Australian Dollar Talking Points

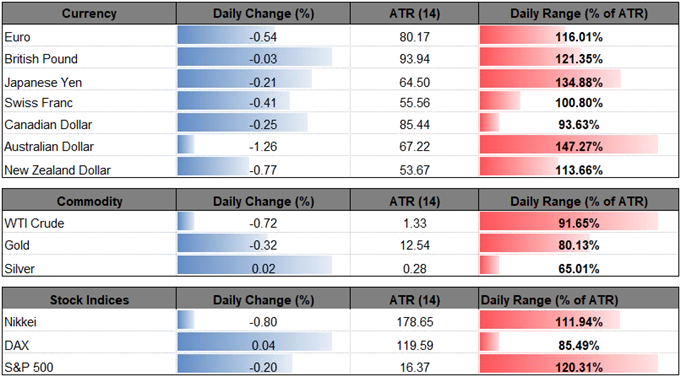

AUD/USD fails to retain the narrow range from earlier this week, with the exchange rate trading to fresh yearly lows following the U.S. Non-Farm Payrolls (NFP) report, and aussie-dollar may continue to exhibit a bearish behavior over the days ahead amid the diverging paths for monetary policy.

AUD/USD Forecast: Post-NFP Weakness to Persist as Narrow Range Snaps

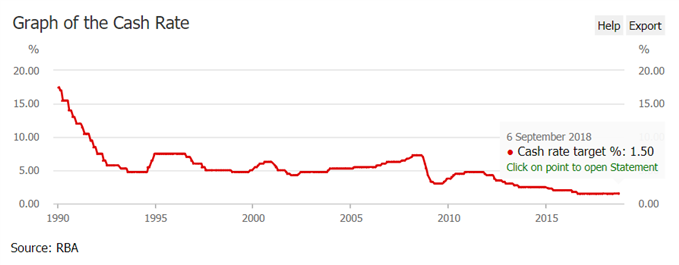

Recent comments from the Reserve Bank of Australia (RBA) suggest the central bank has little to no interest in altering the outlook for monetary policy especially as officials show a limited response to rising mortgage rates.

Higher funding costs for commercial banks may keep the Governor Philip Lowe & Co. on the sidelines as ‘household income has been growing slowly and debt levels are high,’ and the RBA may merely attempt to buy more time at the next meeting on October 2 as ‘the low level of interest rates is continuing to support the Australian economy.’

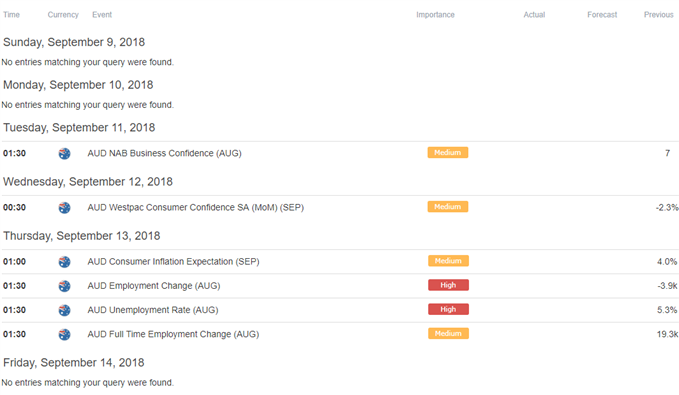

With that said, updates to Australia’s Employment report may do little to influence the monetary policy outlook even though the economy is anticipated to add 18.0K jobs in August, and the diverging paths between the RBA and the Fed may keep AUD/USD under pressure as Chairman Jerome Powell & Co. appear to be on track to deliver four rate-hikes in 2018.

In light of recent price action, the break of the May 2016-low (0.7145) keeps AUD/USD at risk for further losses, with the broader outlook for aussie-dollar still tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish trends from earlier this year. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Daily Chart

- Failure to retain the range from earlier this week keeps AUD/USD at risk for a further decline with a break/close below the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) region opening up the next area of interest around 0.7060 (61.8% expansion).

- Keeping a close eye on the Relative Strength Index (RSI) as it approaches oversold territory, with a break below 30 largely signaling that the bearish momentum is gathering pace.

- Next downside hurdle comes in around 0.7010 (78.6% expansion) followed by the 0.6950 (100% expansion) region.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.