Talking Points:

- EUR/USD Resilience Persists Ahead of NFP Report, RSI Clings to Overbought Territory.

- NZD/USD at Risk for Further Losses Ahead of RBNZ Policy Meeting.

- DailyFX 3Q Forecasts Are Now Available.

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| EUR/USD | 1.1857 | 1.1868 | 1.1794 | 55 | 74 |

EUR/USD climbs to a fresh 2017-high (1.1869) ahead of the highly anticipated U.S. Non-Farm Payrolls (NFP) report, and the pair may continue to exhibit a bullish behavior over the coming days as mixed data prints coming out of the economy drag on interest-rate expectations.

The 178K expansion in ADP Employment raises the risk for a weaker-than-forecast NFP print, and the fresh figures due out later this week may continue to dampen bets for three Fed rate-hikes in 2017 as Average Hourly Earnings are anticipated to slow in July. The ongoing weakness in household earnings may encourage the Federal Open Market Committee (FOMC) to adopt a less-hawkish tone at the next rate decision on September 20, and Chair Janet Yellen and Co. may show a greater willingness to retain the current stance throughout the remainder of the year as official warn ‘overall inflation and the measure excluding food and energy prices have declined and are running below 2 percent.’

EUR/USD Daily Chart

Chart - Created Using Trading View

- Near-term bias for EUR/USD remains tilted to the upside as the pair pokes above the 1.1860 (161.8% expansion) hurdle, while the Relative Strength Index (RSI) continues to sit in oversold territory.

- May see EUR/USD finally attempt to fill the gap from January-2015 (1.2000 down to 1.1955) as the region largely lines up with the next topside hurdle coming in around 1.1960 (38.2% retracement).

- However, lack of momentum to close above 1.1860 (161.8% expansion) may generate a near-term correction in the euro-dollar exchange rate, and the RSI may flash a textbook sell-signal over the coming days should the oscillator break below 70.

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| NZD/USD | 0.7436 | 0.7475 | 0.7411 | 31 | 64 |

NZD/USD stands at risk for further losses ahead of the Reserve Bank of New Zealand’s (RBNZ) August 9 meeting as the pair initiates a bearish sequence following the dismal 2Q Employment report.

The marked slowdown in New Zealand job growth accompanied by the ongoing weakness in Private Wages may encourage the RBNZ to preserve the record-low cash rate beyond Governor Graeme Wheeler’s departure in September, and the central bank may largely retain the wait-and-see approach throughout 2017 as ‘numerous uncertainties remain and policy may need to adjust accordingly.’ In turn, more of the same from the RBNZ may dampen the appeal of the New Zealand dollar, but the shift in NZD/USD behavior may continue to unfold over the coming months as market participants mull the timing of the next Federal Reserve rate-hike.

NZD/USD Daily Chart

Chart - Created Using Trading View

- Broader outlook for NZD/USD has perked up as the pair breaks out of the downward trend from 2016, but the string of failed attempt to close above the 0.7350 (23.6% expansion) hurdle raises the risk for a near-term correction as the pair struggles to preserve the narrow range carried over from the previous week.

- May see NZD/USD extend the recent series of low highs & lows as the Relative Strength Index (RSI) falls back from overbought territory, with a break/close below the 0.7400 (38.2% expansion) handle opening up the former-resistance zone around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion), which may now act as support.

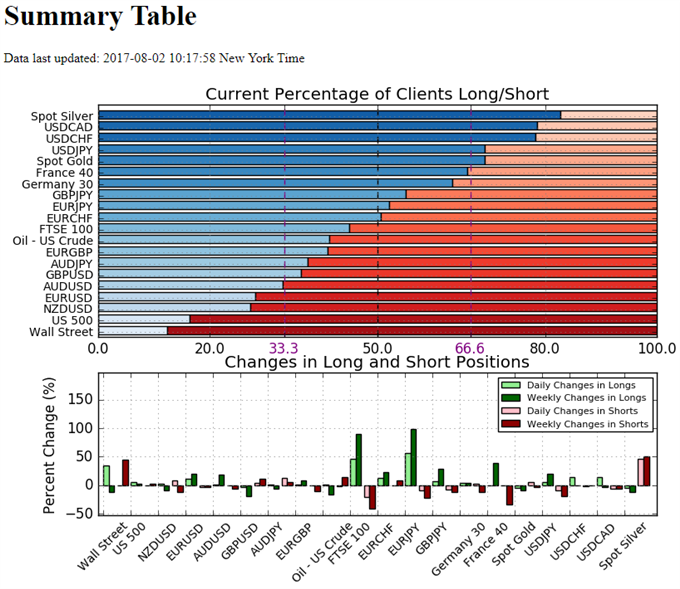

Retail FX Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

- Retail trader data shows 28.1% of traders are net-long EUR/USD with the ratio of traders short to long at 2.55 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.06665; price has moved 11.1% higher since then. The number of traders net-long is 10.5% higher than yesterday and 19.8% higher from last week, while the number of traders net-short is 3.6% lower than yesterday and 3.7% lower from last week.

- Retail trader data shows 27.2% of traders are net-long NZD/USD with the ratio of traders short to long at 2.67 to 1. In fact, traders have remained net-short since May 24 when NZD/USD traded near 0.68667; price has moved 8.3% higher since then. The number of traders net-long is 1.9% higher than yesterday and 8.9% lower from last week, while the number of traders net-short is 7.9% higher than yesterday and 11.9% lower from last week.

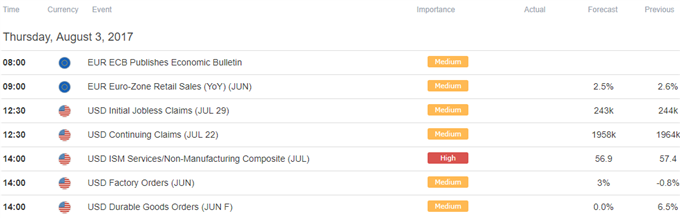

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.