Euro Talking Points

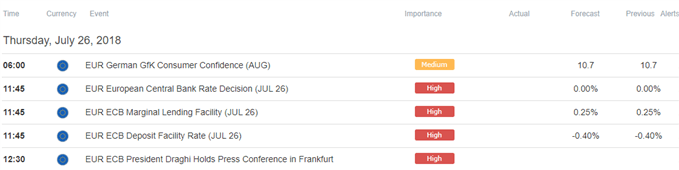

The European Central Bank (ECB) meeting on July 26 may do little to alter the near-term outlook for EUR/USD as the Governing Council is widely expected to retain the current policy, and more of the same from President Mario Draghi & Co. may rattle the single-currency as the central bank remains in no rush to conclude its easing-cycle.

EUR/USD Forecast: Range to Persist on Wait-and-See ECB Policy

After unveiling fresh updates at the last meeting in June, the ECB may merely attempt to buy more time as the quantitative easing (QE) program is now set to expire in December. As a result, the ECB is likely to reiterate that ‘the Governing Council stands ready to adjust all of its instruments as appropriate to ensure that inflation continues to move towards the Governing Council’s inflation aim in a sustained manner,’ and the central bank may persistently tame expectations for an imminent rate-hike as officials expect borrowing costs to ‘remain at their present levels at least through the summer of 2019,’

It looks as though the ECB will stick to its dovish outlook even as the Federal Open Market Committee (FOMC) embarks on its hiking-cycle, and the deviating paths for monetary policy may continue to present a bearish outlook for EUR/USD especially as Chairman Jerome Powell & Co. are widely anticipated to deliver another 25bp rate-hike in September.

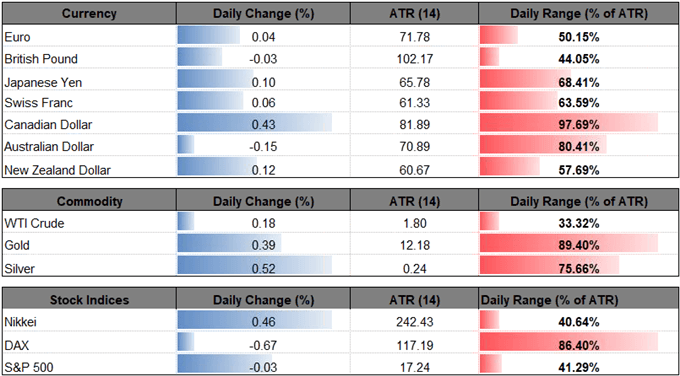

However, the IG Client Sentiment report warns of range-bound conditions for EUR/USD amid the recent back and forth in retail positioning, with 53.7% of traders now net-long EUR/USD as the ratio of traders long to short stands at 1.16 to 1. The number of traders net-long is 9.9% higher than yesterday and 1.4% lower from last week, while the number of traders net-short is 8.1% lower than yesterday and 8.5% higher from last week.

The updates suggest the retail crowd is take advantage of the sideways price action in EUR/USD as it preserves the range carried over from June, but a batch of dovish comments from the ECB may rattle the recent resilience in euro-dollar as the central bank keeps the door open to further expand its balance sheet.

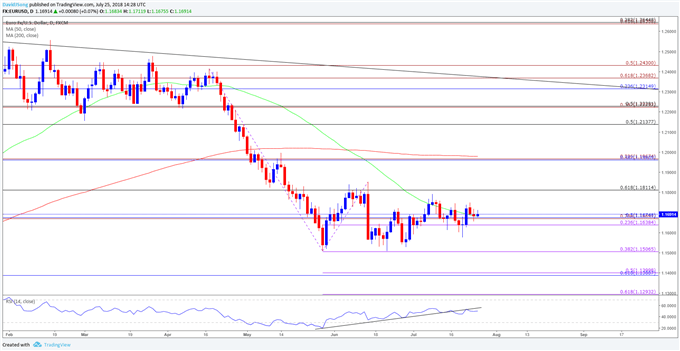

With that said, recent developments in the Relative Strength Index (RSI) highlights a more bearish fate for EUR/USD as the oscillator snaps the bullish formation from earlier this year, but euro-dollar traders appear to be waiting for something meaningful to move on amid the growing uncertainty surrounding global trade policy.

EUR/USD Daily Chart

- String of failed attempts to test the July-high (1.1791) may push EUR/USD back towards the lower bounds of its recent range, with the 1.1510 (38.2% expansion) region on the radar as it largely lines up with the June-low (1.1508).

- Need a break below the stated region to open up the downside targets for EUR/USD, with the first region of interest coming in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion) followed by the 1.1290 (61.8% expansion) hurdle.

For more in-depth analysis, check out the Q3 Forecast for the Euro

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.