Talking Points:

- NZD/USD Risks Larger Recovery Ahead of NZ CPI as RSI Holds Above Oversold Territory.

- GBP/USD Rebound Hit by Slowing U.K. Consumer Credit, Brexit Deadlock.

- Sign Up & Join DailyFX Currency Analyst Christopher Vecchio LIVE to Cover the U.S. CPI Report.

NZD/USD outperforms its major counterparts, with the pair at risk of staging a larger recovery ahead of New Zealand’s 3Q Consumer Price Index (CPI) as the bearish momentum appears to be abating.

DailyFX 4Q 2017 Forecasts Are Now Available!

NZD/USD may continue to retrace the decline from earlier this month as the headline reading for New Zealand inflation is anticipated to pick up during the three-months through September, and a positive development may prop up the local currency as it puts pressure on the Reserve Bank of New Zealand (RBNZ) to lift the cash rate off of the record-low. However, it seems as though the RBNZ is in no rush to move away from its easing-cycle as the central bank warns ‘headline inflation is likely to decline in coming quarters, reflecting volatility in tradables inflation, and acting Governor Grant Spencer may carry the current policy into 2018 especially as the RBNZ retains the verbal intervention and argues a ‘lower New Zealand dollar would help to increase tradables inflation and deliver more balanced growth.’

With that said, the wait-and-see approach may continue to drag on the broader outlook for NZD/USD, and the RBNZ may continue to tame market expectations for an imminent rate-hike as the central bank insists ‘monetary policy will remain accommodative for a considerable period.’

NZD/USD Daily Chart

- With the former-resistance zone around 0.7040 (50% retracement) offering support, a close back above the 0.7100 (38.2% retracement) to 0.7110 (38.2% expansion) region may spur a move towards the 200-Day SMA (0.7158), with the next topside hurdle coming in around 0.7190 (50% retracement) to 0.7200 (38.2% retracement).

- Keep in mind, the Relative Strength Index (RSI) has marked another failed attempt to push into oversold territory, but the broader outlook both price and the momentum indicator remains mired by the bearish formations carried over from the summer months.

The British Pound struggles to hold its ground as a the Bank of England’s (BoE) 3Q Bank Liabilities survey warned ‘credit scoring criteria for granting both credit card and other unsecured loans were reported to have tightened,’ and GBP/USD may continue to face near-term headwinds as the European Union’s chief Brexit negotiator, Michel Barnier, warns the negations have ‘reached a state of deadlock.’

The slowdown in private-sector lending accompanied by the uncertainty surrounding the fiscal outlook may push the Bank of England (BoE) to retain the record-low interest rate at the next meeting on November 2, and we may see another 7 to 2 split within the central bank as ‘there remain considerable risks to the outlook, which include the response of households, businesses and financial markets to developments related to the process of EU withdrawal.’

With that said, the U.K. Consumer Price Index (CPI) due out next week may play a key role in influencing the monetary policy outlook as the BoE expects inflation ‘to overshoot the 2% target over the next three years,’ and signs of heightening price pressures may heighten the appeal of the British Pound as Governor Mark Carney and Co. note that ‘a withdrawal of part of the stimulus that the Committee had injected in August last year would help to moderate the inflation overshoot while leaving monetary policy very supportive.’

GBP/USD Daily Chart

Chart - Created Using Trading View

- GBP/USD stands at risk of extending the pullback from the 2017-high (1.3657) as it snaps the bullish sequence from the monthly-low (1.3027), and the pair may work its way back towards the August-low (1.2774) as both price and the Relative Strength Index (RSI) continue to track the downward trend carried over from September.

- In turn, a move below the Fibonacci overlap around 1.3300 (100% expansion) to 1.3320 (38.2% retracement) may spur a more meaningful run at the 100-Day SMA (1.3024), with the next downside region of interest coming in around 1.2950 (23.6% expansion) to 1.2960 (78.6% retracement).

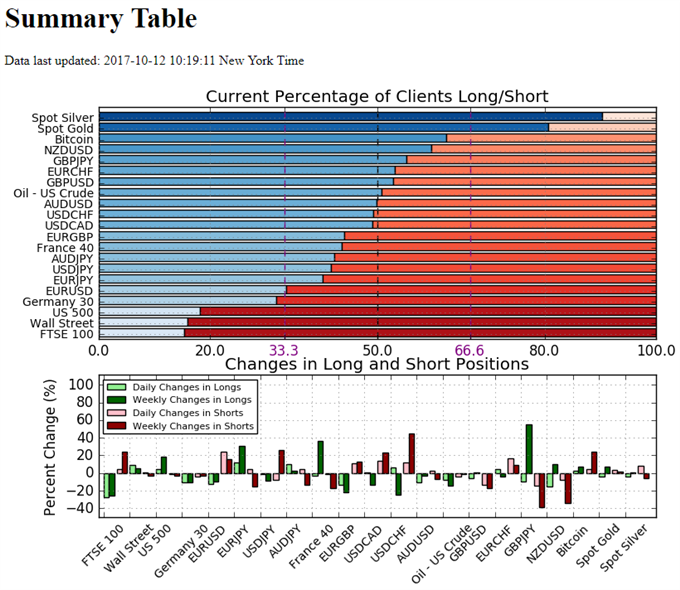

Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

- Retail trader data shows 59.7% of traders are net-long NZD/USD with the ratio of traders long to short at 1.48 to 1. The number of traders net-long is 14.9% lower than yesterday and 9.6% higher from last week, while the number of traders net-short is 7.7% lower than yesterday and 34.1% lower from last week.

- Retail trader data shows 52.8% of traders are net-long GBP/USD with the ratio of traders long to short at 1.12 to 1. The number of traders net-long is 6.1% lower than yesterday and 0.3% higher from last week, while the number of traders net-short is 13.5% lower than yesterday and 17.2% lower from last week.

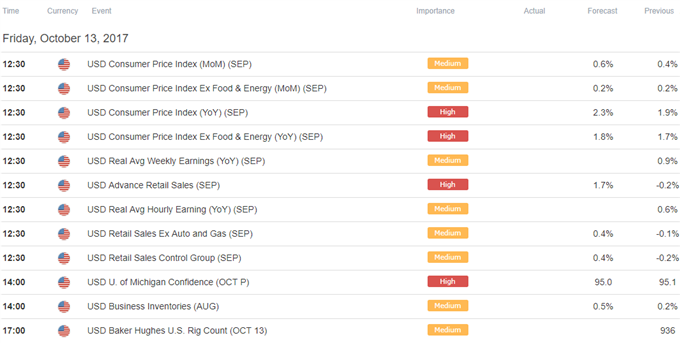

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.