Australian Dollar Talking Points

AUD/USD quickly approaches the 2018-low (0.7203) as the Reserve Bank of Australia (RBA) strikes a cautious tone ahead of the next meeting on September 4, and recent price action highlighting the risk for a further decline in the exchange rate as it extends the series of lower highs & lows from earlier this week.

Bearish AUD/USD Series Warns of Further Losses Ahead of Reserve Bank of Australia (RBA) Meeting

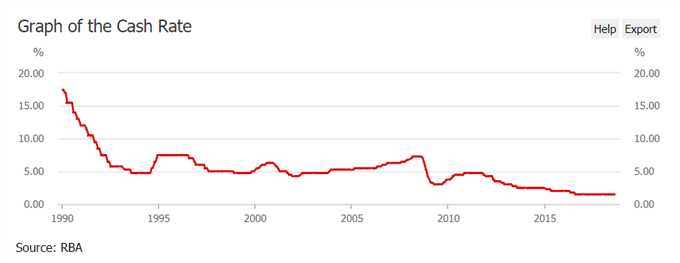

The RBA’s updated corporate plan for 2018/2019 appears to be dragging on the Australian dollar as the central bank warns ‘high debt levels could complicate future monetary policy decisions by making the economy less resilient to shocks.’

It seems as though the RBA is in no rush the lift the official cash rate (OCR) off of the record-low as ‘household income has been growing slowly and debt levels are high,’ and Governor Philip Lowe & Co. may continue to endorse a wait-and-see approach ahead of 2019 election as ‘the low level of interest rates is continuing to support the Australian economy.’

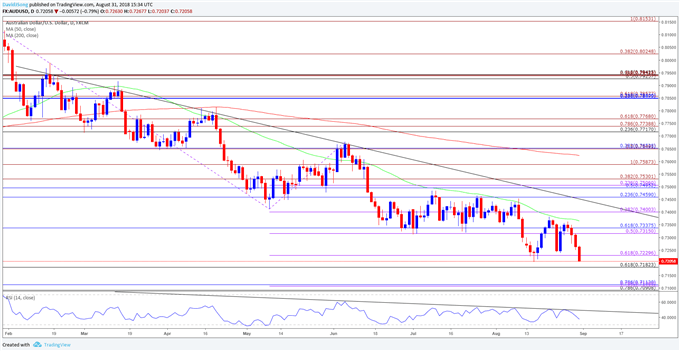

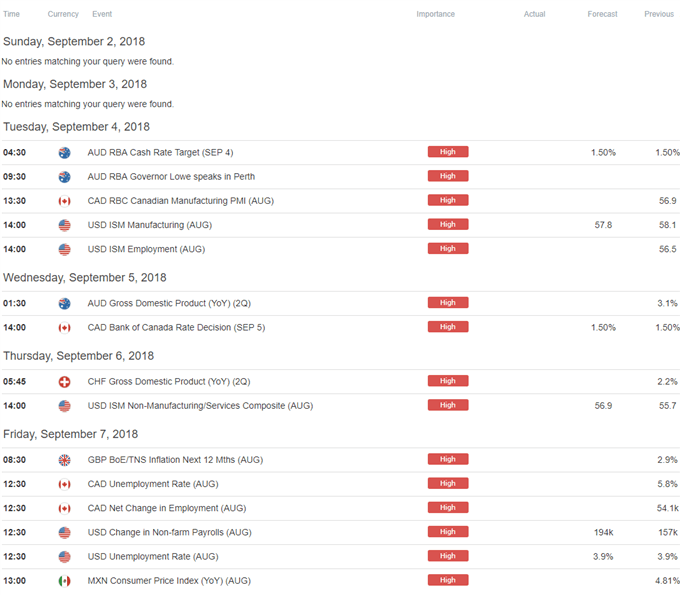

With that said, the RBA may utilize the September meeting to tame bets for higher borrowing-costs, and the uncertainty surrounding the fiscal outlook paired with the more of the same from Governor Lowe & Co. may continue to sap the appeal of the Australian dollar as the central bank keeps the door open to further support the economy. In turn, the broader outlook for AUD/USD remains tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish trends from earlier this year, with the September opening range largely in focus as the exchange rate comes up against near-term support. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Daily Chart

- Recent series of lower highs & lows raises the risk for a further decline in AUD/USD, with a close below the 0.7180 (61.8% retracement) to 0.7230 (61.8% expansion) region opening up the next downside area of interest around 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement).

- However, another failed attempt to break/close below the Fibonacci overlap may generate range-bound conditions, with the first topside hurdle coming in around 0.7320 (50% expansion) to 0.7340 (61.8% retracement) followed by the 0.7400 (38.2% expansion) handle.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.