Talking Points:

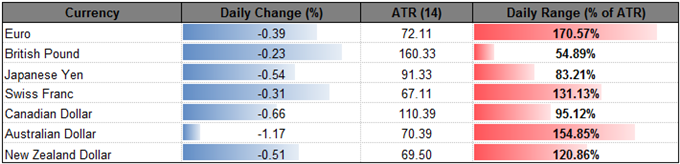

- EUR/USD Post-ECB Outlook Clouded with Mixed Signals as Momentum Deviates.

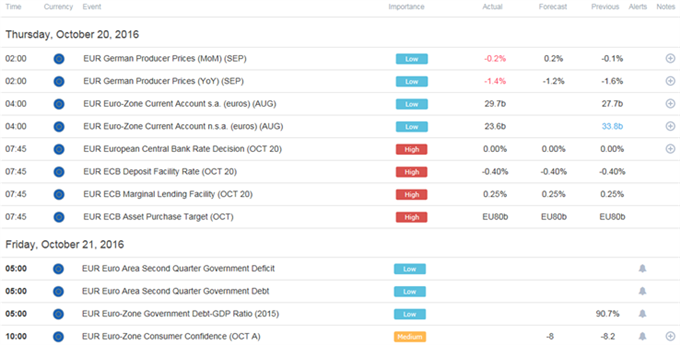

- AUD/USD Risks Larger Pullback as Dismal Australia Employment Report Fuels Bets for RBA-Easing.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| EUR/USD | 1.0931 | 1.1039 | 1.0916 | 43 | 123 |

EUR/USD Daily

Chart - Created Using Trading View

- The Euro may continue to give back the advance from earlier this year as the economic/geopolitical outlook for the monetary union remains clouded with high uncertainty, while the European Central Bank (ECB) keeps the door open to further embark on its easing cycle; nevertheless, the recent price action may foster a near-term recovery in EUR/USD as the pair fails to test the June low (1.0912), while the Relative Strength Index (RSI) holds above oversold territory even as the exchange rate slips to fresh monthly lows.

- It seems as though the ECB will wait for its December 8 policy meeting to announce an extension/adjustment of the quantitative easing (QE) program as the central bank warns ‘the baseline scenario remains subject to downside risks,’ but more of the same from the Governing Council may spur a taper tantrum should the committee stick to the March 2017 deadline for its asset-purchase program.

- A break/close below 1.0910 (38.2% expansion) may open up the next downside region of interest around 1.0780 (100% expansion) to 1.0800 (23.6% retracement), but the divergences between price & the RSI may spark a move back towards former support around 1.1090 (50% retracement) to 1.1110 (50% retracement).

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| AUD/USD | 0.7632 | 0.7734 | 0.7625 | 90 | 109 |

AUD/USD Daily

Chart - Created Using Trading View

- Broader outlook for AUD/USD remains constructive as the pair preserves the upward trend from earlier this year, but another failed attempt to break/close above the Fibonacci overlap around 0.7730 (61.8% retracement) to 0.7740 (78.6% expansion) may spur a larger pullback in the exchange rate as the aussie-dollar appears to be stuck in a triangle/wedge formation.

- The 9.8K decline in Australian employment appears to be fueling speculation for additional monetary support as the weakness was driving by a 53K contraction in full-time positions, but the Reserve Bank of Australia (RBA) may continue to endorse a wait-and-see approach at the next policy meeting on November 1 as the central bank continues to anticipate a ‘moderate’ recovery even as ‘labour market indicators have been somewhat mixed.’

- Will keep a close eye on the downside targets for AUD/USD over the days ahead, with the first region of interest coming in around 0.7590 (1000% expansion) to 0.7600 (23.6% retracement) followed by 0.7530 (38.2% expansion).

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long EUR/USD following the ECB meeting, with the ratio pushing into positive territory on October 10, while traders have flipped net-short AUD/USD at the start of the week.

- EUR/USD SSI currently sits at +1.81 as 64% of traders are long, with long positions 15.2% higher from the previous week even as open interest stands 2.7% below the monthly average.

- AUD/USD SSI currently reads -1.24 as 45% of traders are long, with short positions 22.9% higher from the previous week, while open interest stands 11.1% below the monthly average.

- Will keep a close eye on EUR/USD sentiment as the ratio sits at the most extreme reading since 2014.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

COT-Speculative US Dollar Buying Frenzy

Earnings, ECB and Inflation to Headline Heavy Data Week

Silver Prices: Dead Cat Bounce Keeps Bias Tilted Lower

DAX Battle Lines Drawn as Index Looks to Regain 2016 Losses

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.