Australian Dollar Talking Points

AUD/USD struggles to hold its ground despite the bullish reaction to Australia’s Employment report, and the advance from the 2018-low (0.7041) may continue to unravel as the exchange rate initiates a fresh series of lower highs & lows.

AUD/USD Recovery Vulnerable to Fresh Series of Lower Highs & Lows

The near-term rebound in AUD/USD appears to have stalled even as Australia’s Unemployment Rate unexpectedly slipped to 5.0% in September, marking the lowest reading since 2012, and a deeper look at the report suggests the data will do little to influence the monetary policy outlook as the decline in the jobless rate was largely driven by discouraged workers leaving the labor force.

The updates revealed a downtick in the Participation Rate, with the gauge falling to 65.4% from 65.7% in August, and the developments may encourage the Reserve Bank of Australia (RBA) to retain the wait-and-see approach throughout the remainder of the year as ‘growth in household income remains low and debt levels are high.’ In turn, Governor Philip Lowe & Co. may stick to the same script at the next meeting on November 6, and the central bank may continue to tame expectations for higher borrowing-costs as ‘the low level of interest rates is continuing to support the Australian economy.’

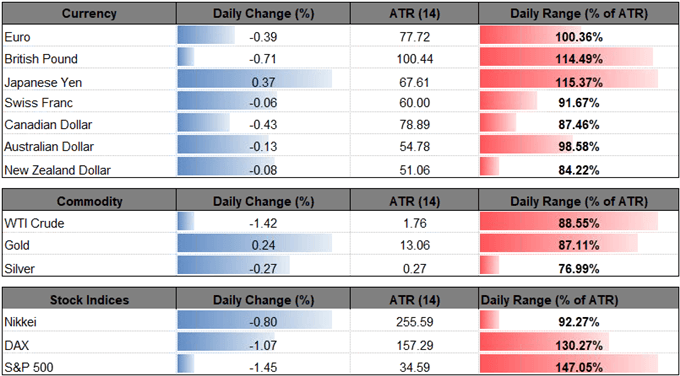

The diverging paths for monetary policy continues to foster a long-term bearish outlook for AUD/USD especially as a growing number of Federal Reserve officials show a greater to extend the hiking-cycle, and a pickup in market volatility may spur a further shift in retail interest as traders appear to be betting on a larger recovery.

The IG Client Sentiment Report shows retail interest hold near extremes as 65.4% of traders are net-long AUD/USD, with the ratio of traders long to short at 1.89 to 1. In fact, traders have remained net-long since September 24 when AUD/USD traded near 0.7270 even though price has moved 2.4% lower since then.

The ongoing slant in retail sentiment provides a contrarian view to crowd sentiment, with the broader outlook for AUD/USD still tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish formations from earlier this year. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

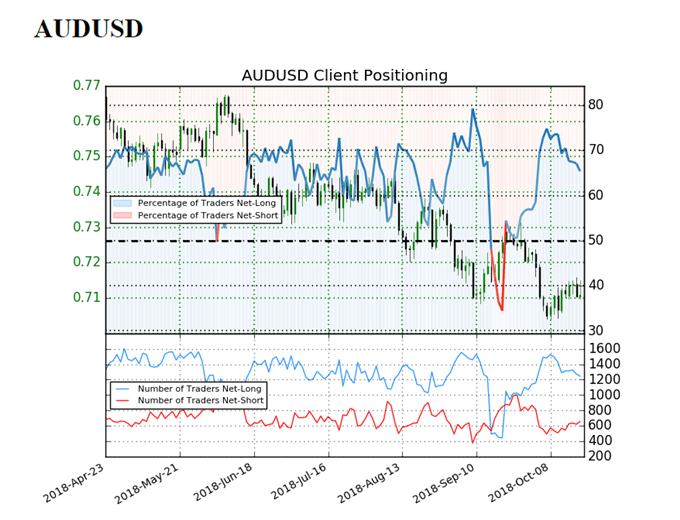

AUD/USD Daily Chart

- The failed attempt to clear the Fibonacci overlap around 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) raises the risk for further losses as AUD/USD snaps the bullish sequence from earlier this week, and the rebound from the 2018-low (0.7041) may continue to unravel as the exchange rate initiates a fresh series of lower highs & lows.

- In turn, a close below the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) area brings the 0.7020 (50% expansion) hurdle back on the radar, with the next region of interest coming in around 0.6950 (61.8% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.