Japanese Yen Talking Points

USD/JPY continues to give back the advance from earlier this month as the European Union (EU) warns that the region ‘would have no choice but to react’ if the U.S. imposes new tariffs on European cars, and recent price action raises the risk for a further decline in the exchange rate as it extends the recent series of lower highs & lows.

USD/JPY Outlook Mired by Lower Highs & Lows, Bearish RSI Signal

USD/JPY appears to be on track to test the June-low (108.72) amid the growing threat of a global trade war, and the shift in trader sentiment may keep the dollar-yen exchange rate under pressure as U.S. President Donald Trump tweets ‘the United States is insisting that all countries that have placed artificial Trade Barriers and Tariffs on goods going into their country, remove those Barriers & Tariffs or be met with more than Reciprocity by the U.S.A.’

In response, China has reduced the reserve requirement ratio (RRR) for qualified banks by 0.5 percentage point as the deepening trade spat poses a risk to global growth, and a further escalation may impede on the Federal Open Market Committee’s (FOMC) hiking-cycle as it undermines the central bank’s forecast for the U.S. economy to grow ‘2.8 percent this year, 2.4 percent next year, and 2 percent in 2020.’

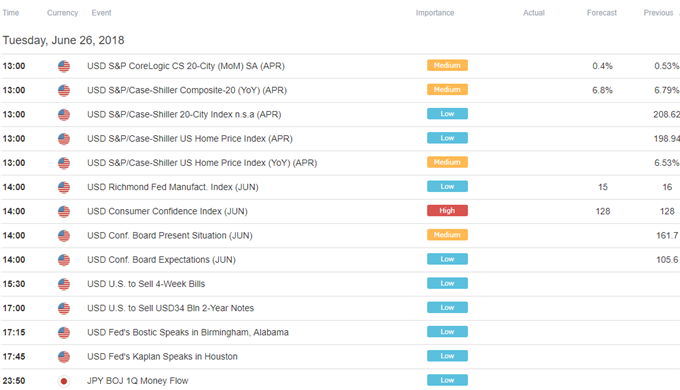

With that said, a growing number of Fed officials may strike a cautious tone over the coming days as Atlanta Fed President Raphael Bostic and Governor Randal Quarles, both 2018-voting members on the FOMC, are scheduled to speak over the coming days, and a batch of dovish comments may drag on USD/JPY as it rattles expectations for four rate-hikes in 2018.

USD/JPY Daily Chart

- The advance from the June-low (108.72) continues to unravel, with a close below the 109.40 (50% retracement) to 110.00 (78.6% expansion) region raising the risk for a move towards 108.30 (61.8% retracement) to 108.40 (100% expansion) as the pair carves a fresh series of lower highs & lows.

- Keeping a close eye on the Relative Strength Index (RSI) as it threatens trendline support and appears to be flashing a bearish trigger, with the next downside region of interest coming in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement).

For more in-depth analysis, check out the Q2 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.