Oil Talking Points

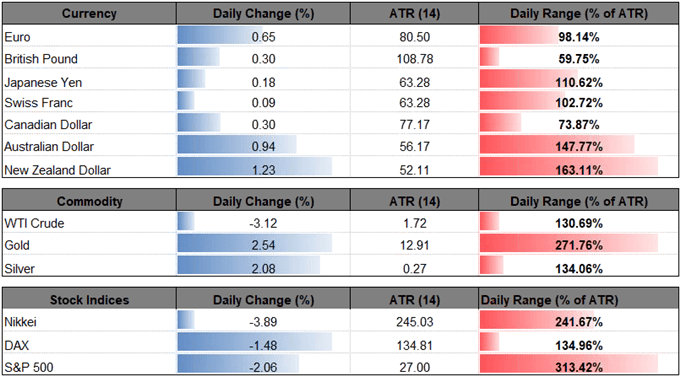

Crude extends the decline from earlier this week as fresh updates from the U.S. Department of Energy (DoE) show a further buildup in oil inventories, and recent developments keep the downside targets on the radar as both price and the Relative Strength Index (RSI) snap the bullish formations from August.

Oil Price Weakness to Persist as Bullish Formations Snap

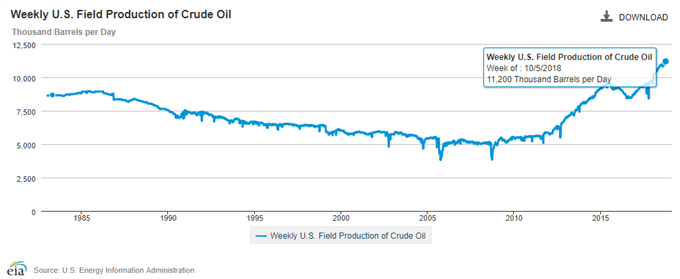

The ongoing pickup in energy inventories is likely to keep oil prices under pressure as the report also shows U.S. field production of crude climbing to 11,200 b/d in the week ending October 5, and the current environment may foster a larger correction in oil especially as the Organization of the Petroleum Exporting Countries (OPEC)see less demand in 2019.

OPEC’s Monthly Oil Market Report (MOMR) now calls for slower consumption in the year ahead, with the organization forecasting world oil demand growth at ‘1.36 mb/d, down by around 50 tb/d from last month’s projections, mainly reflecting adjustments in the economic projections for Turkey, Brazil and Argentina.’

Keep in mind, OPEC and its allies have shown little to no interest in boosting production as the U.S. sanctions on Iran are set to kick in next month, and it seems as though the group will stick to the current quota ahead of the next meeting on December 6 even as the International Monetary Fund (IMF) cuts its world growth forecast for the first time since 2016.

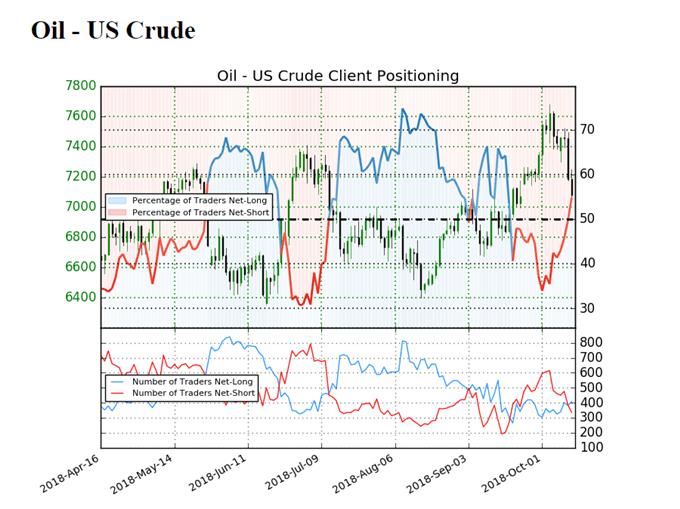

Nevertheless, the IG Client Sentiment Report also warns of a larger pullback in oil prices as the recent selloff has been accompanied by a shift retail interest. The gauge now shows 54.8% of traders are net-long crude, with the ratio of traders long to short at 1.21 to 1. The number of traders net-long is 4.3% higher than yesterday and 12.4% higher from last week, while the number of traders net-short is 27.3% lower than yesterday and 42.9% lower from last week.

The sharp jump in net-long interest suggests traders are attempting to fade the weakness in oil, and a further shift in crowd sentiment may offer a contrarian view especially as both price and the Relative Strength Index (RSI) snap the bullish formations from earlier this year. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

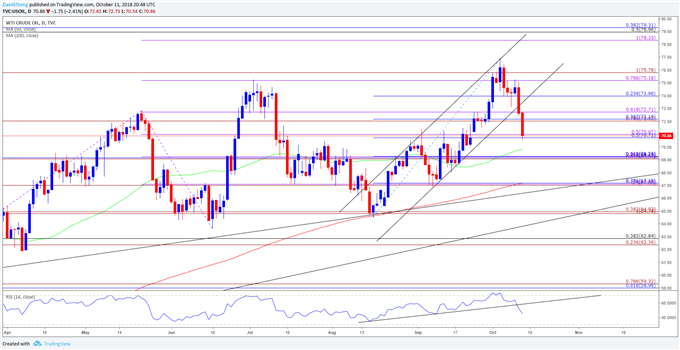

Oil Daily Chart

- Despite the close above the $75.20 (78.6% expansion) to $75.80 (100% expansion) hurdle, the broader outlook for oil no longer remains constructive as crude breaks channel support, with the RSI highlighting a similar dynamic.

- In turn, downside targets are now on the radar, with a closing price below the $70.70 (50% retracement) to $71.00 (50% expansion) raising the risk for a move back towards the $69.10 (61.8% expansion) to $69.30 (61.8% retracement).

- Next downside region of interest comes in around $67.00 (50% expansion) to $67.20 (78.6% retracement) followed by the Fibonacci overlap around $64.80 (100% expansion) to $64.90 (38.2% expansion), which largely lines up with the August-low ($64.45).

For more in-depth analysis, check out the Q4 Forecast for Oil

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.