FX TALKING POINTS:

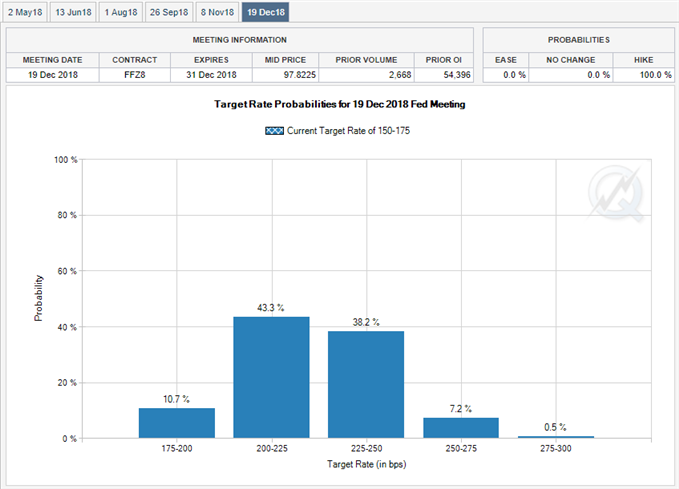

-USD/JPY Pulls Back as U.S. Gross Domestic Product (GDP) Report Fails to Boost Fed Expectations. All Eyes on Federal Open Market Committee (FOMC) Meeting.

- GBP/USD Tumbles to Fresh Monthly-Low on Dismal U.K. Gross Domestic Product (GDP) Report. Relative Strength Index (RSI) Snaps Bullish Formation from 2017.

USD/JPY STRENGTH DWINDLES AHEAD OF BANK OF JAPAN (BOJ) RATE DECISION. RELATIVE STRENGTH INDEX (RSI) PULLS BACK FROM OVERBOUGHT TERRITORY.

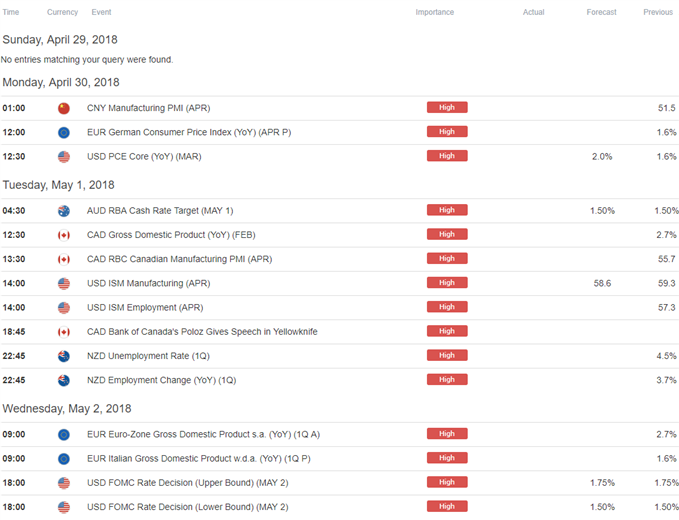

USD/JPY pulls back from a fresh monthly-high (109.54) as the 1Q U.S. Gross Domestic Product (GDP) report does little to boost expectations for four Fed rate-hikes in 2018, and the pair may continue to give back the advance from the previous month as the bullish momentum starts to abate. With the Bank of Japan (BoJ) in no rush to alter the outlook for monetary policy, key developments coming out of the U.S. economy may continue to influence the dollar-yen exchange rate as market attention turns to the Federal Open Market Committee (FOMC) interest rate decision on May 2.

