British Pound Talking Points

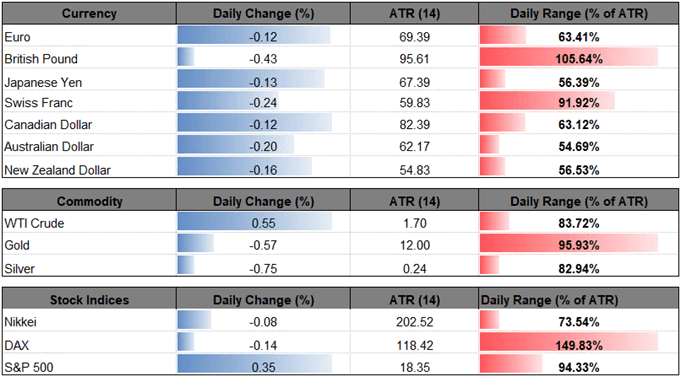

The British Pound extends the decline following the Bank of England (BoE) meeting, with GBP/USD at risk of exhibiting a more bearish behavior over the days ahead as it carves a series of lower highs & lows.

GBP/USD Rate Eyes Fresh 2018-Lows as Bearish Series Takes Shape

Renewed fears surrounding Brexit appears to be weighing on the British Pound as Bank of England (BoE) Governor Mark Carney warns an undesired scenario may ultimately require a rate-cut in the U.K., and the central bank may move to the sidelines after delivering a 25bp hike earlier this month as ‘the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of EU withdrawal.’

Keep in mind, the recent comments from the Monetary Policy Committee (MPC) suggests Governor Carney & Co. will further embark on its hiking-cycle as ‘an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to the 2% target at a conventional horizon,’ but it seems as though the central bank will merely attempt to buy more time at the next meeting on September 13 as ‘any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent.’

As a result, concerns surrounding Prime Minister Theresa May’s leadership may continue to drag on GBP/USD as it clouds the outlook for monetary policy, and the pound-dollar exchange rate stands at risk of extending the series of lower highs & lows from earlier this week as the bearish momentum appears to be gathering pace.

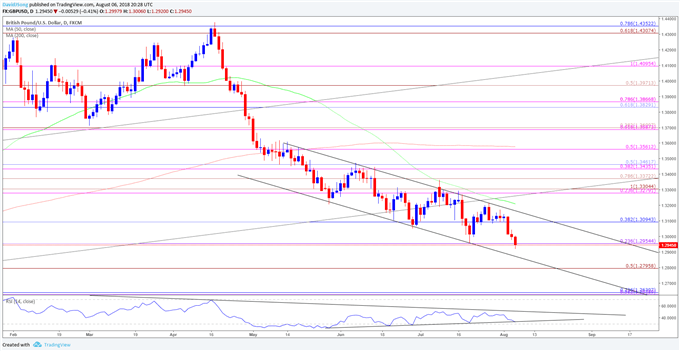

GBP/USD Daily Chart

- The break of the July-low (1.2956) paired with the closing price below the 1.2950 (23.6% expansion) hurdle brings the downside targets on the radar, with the next region of interest coming in around the 1.2800 (50% expansion) handle followed by the Fibonacci overlap around 1.2630 (38.2% expansion) to 1.2640 (23.6% retracement).

- Keeping a close eye on the Relative Strength Index (RSI) as the oscillator appears to be snapping the uptrend trend from June, with a break of trendline support raising the risk for a further decline in the exchange rate as the momentum indicator comes up against oversold territory.

For more in-depth analysis, check out the Q3 Forecast for the British Pound

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.