Talking Points:

- USD/JPY Rebound Stalls as FOMC Warns of Below-Target Inflation.

- Crude Oil Prices Continue to Search for Support as U.S. Outputs Climb to Fresh 2017-High.

- Sign Up for the DailyFX Trading Webinars for an opportunity to discuss potential trade setups.

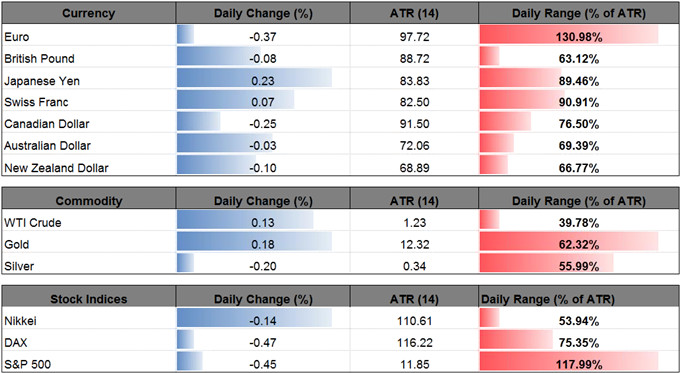

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/JPY | 109.95 | 110.37 | 109.62 | 24 | 75 |

USD/JPY pares the rebound from the August-low (108.73) as the Federal Open Market Committee (FOMC) Minutes rattle expectations for another 2017 rate-hike.

The policy statement sounded rather dovish as many Fed officials‘saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.’ Even though Fed Fund Futures still highlight a 50/50 chance for a move in December, Chair Janet Yellen and Co. may stick to the sidelines throughout the remainder of the year as officials warn ‘inflation expectations might need to be bolstered in order to ensure their consistency with the Committee’s longer-term inflation objective.’

In turn, USD/JPY may continue to consolidate ahead of the Fed Economic Symposium in Jackson Hole, Wyoming, but another batch of dovish rhetoric may produce headwinds for the greenback especially as the FOMC is widely expected to keep the benchmark interest rate on hold in September.

USD/JPY Daily Chart

Chart - Created Using Trading View

- USD/JPY snaps the bullish sequence carried over from the previous week after failing to break the monthly opening-range, with the near-term outlook capped around 111.10 (61.8% expansion) to 111.60 (38.2% retracement).

- A move back below the Fibonacci overlap around 109.40 (50% retracement) to 109.90 (78.6% expansion) may spur a run at the August-low (108.73), with the next downside hurdle coming in around 108.30 (61.8% retracement) to 108.40 (100% expansion).

- Nevertheless, the recent developments in the Relative Strength Index (RSI) suggests the dollar-yen exchange rate may work its way back towards the top of the broader range as the oscillator breaks out of the bearish formation from July.

| Ticker | Last | High | Low | Daily Change ($) | Daily Range ($) |

|---|---|---|---|---|---|

| USOIL | 46.88 | 46.96 | 46.44 | 0.09 | 0.52 |

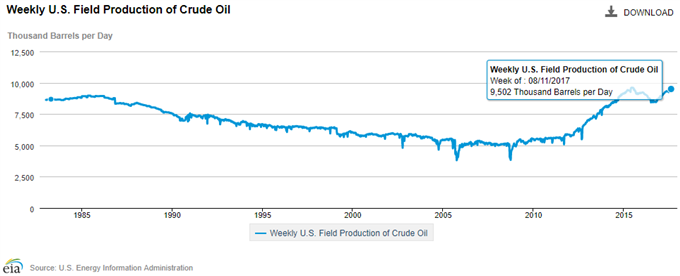

Crude has bounced back from a fresh monthly-low ($46.44), but oil prices stand at risk for a further decline amid the pickup in U.S. production.

For Additional Resources, Download the DailyFX Trading Guides and Forecasts

Even though U.S. Crude Oil Inventories narrowed another 8945K in the week ending August 11, separate figures from the Energy Information Administration (EIA) showed field production increased 9,502K during the same period to mark the fastest pace of growth for 2017. The upward trend in U.S. outputs may continue to foster a bearish outlook for energy prices especially as USOIL largely preserves the downward trend from the previous year.

USOIL Daily Chart

Chart - Created Using Trading View

- Near-term outlook for USOIL remains tilted to the downside as it pulls back from channel resistance, with crude prices at risk for further losses as it starts to carve a series of lower highs & lows.

- Break/close below the $46.40 (50% expansion) region may open up the next downside region of interest coming in around $44.90 (78.6% retracement) to $45.30 (23.6% expansion) followed by overlap around $44.10 (61.8% retracement) to $44.50 (78.6% retracement).

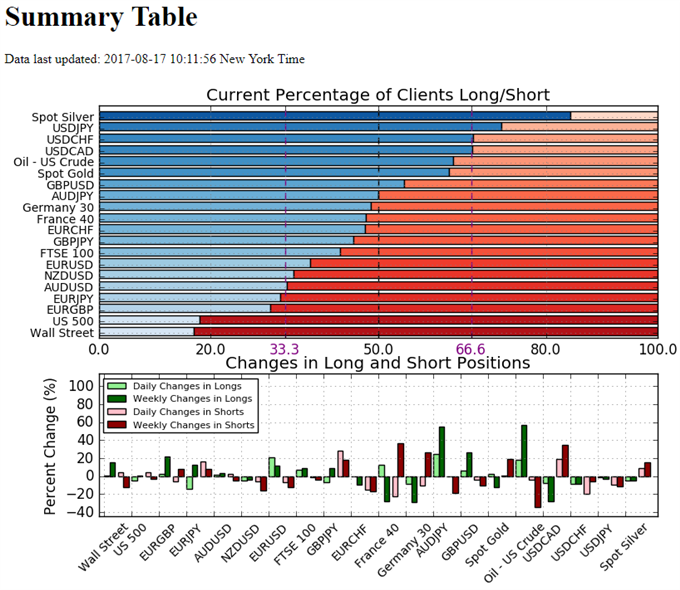

Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

- Retail trader data shows 72.0% of traders are net-long USD/JPY with the ratio of traders long to short at 2.57 to 1. In fact, traders have remained net-long since July 18 when USD/JPY traded near 112.524; price has moved 2.5% lower since then. The number of traders net-long is 1.2% lower than yesterday and 2.8% lower from last week, while the number of traders net-short is 9.4% lower than yesterday and 11.3% lower from last week.

- Retail trader data shows 63.3% of traders are net-long Oil - US Crudewith the ratio of traders long to short at 1.72 to 1. The number of traders net-long is 18.2% higher than yesterday and 57.0% higher from last week, while the number of traders net-short is 3.7% lower than yesterday and 34.3% lower from last week.

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.