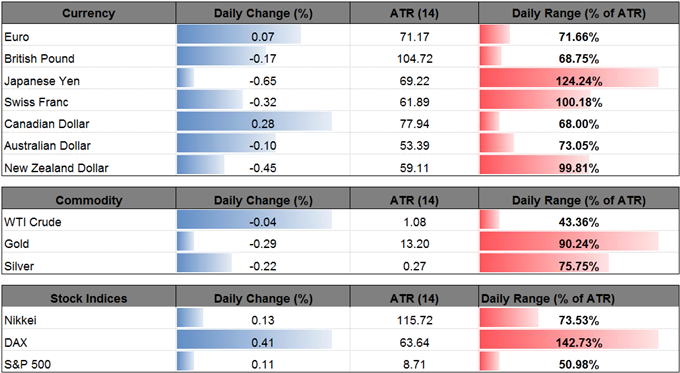

Talking Points:

- Fresh ECB Rhetoric Fails to Boost EUR/USD Outlook.

- Gold Rebound Unravels as Fed Officials Endorse Three-Rate Hikes for 2018.

- Sign Up & Join DailyFX Currency Analyst David Song to Discuss Key FX Themes & Potential Trade Setups.

Fresh rhetoric coming out of the European Central Bank (ECB) has failed to prop up EUR/USD, with the pair at risk of extending the bearish sequence from the previous week as President Mario Draghi and Co. appear to be on course to carry the quantitative-easing (QE) program into 2018.

DailyFX 4Q 2017 Forecasts Are Now Available!

Even though Governing Council member Francois Villeroy de Galhau warns ‘there should be an adequate reduction of our net asset purchases, toward their possible end,’ it seems as though the ECB remains in no rush to halt the non-standard measure as the central bank struggles to achieve its one and only mandate for price stability. In a recent speech, President Draghi offered zero guidance, with the central bank head merely noting that there is a ‘window of opportunity’ to implement structural reforms as the central bank sticks to the zero-interest rate policy (ZIRP).

As a result, the Euro stands at risk of facing headwinds ahead of the ECB’s October 26 meeting as officials show a greater willingness to preserve the QE program beyond the December deadline.

EUR/USD Daily Chart

- Near-term outlook for EUR/USD remains tilted to the downside as it price & the Relative Strength Index extend the bearish formations from August, with the former-support zone around 1.1860 (161.8% expansion) region offering resistance.

- May see a move back towards the 1.1670 (50% retracement) hurdle, which largely lines up with the monthly-low (1.1669), with the next downside target coming in around 1.1580 (100% expansion).

Fresh comments from Federal Reserve officials appear to be weighing on gold prices as Chair Janet Yellen and Co. look to further normalize monetary policy over the coming months.

Even though Philadelphia Fed President Patrick Harker argues the Federal Open Market Committee (FOMC) has ‘no need to firmly commit’ to a December rate-hike, the 2017-voting member went onto say the central bank should ‘prudently move up to the neutral real rate as quickly as possible’ as there remains ‘very little slack’ in the U.S. labor market. At the same time, New York Fed President William Dudley also appears to be on board to further normalize monetary policy as the permanent voting-member notes that ‘pressure on resources will drive up wages over time.’

With that said, the FOMC may stick with its current pace and deliver three-hikes in 2018, but the downward revision in the longer-run interest rate forecast suggests the committee may hit the end of the hiking-cycle ahead of schedule as the central bank struggles to achieve the 2% target for inflation.

XAU/USD Daily Chart

Chart - Created Using Trading View

- Broader outlook for gold remains constructive as both price & the Relative Strength Index (RSI) retain the upward trends from earlier this year.

- However, recent price action raises the risk for a larger correction in XAU/USD amid the failed attempt to test the Fibonacci overlap around $1312 (61.8% expansion) to $1315 (23.6% retracement).

- In turn, XAU/USD stands at risk for further losses as it initiates a series of lower highs & lows, with a break/close below the $1270 (38.2% expansion) region opening up the next downside hurdle around $1260 (23.6% expansion), which lines up with the monthly-low ($1261).

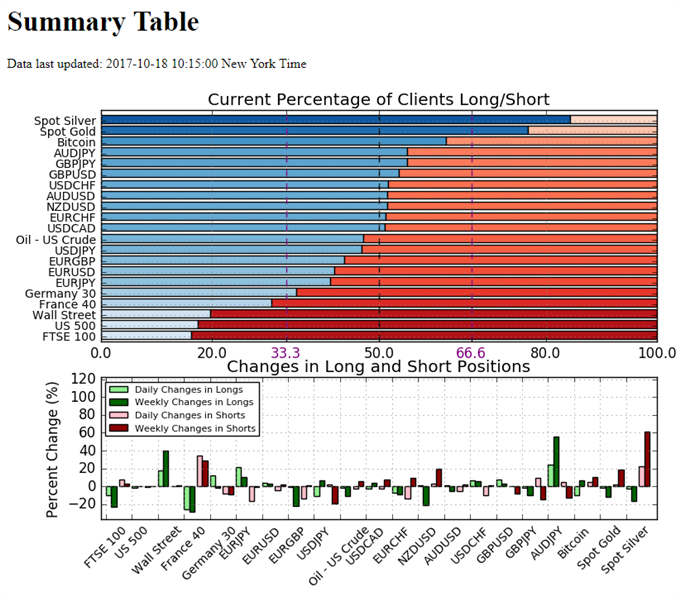

Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

- Retail trader data shows 42.0% of traders are net-long EUR/USD with the ratio of traders short to long at 1.38 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.08123; price has moved 8.8% higher since then. The number of traders net-long is 4.0% higher than yesterday and 3.3% higher from last week, while the number of traders net-short is 4.1% lower than yesterday and 2.0% higher from last week.

- Retail trader data shows 76.8% of traders are net-long Spot Gold with the ratio of traders long to short at 3.31 to 1. The number of traders net-long is 2.0% lower than yesterday and 12.1% lower from last week, while the number of traders net-short is 2.3% higher than yesterday and 19.0% higher from last week.

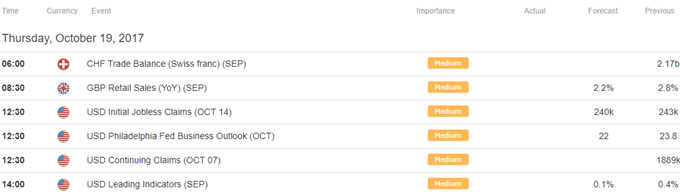

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.