Japanese Yen Talking Points

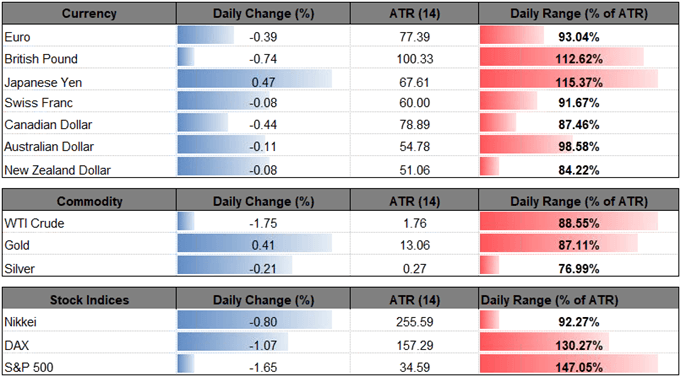

USD/JPY fails to extend the series of higher highs & lows from earlier this week even as the Federal Open Market Committee (FOMC) Minutes fuel bets for above-neutral interest rates, and the exchange rate may continue to threaten the bullish trend from earlier this year amid the ongoing shift in retail interest.

Shift in USD/JPY Sentiment Persists Even as Rebound Stalls

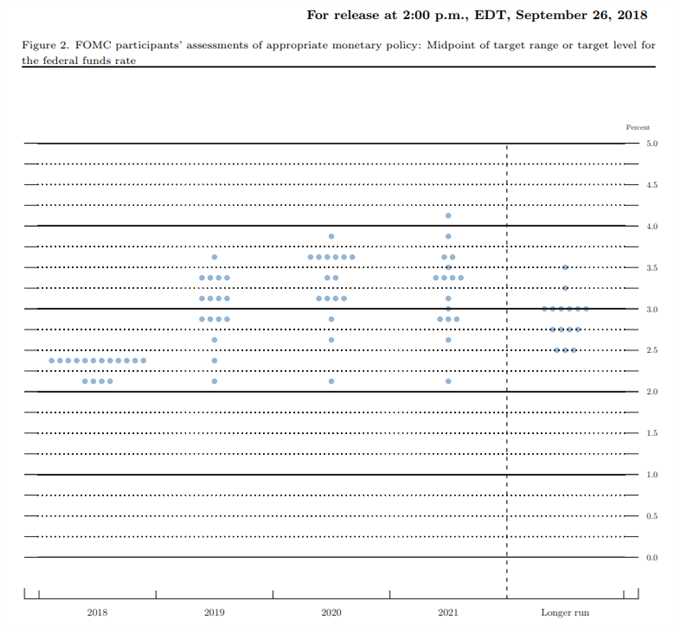

The reaction to the FOMC Minutes fosters a bullish outlook for USD/JPY as Chairman Jerome Powell & Co. adopt a more hawkish tone, and the central bank may show a greater willingness to extend its hiking-cycle as a number of officials ‘judged that it would be necessary to temporarily raise the federal funds rate above their assessments of its longer-run level in order to reduce the risk of a sustained overshooting of the Committee's 2 percent inflation objective or the risk posed by significant financial imbalances.’

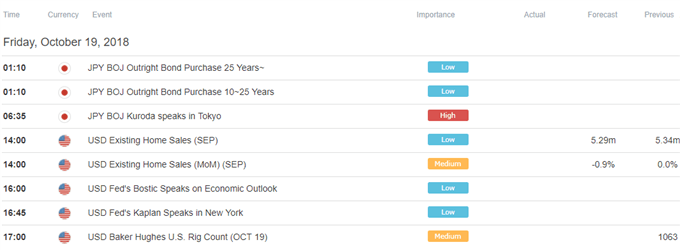

The fresh remarks suggest the FOMC may overshoot the current trajectory for the Fed Funds rate even as the transition in U.S. trade policy clouds the outlook for growth, with rising tariffs likely to sap purchasing power for households and businesses as they face higher import costs. In response, the Federal Reserve may warn of an imminent rate-hike at the next interest rate decision on November 8, and the hawkish forward-guidance for monetary policy may continue to keep USD/JPY afloat especially as the Bank of Japan (BoE) sticks to its Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control.

