Japanese Yen Talking Points

USD/JPY slips to a fresh monthly-low (111.97) amid the recent rout in risk appetite, and the exchange rate may stage a larger correction over the remainder of the week as it extends the series of lower highs carried over from the previous week.

USD/JPY Rate Outlook Mired by Lower Highs, Lackluster U.S. CPI

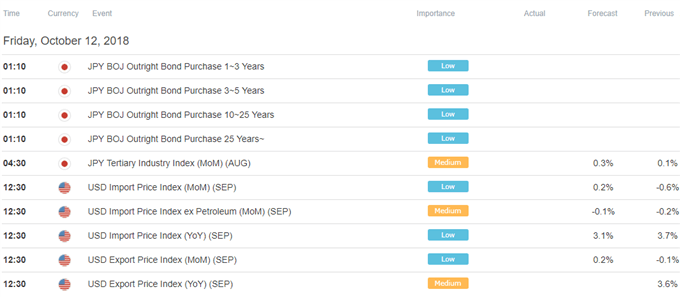

The fresh updates to the U.S. Consumer Price Index (CPI) have done little to prop up USD/JPY as the headline reading narrows more-than-expected in September, with the figure slipping to 2.3% from 2.7% per annum the month prior.

A deeper look at the report showed the core rate of inflation also falling short of market expectations as the gauge held steady at 2.2% for the second consecutive month, and signs of easing price pressures may start to sway the outlook for monetary policy as the development highlights a limited threat for above-target inflation.

The recent batch of lackluster data prints may force the Federal Open Market Committee (FOMC) to soften its hawkish tone especially as President Donald Trump warns that the ‘Fed is making a mistake,’ but it seems as though Chairman Jerome Powell & Co. have little to no interest in deviating from the hiking-cycle as the central bank largely achieves its dual mandate for full-employment and price stability.

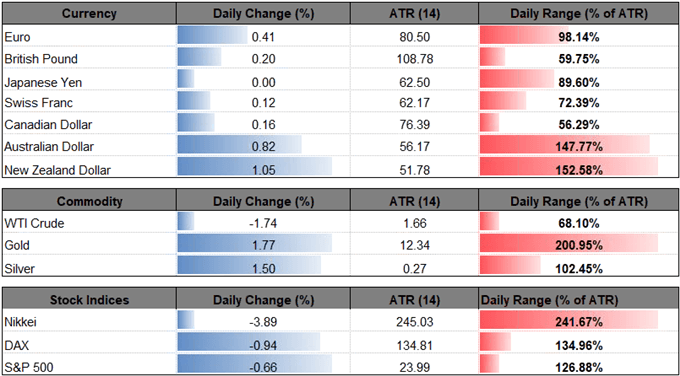

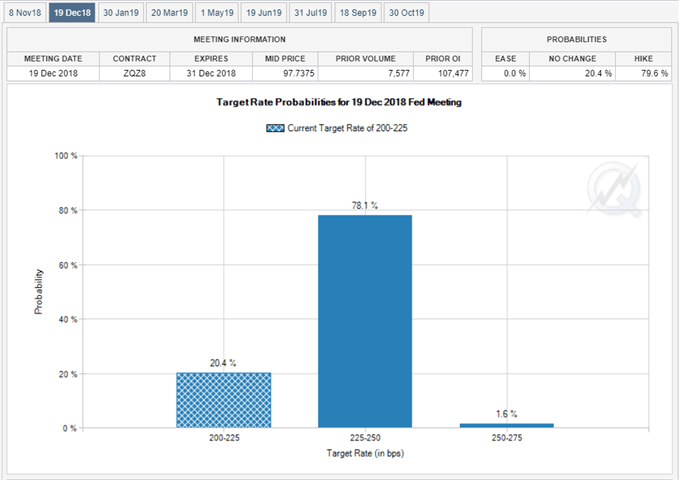

With that said, Fed Fund Futures may continue to reflect expectations for another 25bp rate-hike at the next quarterly meeting in December, and the material shift in retail interest may continue to materialize over the near-term amid the pickup in market volatility.

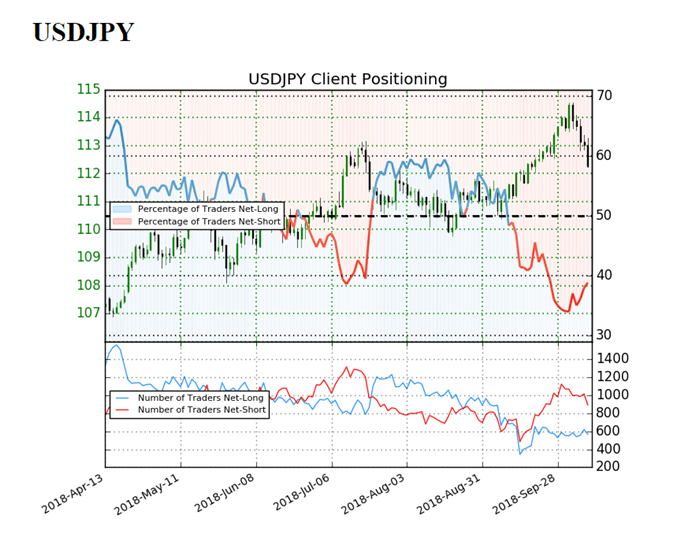

The IG Client Sentiment Report shows 38.8% of traders are net-long USD/JPY, with the ratio of traders short to long at 1.58 to 1.In fact, traders have remained net-short since September 13 when USD/JPY traded near the 111.20 region even though price has moved 1.0% higher since then.The number of traders net-long is 12.4% lower than yesterday and 4.5% lower from last week, while the number of traders net-short is 15.7% lower than yesterday and 14.4% lower from last week.

The ongoing skew in retail position offers a contrarian view to crowd sentiment, but recent price action keeps the downside targets on the radar as the exchange rate extends the series of lower highs carried over from the previous week. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

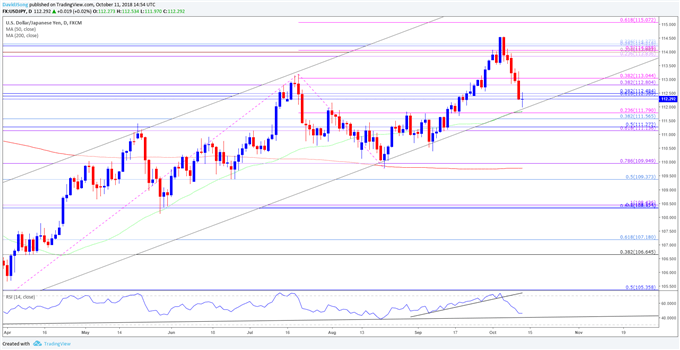

USD/JPY Daily Chart

- Keep in mind, the broader outlook for USD/JPY remains constructive as the exchange rate finally marks a closing price action the 113.80 (23.6% expansion) to 114.30 (23.6% retracement) region, with the exchange rate still tracking the upward trending channel from earlier this year.

- However, USD/JPY may stage a larger correction following the failed run at the November 2017-high (114.74), with the 111.10 (61.8% expansion) to 111.80 (23.6% expansion) region now on the radar as the exchange rate approaches channel support.

- A break/close below the stated region may warn of a broader shift in USD/JPY, with the next downside region of interest coming in around 109.40 (50% retracement) to 110.00 (78.6% expansion).

For more in-depth analysis, check out the Q4 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.