Japanese Yen Talking Points

The recent advance in USD/JPY sputters as the Federal Reserve keeps the benchmark interest rate on hold, but the fresh string of higher highs & lows may fuel the recent advance in the exchange rate as it breaks out of a narrow range.

USD/JPY Strength Sputters as Fed Keeps Key Interest Rate on Hold

The July-high (113.18) remains on the radar following the Bank of Japan (BoJ) meeting as Governor Haruhiko Kuroda & Co. lower the inflation forecast, and the dovish forward-guidance for monetary policy may keep USD/JPY afloat as the central bank remains in no rush to abandon the Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control.

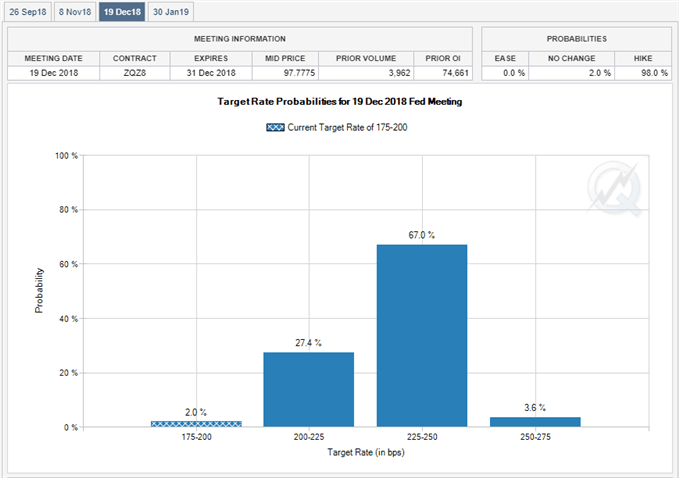

The Federal Reserve on the other hand appears to be on track to implement higher borrowing-costs even though the central bank keeps the benchmark interest rate on hold in August, and Chairman Jerome Powell & Co. may continue to prepare U.S. households and businesses for a less-accommodative stance as ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

In turn, market participants appear to be gearings up for four rate-hikes in 2018 as Fed Fund Futures continue to reflect expectations for a move in September and December, and the FOMC’s hiking-cycle may keep the U.S. dollar bid over the coming months especially as the central bank largely achieves its dual mandate for full-employment and price stability.

With that said, recent price action fosters a constructive outlook for USD/JPY as it carves a series of higher highs & lows after breaking out of a narrow range, and the exchange rate may make a more meaningful attempt to test the July-high (113.18) going into the U.S. Non-Farm Payrolls (NFP) report as the economy is anticipated to add 192K jobs in July.

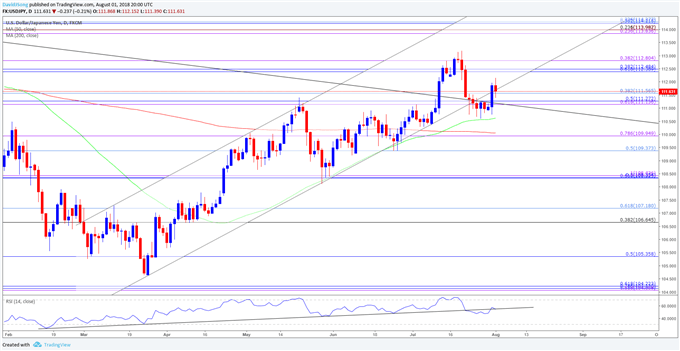

USD/JPY Daily Chart

- Keep in mind, there appears to be a shift in USD/JPY behavior as the upward trend in both price and the Relative Strength Index (RSI) unravel, but recent price action raises the risk for a run at the July-high (113.18) as it breaks out of the previous week’s range.

- The close above the 111.10 (61.8% expansion) to 111.60 (38.2% retracement) region brings the 112.40 (61.8% retracement) to 112.80 (38.2% expansion) area back on the radar, with the next region of interest coming in around 113.80 (23.6% expansion) to 114.30 (23.6% retracement) on the radar, which sits just above the December-high (113.75).

For more in-depth analysis, check out the Q3 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.