FX Talking Points:

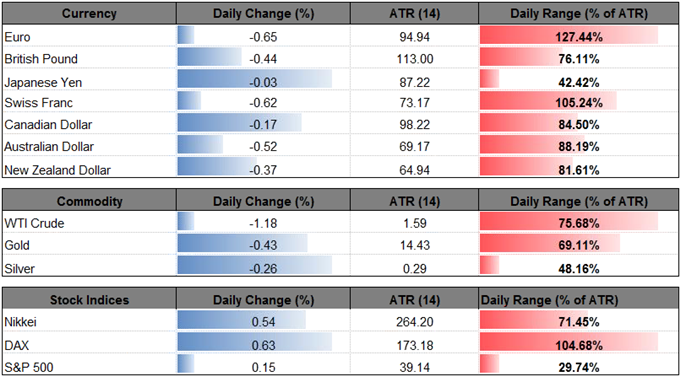

- EUR/USD Rebound Snaps as European Central Bank (ECB) Holds Off on Detailed Exit-Strategy. Relative Strength Index (RSI) Extends Bearish Formation.

- AUD/USD Rate at Risk for Range-Bound Conditions as Bearish Momentum Abates. All Eyes on U.S. Non-Farm Payrolls (NFP) Report.

EUR/USD snaps the recent series of higher highs & lows as the European Central Bank (ECB) refuses to deliver a detailed exit-strategy, and the pair may continue to give back the advance from the monthly-low (1.2155) as the Relative Strength Index (RSI) clings to the bearish formation carried over from earlier this year.

Despite the small upward revision in the ECB’s growth forecast, recent remarks from the Governing Council suggest the central bank is in no rush to abandon its easing-cycle as ‘measures of underlying inflation remain subdued and have yet to show convincing signs of a sustained upward trend.’ It seems as though the ECB will largely stick to the current script throughout the first-half of 2018 as ‘an ample degree of monetary stimulus remains necessary for underlying inflation pressures to continue to build up,’ and the wait-and-see approach for monetary policy may ultimately lead to a larger correction in EUR/USD especially as the Federal Reserve pledges to further normalize monetary policy over the coming months.

Nevertheless, President Mario Draghi and Co. may have little choice but to gradually alter the forward guidance for monetary policy as the quantitative easing (QE) program is set to expire in September, and the ECB may continue to make minor adjustments to prepare European households and businesses for a less-accommodative stance as ‘incoming information, including our new staff projections, confirms the strong and broad-based growth momentum in the euro area economy, which is projected to expand in the near term at a somewhat faster pace than previously expected.’ With that said, the broader shift in EUR/USD may continue to take shape over the course of the year, but recent price action keeps the near-term outlook tilted to the downside as the bearish momentum from earlier this year appears to be reemerging.

EUR/USD Daily Chart

- EUR/USD stands at risk for a larger correction as the recent advance fails to generate a test of the 2018-high (1.2556), while the Relative Strength Index (RSI) appears to be extending the bearish formation carried over from the previous month as the oscillator comes off of trendline resistance.

- May see EUR/USD continue to pullback from the 1.2430 (50% expansion) region, with a break/close below the 1.2320 (23.6% retracement) to 1.2370 (61.8% expansion) zone raising the risk for a move back towards 1.2230 (50% retracement).

- Next downside hurdle comes in around 1.2130 (50% retracement), which sits just beneath the March-low (1.2155), with the next area of interest coming in around 1.1960 (38.2% retracement) to 1.1970 (23.6% expansion).

AUD/USD pares the advance from earlier this week as the Reserve Bank of Australia (RBA) remains reluctant to alter the outlook for monetary policy, but a batch of mixed U.S. data prints may keep aussie-dollar afloat as it undermines the Federal Open Market Committee’s (FOMC) scope to deliver three rate-hikes in 2018.

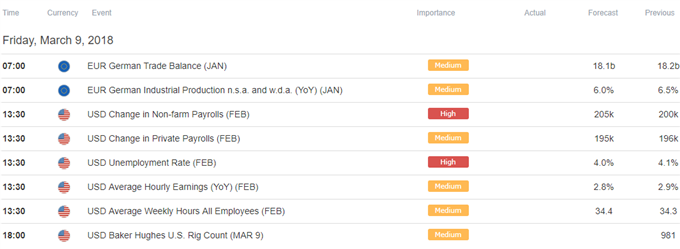

With the RBA rate decision out of the way, attention turns to the key developments coming out of the U.S. especially as the FOMC is widely anticipated to increase the benchmark interest rate by 25bp later this month. A 205K expansion in Non-Farm Payrolls (NFP) should keep the Fed on track to implement higher borrowing-costs, but a slowdown in Average Hourly Earnings may drag on interest-rate expectations as the committee struggles to achieve the 2% target for inflation. As a result, the U.S. dollar stands at risk of exhibiting a more bearish behavior ahead of the March 21 interest rate decision if the data dampens bets for a more aggressive hiking-cycle.

In turn, the pullback from the 2018-high (0.8136) may continue to unravel, with AUD/USD at risk of extending the advance from the monthly-low (0.7713) as the bearish momentum abates.

AUD/USD Daily Chart

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

- Near-term outlook for AUD/USD has perked up following the failed attempts to close below the 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion) region, while the Relative Strength Index (RSI) continues to trade above oversold territory.

- However, lack of momentum to break/close above the 0.7850 (38.2% retracement) to 0.7860 (61.8% expansion) region may generate range-bound conditions over the days ahead as the recent rebound in the exchange rate fizzles.

- Next topside hurdle comes in around 0.7930 (50% retracement) to 0.7940 (61.8% retracement) followed by the 0.8030 (38.2% expansion) area.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.