FX TALKING POINTS:

- USD/JPY Continues to Carve Bearish Series Following Dismal Non-Farm Payrolls (NFP) Report.

- NZD/USD Outlook Hinges on Reserve Bank of New Zealand (RBNZ) Interest Rate Decision.

The U.S. dollar fails to benefit from the Non-Farm Payrolls (NFP) report as the updates fall short of market expectations, with USD/JPY at risk for a larger pullback as a bearish series takes shape.

Looking ahead, attention turns to the Reserve Bank of New Zealand (RBNZ) interest rate decision on tap for May 10 as Governor Adrian Orr hosts his first meeting, and a mere attempt to buy more time may drag on NZD/USD as the central bank appears to be on track to retain the record-low cash rate throughout 2018.

USD/JPY CONTINUES TO CARVE BEARISH SERIES FOLLOWING DISMAL NON-FARM PAYROLLS (NFP) REPORT

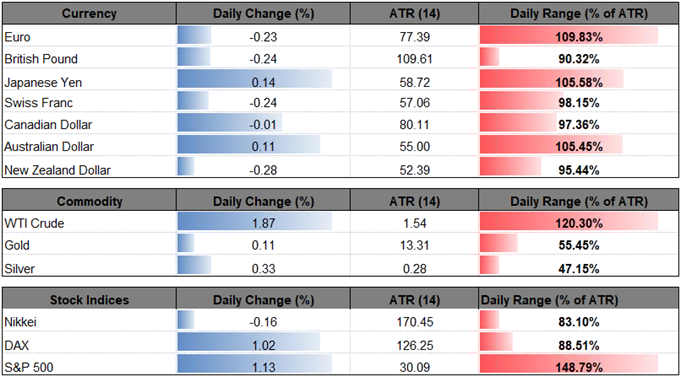

USD/JPY slips to a fresh weekly-low (108.65) as updates to the U.S. Non-Farm Payrolls (NFP) report dampen bets for four Fed rate-hikes in 2018, and the pair may continue to give back the advance from the previous month as it carves a series of lower highs & lows.

Beyond the 164K expansion in job growth, the downtick in the Labor Force Participation rate paired with the unexpected slowdown in Average Hourly Earnings dampens the Federal Open Market Committee’s (FOMC) scope to expand the hiking-cycle as the developments highlight ongoing slack in the real economy.

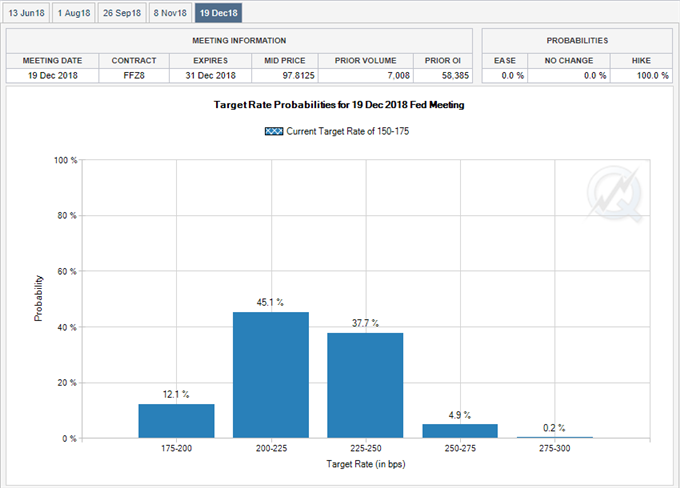

As a result, the Fed may tolerate above-target price growth for the foreseeable future as the central bank pledges to ‘carefully monitor actual and expected inflation developments relative to its symmetric inflation goal,’ and Chairman Jerome Powell and Co. may continue to project a neutral Fed Funds rate of 2.75% to 3.00% as borrowing-costs are ‘likely to remain, for some time, below levels that are expected to prevail in the longer run.’

With that said, Fed Fund Futures may continue to reflect waning expectations for four rate-hikes in 2018, with the greenback at risk of exhibiting a more bearish behavior over the days ahead as U.S. Treasury Yields pullback from recent highs.

USD/JPY DAILY CHART

- Lack of momentum to break/close above the 109.40 (50% retracement) to 110.00 (78.6% expansion) hurdle raises the risk for a larger pullback in USD/JPY especially as the Relative Strength Index (RSI) snaps the bullish formation carried over from the previous month.

- Waiting for a break/close below the 108.30 (61.8% retracement) to 108.40 (100% expansion) region to bring the downside targets back on the radar, with the next area of interest coming in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement).

For more in-depth analysis, check out the Q2 Forecast for USD/JPY

NZD/USD OUTLOOK HINGES ON RESERVE BANK OF NEW ZEALAND (RBNZ) INTEREST RATE DECISION.

NZD/USD struggles to hold its ground ahead of the Reserve Bank of New Zealand (RBNZ) interest rate decision on May 10, with the pair at risk of giving back the rebound from earlier this week as the central bank is widely expected to keep the official cash rate at the record-low of 1.75%.

The RBNZ may attempt to buy more time at Governor Adrien Orr’s first meeting as ‘inflation is expected to weaken further in the near term due to softness in food and energy prices and adjustments to government charges,’ and the new central bank head may stick with status quo for the foreseeable future as the new Policy Targets Agreement (PTA) brings a material change to the monetary policy-setting process.

With that said, more of the same from the RBNZ may keep the NZD/USD rate under pressure, but recent price action raises the risk for a larger rebound ahead of the interest rate decision as kiwi-dollar initiates a fresh series of higher highs and lows.

NZD/USD DAILY CHART

- The recent decline in NZD/USD appears to have run its course as the pair snaps the bearish sequence from earlier this week, with the series of failed attempts to break/close below the 0.6940 (61.8% expansion) to 0.6990 (50% expansion) raising the risk for a larger rebound especially as the Relative Strength Index (RSI) bounces back from oversold territory.

- Need a move back above the 0.7040 (50% retracement) to 0.7110 (38.2% expansion) region to spur a run at the former-support zone around 0.7170 (50% retracement) to 0.7200 (38.2% retracement), with the next region of interest coming in around 0.7240 (61.8% retracement) to 0.7260 (38.2% retracement).

For more in-depth analysis, check out the Q2 Forecast for the U.S. Dollar

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.