure as it highlights an improved outlook for the U.S. economy.

Little to no signs of a recession may put pressure on the Federal Reserve to further normalize monetary policy as the economy sits at full-employment, and a U. of Michigan print of 93.9 or higher may heighten the appeal of the dollar as renews speculation for a Fed rate-hike in 2019.

However, another sharp decline in the gauge for household sentiment may spark a bearish reaction in the dollar as it dampens the outlook for growth and inflation, and dismal development may ultimately fuel a larger rebound in EUR/USD as it encourages the Federal Open Market Committee (FOMC) to conclude the hiking-cycle ahead of schedule. Sign up and join DailyFX Currency Analyst David Song LIVE to cover the fresh updates to the U of Michigan Confidence survey.

Impact that the U. of Michigan Confidencesurvey had on EUR/USD during the last print

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JAN P 2019 | 01/18/2019 15:00:00 GMT | 96.8 | 90.7 | -8 | -12 |

January 2019 U. of Michigan Confidence

EUR/USD 5-Minute Chart

The U. of Michigan Confidence survey unexpectedly dipped to 90.7 from 98.3 in December to mark the lowest reading since 2016. A deeper look at the report showed the gauge for future expectations slipping to 78.3 from 87.0 during the same period, while the index for 12-month inflation expectations held steady at 2.7% for the second month.

The mixed data prints did little to shape up the dollar, with EUR/USD grinding lower throughout the day to close at 1.1362. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

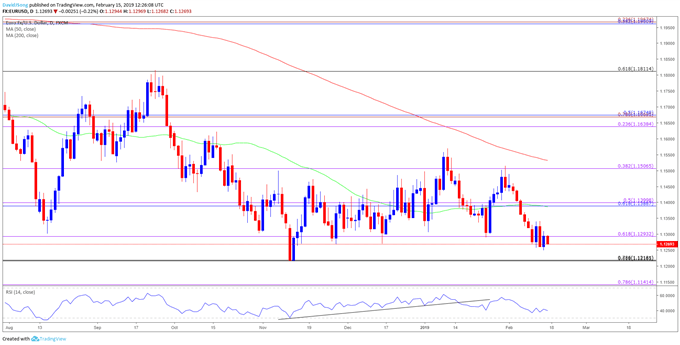

EUR/USD Daily Chart

- Keep in mind, the break above the November-high (1.1500) offers a constructive outlook for EUR/USD, but the advance from earlier this year unravels following the failed attempt to trade back above the 1.1510 (38.2% expansion) hurdle.

- As a result, the break of the January-low (1.1289) raises the risk for a run at the 2018-low (1.1216), with a break/close below 1.1220 (7.86% retracement) brining the 1.1140 (78.6% expansion) region on the radar.

For more in-depth analysis, check out the 1Q 2019 Forecast for EUR/USD

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide !

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.