Japanese Yen Talking Points

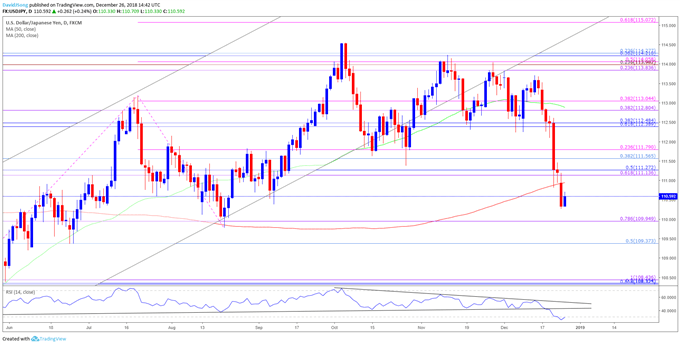

USD/JPY bounces back from the monthly-low (110.27), with U.S. Treasury yields displaying a similar behavior, but recent developments in the Relative Strength Index (RSI) raises the risk for a further depreciation in the exchange rate as the oscillator sits in oversold territory.

USD/JPY Weakness to Persist as RSI Pushes Into Oversold Territory

USD/JPY appears to be catching a bid as U.S. President Donald Trump tweets that the Federal Reserve doesn’t ‘have a feel for the Market, they don’t understand necessary Trade Wars or Strong Dollars,’ and the administration may take additional steps to shore up market sentiment as Treasury Secretary Steven Mnuchin holds a series of calls with the CEOs of the nation’s six largest banks.

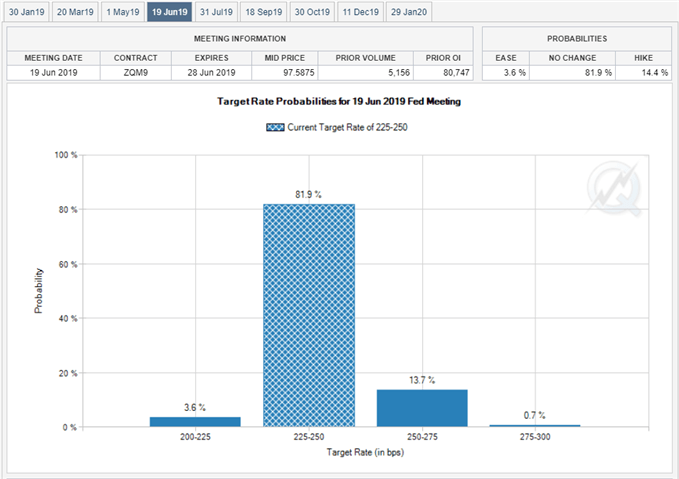

However, the current environment may keep USD/JPY under pressure even though the Federal Reserve maintains a hawkish forward-guidance for monetary policy as the ongoing government shutdown poses a risk to the economic outlook. If the stalemate in Congress carries into 2019, the Federal Open Market Committee (FOMC) may ultimately adopt a more cautious tone at the next interest rate decision on January 30, and Chairman Jerome Powell & Co. may largely endorse a wait-and-see approach over the coming months especially as Fed Fund Futures show the benchmark interest rate on hold throughout the first half of the year.

It seems as though market participants are becoming more risk adverse as the outlook for the global economy becomes clouded with increased uncertainty, and the ongoing adjustment in U.S. trade policy may push the FOMC to conclude the hiking-cycle ahead of schedule as officials ‘see growth moderating ahead.’ With that said, USD/JPY remains vulnerable as it fails to preserve the opening range for December, with the downside targets still on the radar as the pickup in volatility fuels the recent shift in retail interest.

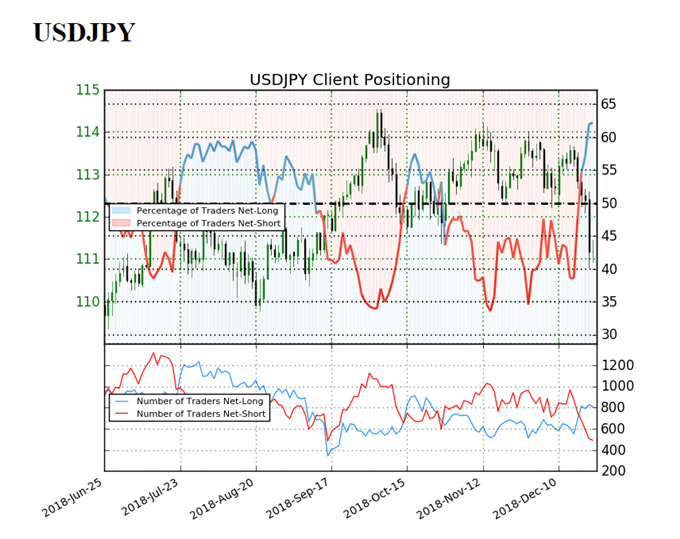

The IG Client Sentiment Report shows 62.2%of traders are now net-long USD/JPY compared to 61.3% last week, with the ratio of traders long to short at 1.65 to 1.The number of traders net-long is 2.3% lower than yesterday and 48.4% higher from last week, while the number of traders net-short is 1.2% lower than yesterday and 42.8% lower from last week.

The decline in net-short position is indicative of profit-taking behavior as USD/JPY trades near the monthly lows, but the widening tilt in retail interest offers a contrarian view to crowd sentiment, with the series of failed attempt totest the 2018-high (114.55) warning of a larger correction. Moreover, recent developments in Relative Strength Index (RSI) suggests the bearish momentum is gathering pace as the oscillator breaks below 30 and pushes into oversold territory for the first time since February. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

USD/JPY Daily Chart

- Near-term outlook for USD/JPY remains capped by the 113.80 (23.6% expansion) to 114.30 (23.6% retracement) region, with the exchange rate at risk of exhibiting a more bearish behavior as long as the Relative Strength Index (RSI) sits below 30.

- The close below the 111.10 (61.8% expansion) to 111.80 (23.6% expansion) region opens up the next downside hurdle around 109.40 (50% retracement) to 110.00 (78.6% expansion), which largely lines up with the August-low (109.77), followed by the Fibonacci overlap around 108.30 (61.8% retracement) to 108.40 (100% expansion), which coincides with the May-low (108.11).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.