Talking Points:

- EUR/USD Climbs to Fresh 2017 High as ECB Warns of Imminent Shift in Monetary Policy.

- British Pound Lags Behind Despite Strong U.K. CPI; Focus Turns to Jobless Claims Report.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| EUR/USD | 1.1078 | 1.1089 | 1.0975 | 103 | 114 |

EUR/USD extends the advance from earlier this week, with the exchange rate climbing to a fresh 2017-high of 1.1089, and the Euro may continue to outperform its major counterparts as the European Central Bank (ECB) appears to be on course to alter the monetary policy outlook.

According to an interview with MNI, Governing Council memberJan Smets warned the ECB ‘will not wait until New Year’s Eve to tell the markets what will happen on the first of January,’ and went onto say that the ‘next reassessment will happen with the new staff projections in June’ as the central bank plans to conclude its quantitative easing (QE) program in December. With that said, the ECB may continue to reduce its asset-purchases over the coming months, and the threat of a taper tantrum may prop up the single-currency as President Mario Draghi and Co. show a greater willingness to move away from the easing-cycle.

EURUSD Daily

Chart - Created Using Trading View

- Topside targets remain in focus for EUR/USD as it holds above the 200-Day SMA (1.0830) and carves a near-term series of higher highs & lows, with the next area of interest coming in around 1.1140 (23.6% expansion) to 1.1160 (38.2% 38.2% expansion) followed by 1.1220 (61.8% retracement).

- Nevertheless, will need to keep a close eye on the Relative Strength Index (RSI) as it approaches overbought territory, with another failed attempt to push above 70 raising the risk for a near-term pullback in EUR/USD; 200-Day SMA (1.0830) stands as the first line of defense followed by the Fibonacci overlap around 1.0780 (100% expansion) to 1.0790 (38.2% expansion).

Have a question about the currency markets? Join a Trading Q&A webinar and ask it live!

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| GBP/USD | 1.2913 | 1.2958 | 1.2866 | 17 | 92 |

The British Pound failed to benefit from the marked uptick in the U.K. Consumer Price Index (CPI), with the rise largely attributed to second-round effects of higher energy prices, and the GBP/USD exchange rate may continue to grind lower over the remainder of the week as it fails to break the monthly opening range.

With that said, the U.K. Jobless Claims report may also yield a lackluster response as Average Weekly Earnings excluding bonuses are expected to slow for the second consecutive month in March, and signs of weaker wage growth may encourage the Bank of England (BoE) to preserve the record-low interest rate throughout 2017 as Governor Mark Carney and Co. warn ‘consumption growth will be slower in the near term than previously anticipated.’

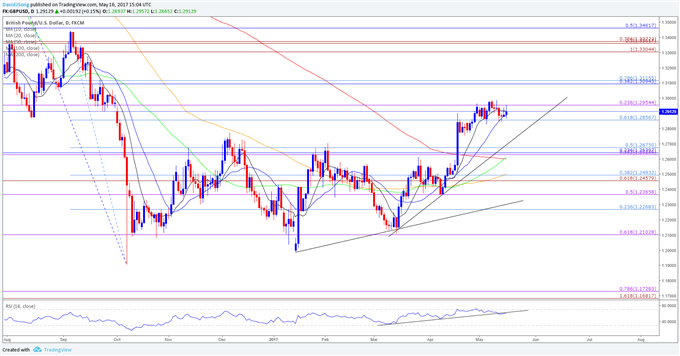

GBP/USD Daily

Chart - Created Using Trading View

- With that said, the relief rally in GBP/USD appears to be getting exhausted as the RSI deviates from price and falls back from overbought territory, with the oscillator failing to preserve the bullish formation carried over from March.

- In turn, the pullback from the monthly high (1.2988) may gather pace over the coming days, with a break/close below the 1.2860 (61.8% retracement) hurdle opening up the next downside region of interest around 1.2630 (38.2% expansion) to 1.2680 (50% retracement).

Make Sure to Check Out the DailyFX Guides for Additional Trading Ideas.

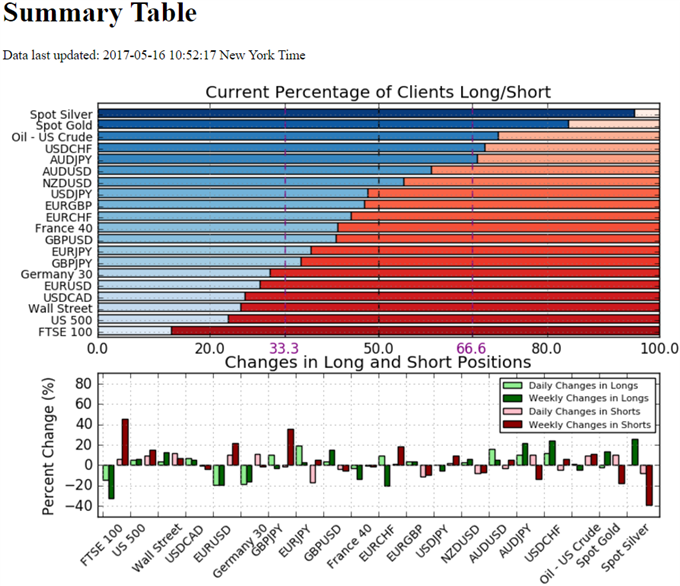

- Retail trader data shows 28.9% of traders are net-long EUR/USD with the ratio of traders short to long at 2.46 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.06042; price has moved 4.5% higher since then. The number of traders net-long is 19.3% lower than yesterday and 19.5% lower from last week, while the number of traders net-short is 10.3% higher than yesterday and 21.6% higher from last week.

- Retail trader data shows 42.4% of traders are net-long GBP/USD with the ratio of traders short to long at 1.36 to 1. In fact, traders have remained net-short since April 12 when GBP/USD traded near 1.23717; price has moved 4.4% higher since then. The number of traders net-long is 3.4% higher than yesterday and 14.9% higher from last week, while the number of traders net-short is 4.1% lower than yesterday and 5.7% lower from last week.

For More Information on Retail Sentiment, Check Out the New Gauge Developed by DailyFX Based on Trader Positioning

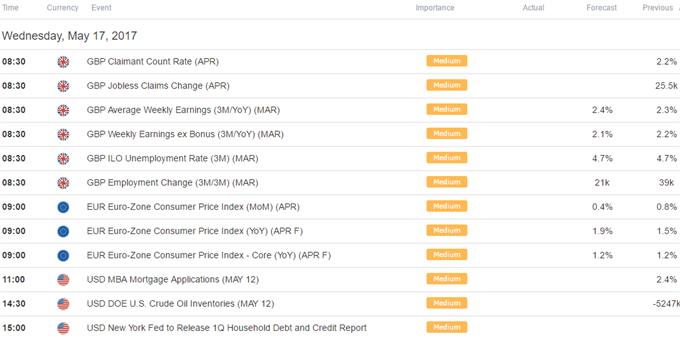

Click Here for the DailyFX Calendar

For LIVE Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.