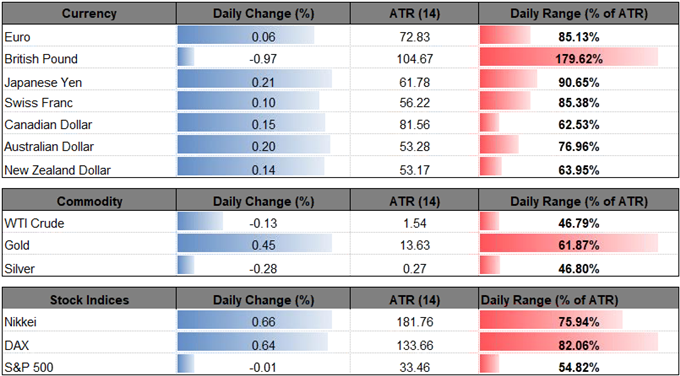

U.S. Treasury Yields are under pressure even as the core Personal Consumption Expenditure (PCE), the FOMC’s preferred gauge for inflation, meets market expectations, with the reading climbing to an annualized 2.5% from 1.9%. The reaction suggests the updated figures are not enough to generate an extended hiking-cycle as Fed Fund Futures now point to the benchmark interest rate ending the year around 2.00% to 2.25% (currently sitting at 1.50% to 1.75%).

In turn, USD/JPY may continue to pare the recent advance as the Federal Reserve is widely anticipated to retain the current policy next week, and more of the same from Chairman Jerome Powell and Co. may produce headwinds for the greenback as the central bank reverts back to a wait-and-see approach for monetary policy.

USD/JPY DAILY CHART

- Lack of momentum to extend the bullish sequence from earlier this week raises the risk for further losses, with USD/JPY as risk for a move back towards 108.30 (61.8% retracement) to 108.40 (100% expansion) following the failed attempt to clear the Fibonacci overlap around 109.40 (50% retracement) to 110.00 (78.6% expansion).

- Keeping a close eye on the Relative Strength Index (RSI) as it falls back from overbought territory, with a break of trendline support raising the risk for a more material decline in USD/JPY as the bullish formation unravels.

- Next downside region of interest comes in around 106.70 (38.2% expansion) to 107.20 (61.8% retracement). Followed by the 105.40 (50% retracement) region.

For more in-depth analysis, check out the Q2 Forecast for USD/JPY

GBP/USD TUMBLES TO FRESH MONTHLY-LOW ON DISMAL U.K. GROSS DOMESTIC PRODUCT (GDP) REPORT. RELATIVE STRENGTH INDEX (RSI) SNAPS BULLISH FORMATION FROM 2017.

GBP/USD tumbled to a fresh monthly-low (1.3747) as updates to the U.K. Gross Domestic Product (GDP) report showed the growth rate slowing to an annualized 1.2% from 1.4% in the fourth-quarter of 2017, and the pair may continue to give back the advance from the 2018-low (1.3458) as the dismal development dampens bets for an imminent Bank of England (BoE) rate-hike.

Lackluster data prints coming out of the real economy may push Governor Mark Carney and Co. to delay the hiking-cycle as ‘all members agree that any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent,’ and the central bank may continue to endorse a wait-and-see approach for monetary policy as ‘developments regarding the United Kingdom’s withdrawal from the European Union – and in particular the reaction of households, businesses and asset prices to them – remain the most significant influence on, and source of uncertainty about, the economic outlook.’

Keep in mind, the policy meeting minutes may reveal another 7 to 2 split within the Monetary Policy Committee (MPC) as ‘these members noted the widespread evidence that slack was largely used up and that pay growth was picking up, presenting upside risks to inflation in the medium term,’ and the BoE may look to implement higher borrowing-costs later this year as ‘an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to its target at a more conventional horizon.’

Nevertheless, recent price action keeps the near-term outlook for GBP/USD tilted to the downside as it initiates a fresh series of lower highs & lows, while the Relative Strength Index (RSI) snaps the bullish formation carried over from late last year.

GBP/USD DAILY CHART

- GBP/USD approaches the March-low (1.3712) after snapping the monthly opening range, with a close below the 1.3830 (61.8% retracement) to 1.3870 (78.6% expansion) opening up the next downside region of interest around 1.3690 (61.8% expansion) to 1.3700 (38.2% expansion).

- Need to keep a close eye on the RSI as it comes up against oversold territory, with a break below 30 raising the risk for a further decline in the exchange rate as the bearish momentum gathers pace.

- Next downside hurdle comes in around 1.3560 (50% retracement) followed by the Fibonacci overlap around 1.3440 (38.2% expansion) to 1.3460 (50% expansion), which largely lines up with the 2018-low (1.3458).

For more in-depth analysis, check out the Q2 Forecast for GBP/USD

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.