Japanese Yen Talking Points

USD/JPY is back under pressure, with the exchange rate slipping to a fresh monthly-low of 112.76, and recent price action raises the risk for a larger correction in dollar-yen as the exchange rate continues to carve a series of lower highs.

USD/JPY Continues to Carve Lower-Highs Despite Hawkish Fed Rhetoric

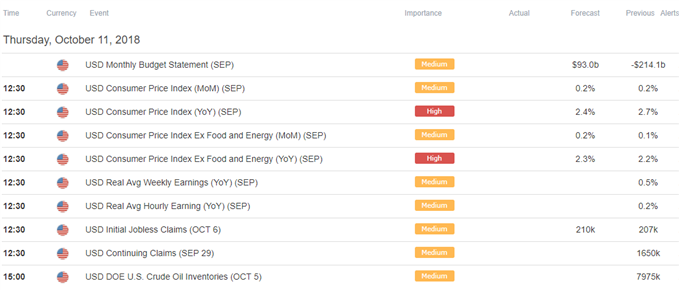

USD/JPY struggles to hold its ground despite the limited reaction to the U.S. Producer Price Index (PPI), which showed the headline reading slipping to 2.6% from 2.8% per annum in August, but the broader outlook for dollar-yen remains supportive as Fed officials continue to prepare U.S. households and businesses for higher borrowing-costs.

Fresh remarks from New York Fed President John Williams, a permanent voting-member on the Federal Open Market Committee (FOMC), suggest the central bank will stick to its hiking-cycle as ‘further gradual

increases in interest rates will best foster a sustained economic expansion and achievement of our dual mandate goals,’ and Chairman Jerome Powell & Co. may continue to strike a hawkish tone at the next interest rate decision on November 8 as ‘the U.S. economy is doing so well in terms of our goals.’

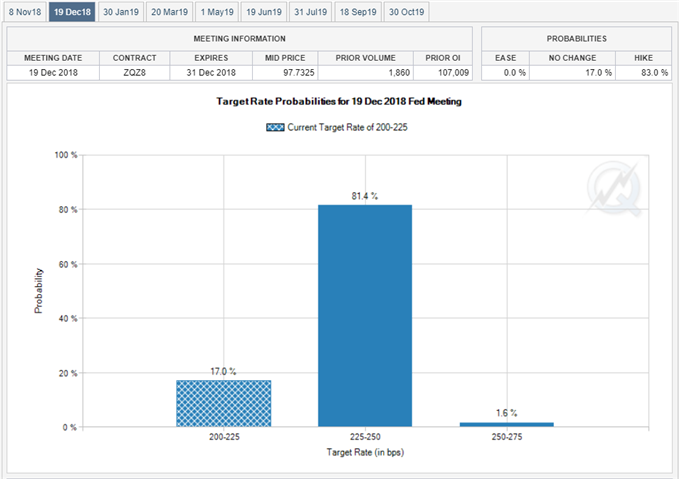

In turn, Fed Fund Futures may continue to reflect expectations for another 25bp rate-hike at the next quarterly meeting in December, and the material shift in retail interest may continue to materialize over the coming days amid the pickup in market volatility.

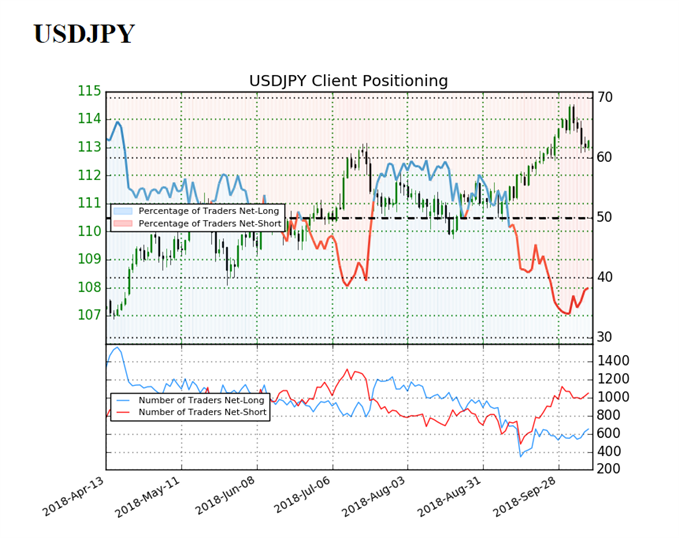

Keep in mind, the IG Client Sentiment Report shows only 38.3% of traders are net-long USD/JPY, with the ratio of traders short to long at 1.61 to 1. In fact, traders have remained net-short since September 13 when USD/JPY traded near the 111.20 region even though price has moved 1.9% higher since then.The number of traders net-long is 6.5% higher than yesterday and 10.9% higher from last week, while the number of traders net-short is 2.3% higher than yesterday and 7.6% lower from last week.

The skew in retail position provides a contrarian view to crowd sentiment, but recent price action warns of a larger pullback in USD/JPY as the exchange rate continues to carve a series of lower highs. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

USD/JPY Daily Chart

- The broader outlook for USD/JPY remains constructive as the exchange rate finally marks a closing price action the 113.80 (23.6% expansion) to 114.30 (23.6% retracement) region, but the lack of momentum to test the November 2017-high (114.74) raises the risk for a larger pullback.

- As a result, the 112.40 (61.8% retracement) to 113.00 (38.2% expansion) region still sits on the radar, with a break/close below the stated region raising the risk for a move towards 111.10 (61.8% expansion) to 111.80 (23.6% expansion).

For more in-depth analysis, check out the Q4 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.