Euro Talking Points

EUR/USD breaks out of a near-term holding pattern as the U.S. Non-Farm Payrolls (NFP) report instills a mixed outlook for growth and inflation, and the euro-dollar exchange rate stands at risk of staging a larger advance as it extends it the bullish sequence from earlier this week.

EUR/USD Breaks Out of Holding Pattern on Lackluster U.S. NFP Report

Updates to the NFP report showed the U.S. economy added another 213K jobs in June amid projections for a 190K print, while the Unemployment Rate unexpectedly climbed to 4.0% per annum from 3.8% during the same period as the Labor Force Participation Rate widened to 62.9% from 62.7%.

At the same time, Average Hourly Earnings fell short of expectations as the gauge held steady at 2.7% for the second consecutive month, and the fresh data prints may do little to encourage a more aggressive hiking-cycle as the Federal Open Market Committee (FOMC) pledges to ‘assessrealized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.’

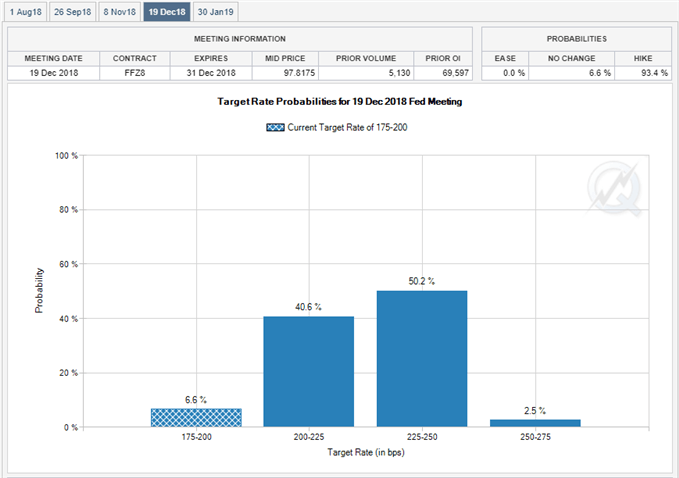

Keep in mind, there seems to be little in the way for the FOMC to deviate from its current course as Fed Fund Futures reflect a greater than 70% probability for a September rate-hike, with market participants leaning towards another 25bp rise in December, and central bank officials may continue to project a longer-run neutral rate of 2.75% to 3.00% as ‘almost all participants expressed the view that it would be appropriate for the Committee to continue its gradual approach to policy firming.’

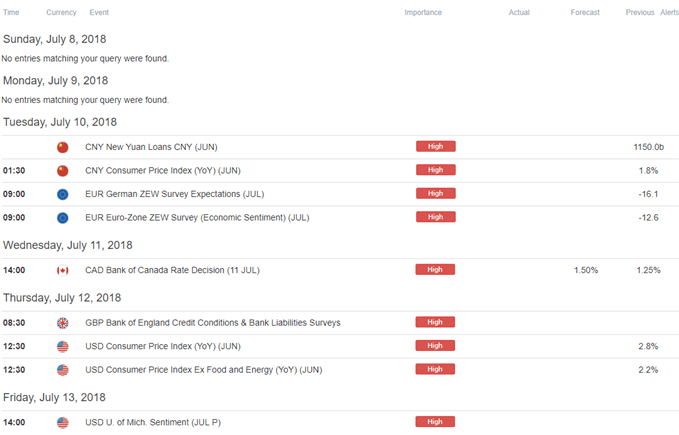

However, the FOMC appears to be in no rush to extend its hiking-cycle as ‘participants commented on a number of risks and uncertainties associated with their outlook,’ and Chairman Jerome Powell may strike a more balanced tone in front of Congress as the central bank head is scheduled to deliver the semi-annual Humphrey-Hawkins testimony next week. In turn, a batch of less-hawkish comments may sap the appeal of U.S. dollar, with EUR/USD at risk of exhibiting a more bullish behavior over the coming days as it carves a series of higher highs & lows.

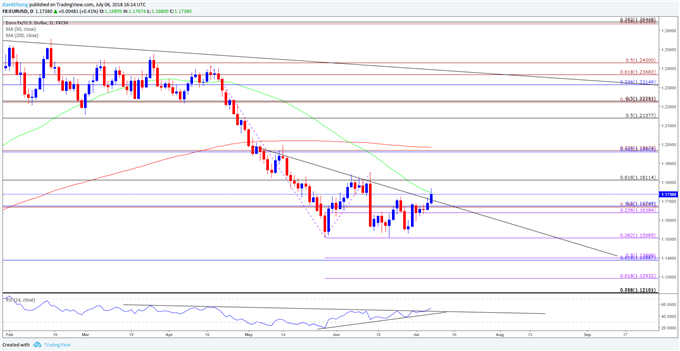

EUR/USD Daily Chart

- EUR/USD appears to be on track to test the June-high (1.1852) as it breaks out of a triangle/wedge formation, with the Relative Strength Index (RSI) highlighting a similar dynamic as it threatens the downward trend carried over from earlier this year.

- Need a close above the 1.1810 (61.8% retracement) hurdle to open up the topside targets, with the first region of interest coming in around 1.1970 (23.6% expansion) followed by the 1.2140 (50% retracement) area.

For more in-depth analysis, check out the Q3 Forecast for the Euro

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.