Australian Dollar Talking Points

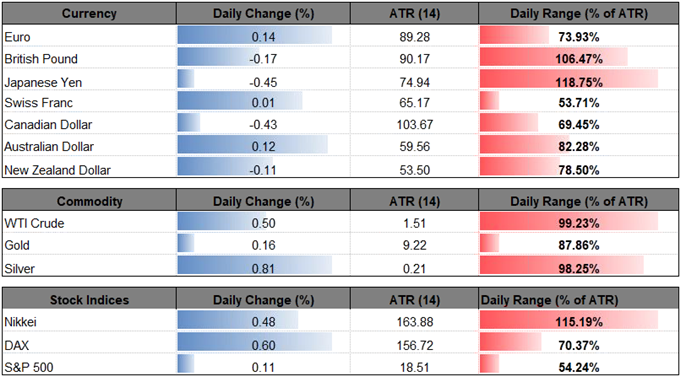

AUD/USD retraces the decline from late last week even as the G7 Summit does little to ward off the threat for a global trade war, and the pair may continue to catch a bid over the next 24-hours of trade as the recent pickup in market sentiment appears to be gathering pace.

AUD/USD Outlook Mired by Failed Attempt to Break Trendline Resistance

Following the reaction to the Australia’s 1Q Gross Domestic Product (GDP) report, recent developments in AUD/USD raises the scope for a more meaningful recovery as the pair breaks out of a near-term range.

Even though the Reserve Bank of Australia (RBA) remains in no rush to lift the cash rate off of the record-low, indications of stronger-than-expected growth may push the central bank to gradually change its tune in the second-half of the year, with the improvement in risk appetite likely to keep AUD/USD afloat ahead of the meeting minutes due out on June 18 as the rebound from the May-low (0.7412) continues to unfold.

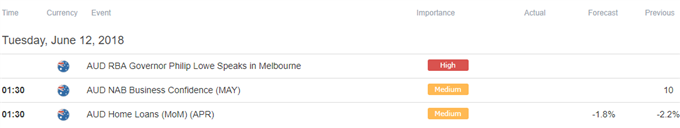

Keep in mind, a marked slowdown in Australia Home Loans may rattle the aussie-dollar exchange rate as Governor Philip Lowe and Co. warns that ‘the level of household debt remains high,’ but the RBA Minutes may heighten the appeal of the Australia dollar as ‘members agreed that it was more likely that the next move in the cash rate would be up, rather than down.’ With that said, AUD/USD may make another attempt to threaten the downward trend from earlier this year as bullish momentum appears to be gathering pace, with a break of trendline resistance raising the risk for a more meaningful recovery in the exchange rate.

AUD/USD Daily Chart

- String of lower-highs may produce a larger pullback in AUD/USD as the near-term rebound appears to be stalling ahead of trendline resistance, with a break/close below 0.7590 (100% expansion) bringing the downside targets back on the radar.

- However, the 0.7650 (38.2% retracement) remains on the radar as the Relative Strength Index (RSI) extends the bullish formation carried over from the previous month, with a close back above the stated region raising the risk for a run at the Fibonacci overlap around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion).

- Next region of interest comes in around 0.7850 23.6% retracement) to 0.7860 (61.8% expansion) followed by the overlap around 0.7930 (50% retracement) to 0.7940 (61.8% retracement), which sits just above the March-high (0.7916).

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.