Japanese Yen Talking Points

USD/JPY climbs to a fresh monthly-high (112.80) ahead of the semi-annual Humphrey-Hawkins testimony, with the dollar-yen exchange now at risk of making a run at the 2018-high (113.39) as it extends the series of higher highs & lows from earlier this week.

USD/JPY Overbought Signal Persists Ahead of Fed Chairman Testimony

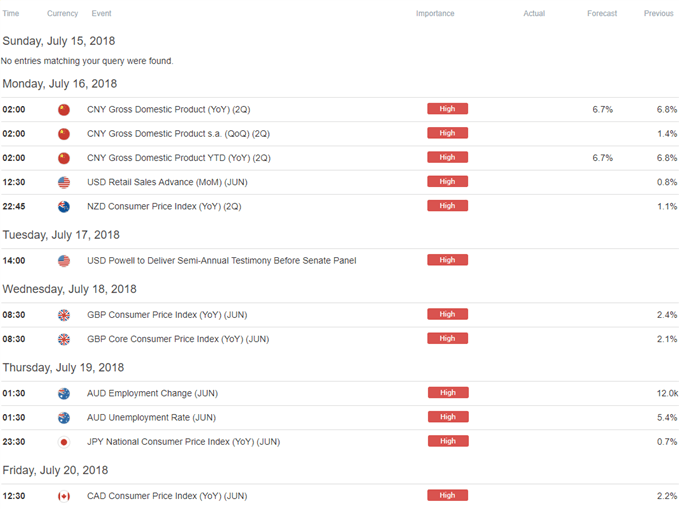

Despite the growing threat of a trade war, recent comments from Chairman Powell suggest the Federal Open Market Committee (FOMC) will stay on course to further normalize monetary policy as the U.S. economy is in a ‘good place.’

In turn, Chairman Powell may continue to strike a upbeat tone in front of U.S. lawmakers as the central bank head pledges to ‘work in a strictly nonpolitical way, based on detailed analysis,’ and a batch of hawkish comments is likely to boost the appeal of the greenback as the Fed appears to be on track to implement four rate-hikes in 2018.

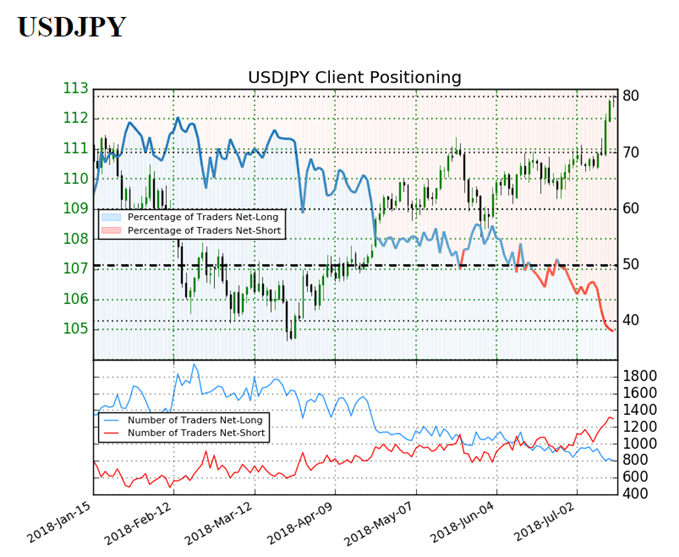

Keep in mind, the IG Client Sentiment report shows the retail crowd has remained net-short since June 28 when USD/JPY traded near the 110.50area even though price has moved 1.9% higher since then.

It looks as though the swing in retail positioning will continue as the number of traders net-long is 5.2% lower than yesterday and 20.3% lower from last week, while the number of traders net-short is 5.0% higher than yesterday and 17.0% higher from the previous week. The recent shift in sentiment offers a contrarian view as retail traders appear to be going against the current trend and continue to boost their net-short exposure, with USD/JPY at risk of extending the recent rally as it continues to carve a series of higher highs & lows.

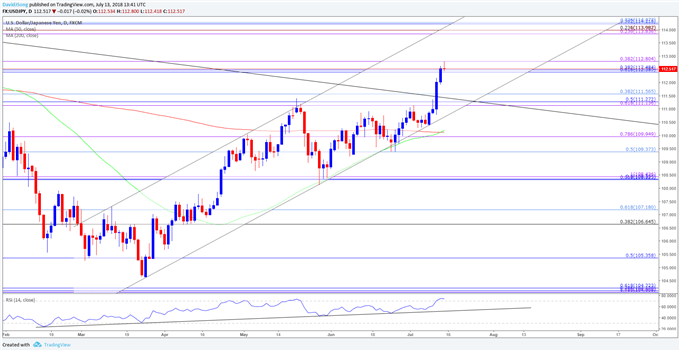

At the same time, recent developments in the Relative Strength Index (RSI) suggest the bullish momentum is gathering pace as the oscillator pushes deeper into overbought territory, and the dollar-yen exchange rate is likely to stay bid as long as the indicator holds above 70.

USD/JPY Daily Chart

- Topside targets remain on the radar for USD/JPY as the pair continues to carve a bullish sequence, but need a close above the 112.40 (61.8% retracement) to 112.80 (38.2% expansion) region to open up the next region of interest coming in around 113.80 (23.6% expansion) to 114.30 (23.6% retracement).

- Failed attempts to close above the stated region may generate a pullback, with the first downside area of interest coming in around 111.10 (61.8% expansion) to 111.60 (38.2% retracement), and the pair may ultimately stage a larger correction once the RSI flashes a textbook sell-signal and slips below 70.

For more in-depth analysis, check out the Q3 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.