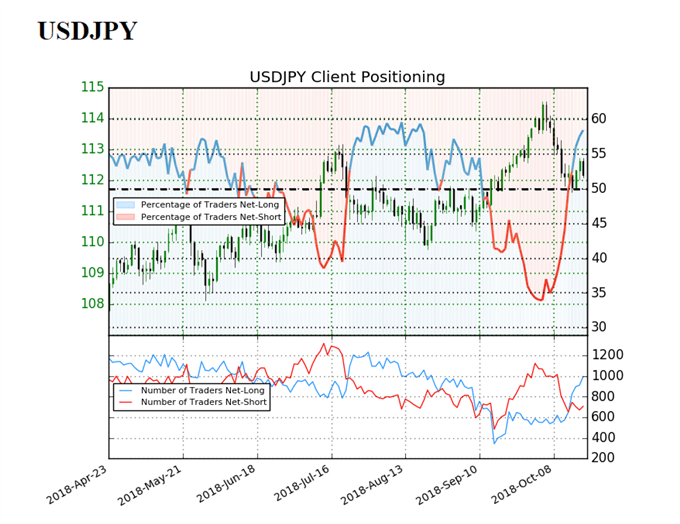

Keep in mind, the recent pickup in volatility has spurred a shift in retail interest as traders appear to be fading the selloff from the October-high (114.55), and the current environment may continue to produce gyrations in USD/JPY sentiment as the rebound in the exchange rate has largely been accompanied by a pickup in risk appetite.

The IG Client Sentiment Report shows 58.5% of traders are net-long USD/JPY, with the ratio of traders long to short at 1.41 to 1. The percentage of traders net-long is now its highest since August 13 when USD/JPY traded near the 110.70 region. The number of traders net-long is 9.0% higher than yesterday and 63.3% higher from last week, while the number of traders net-short is 3.3% lower than yesterday and 11.8% lower from last week.

The recent shift in retail interest offers a mixed signal, with the development undermining the advance in dollar-yen as it offers a contrarian view to crowd sentiment. In turn, USD/JPY may make further attempt to threaten the upward trend from earlier this year if the change in trader sentiment persists. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

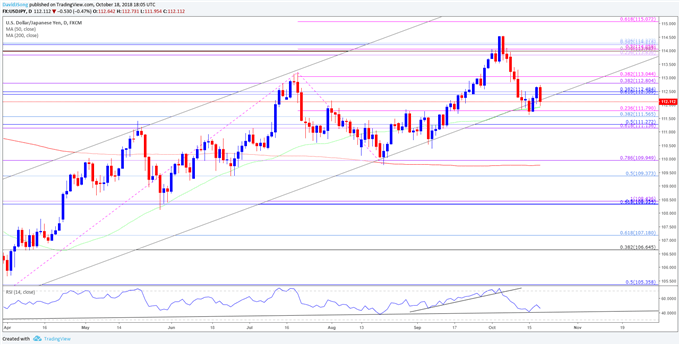

USD/JPY Daily Chart

- The failed attempt to break/close below the 111.10 (61.8% expansion) to 111.80 (23.6% expansion) hurdle may produce range-bound conditions for USD/JPY as the exchange rate struggles to retain the series of higher highs & lows from earlier this week.

- Need a move back above the 112.40 (61.8% retracement) to 113.00 (38.2% expansion) region to open up the topside targets, with the next area of interest coming in around 113.80 (23.6% expansion) to 114.30 (23.6% retracement) followed by the 2018-high (114.55).

- However, a break/close below the 111.10 (61.8% expansion) to 111.80 (23.6% expansion) hurdle brings the downside targets on the radar, with the first hurdle coming in around 109.40 (50% retracement) to 110.00 (78.6% expansion).

For more in-depth analysis, check out the Q4 Forecast for the Japanese Yen

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.