New Zealand Dollar Talking Points

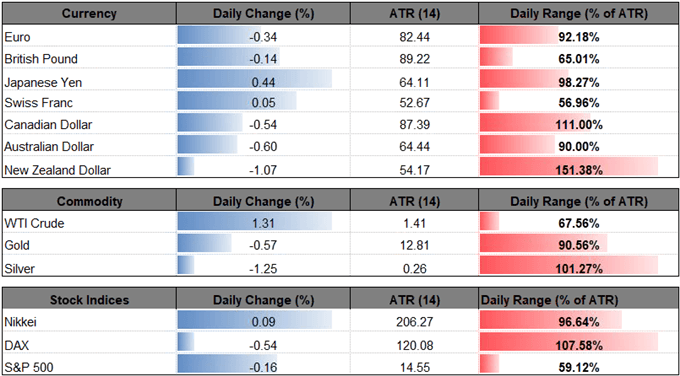

NZD/USD pares the rebound from the 2018-low (0.6544) as business sentiment in New Zealand slips to a 10-year low, and the exchange rate may exhibit a more bearish behavior over the coming days as it continues to track the downward trend from earlier this year.

NZD/USD Outlook Mired by Failure to Break Channel Resistance

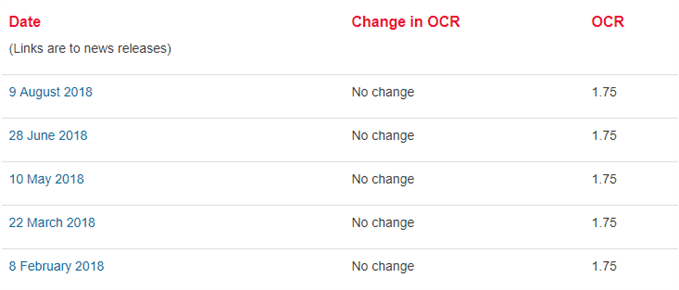

The New Zealand dollar struggles to hold its ground as the ANZ Business Confidence survey declines to -50.3 from -44.9 in August to mark the lowest reading since April 2008, and signs of a slowing economy may continue to produce headwinds for the local currency as it encourages the Reserve Bank of New Zealand (RBNZ) to keep the official cash rate (OCR) at the record-low.

Moreover, the RBNZ appears to be in no rush to alter the monetary policy outlook as the central bank pledges to ‘keep the OCR at an expansionary level for a considerable period,’ and Governor Adrian Orr & Co. may keep the door open to further support the economy as ‘low business confidence can affect employment and investment decisions.’ With that said, the RBNZ may continue to cast dovish forward-guidance for monetary policy, and the central bank may merely attempt to buy more time at the next meeting on September 27 as officials ‘expect to keep the OCR at this level through 2019 and into 2020, longer than we projected in our May Statement.’

With that said, the diverging paths for monetary policy keeps the broader outlook for NZD/USD tilted to the downside especially as the Federal Open Market Committee (FOMC) is widely anticipated to deliver a 25bo rate-hike in September, and kiwi-dollar may continue to track the downward trend from earlier this year as the exchange rate appears to be pulling back from channel resistance. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

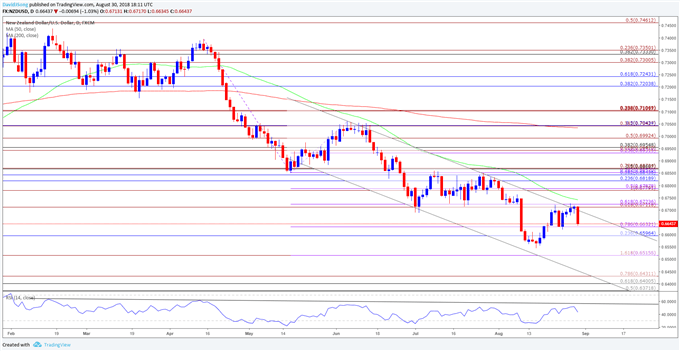

NZD/USD Daily Chart

- The string of failed attempts to close back above the former-support zone around 0.6710 (61.8% expansion) to 0.6720 (61.8% expansion) may open up the downside targets, with a move below the 0.6600 (23.6% retracement) to 0.6630 (78.6% expansion) region raising the risk for a move towards the 2018-low (0.6544).

- Next region of interest comes in around 0.6520 (100% expansion) followed by the Fibonacci overlap around 0.6370 (50% retracement) to 0.6430 (78.6% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.