Talking Points:

- AUD/USD to Stage Larger Recovery on Wait-and-See RBA; Retail Sentiment Approaches 2016 Extreme.

- USDOLLAR Weakness to Persist on Slowing U.S. Consumer Price Index (CPI).

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

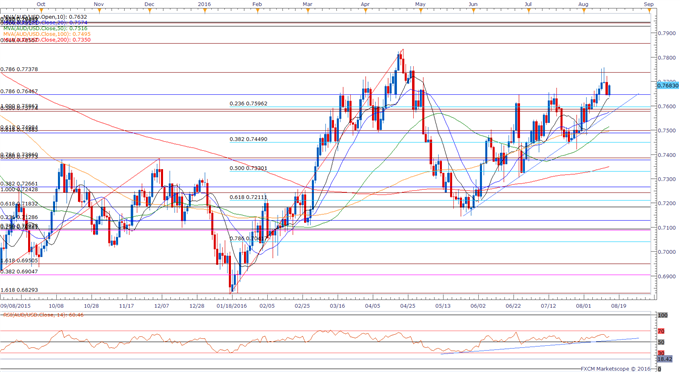

Chart - Created by David Song

- Despite the recent series of lower highs & lows in AUD/USD, the pair may work its way back towards the 2016 high (0.7834) as price & the Relative Strength Index (RSI) preserve the bullish trends carried over from May; will retain a constructive outlook over the near-term as long as aussie-dollar continues to hold above the Fibonacci overlap around 0.7580 (50% expansion) to 0.7600 (23.6% retracement).

- With Reserve Bank of Australia (RBA) Governor Glenn Stevens scheduled to depart from the central bank next month, the meeting minutes may spark a bullish reaction in the Australian dollar should the statement largely endorse a wait-and-see approach for monetary policy as Philip Lowe takes the helm on September 18; may see a more meaningful market reaction to the 2Q Wage Price Index as well as the Employment report for July as the central bank provides little forward-guidance.

- Need a closing price above 0.7740 (78.6% expansion) to open up the 2016 high (0.7834) along with the next topside objective coming in around 0.7860 (61.8% expansion).

- The DailyFX Speculative Sentiment Index (SSI) shows retail FX crowd remains net-short AUD/USD since August 2, with the ratio approaching the most extreme reading since March when the gauge for retail sentiment slipped to -2.17.

- The ratio currently sits at -1.58 as 39% of traders are long, with short positions 6.0% higher from the previous week, while open interest stands 8.2% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 11960.91 | 11974.18 | 11947.66 | -0.05 | 47.53% |

Chart - Created by David Song

- The mixed data prints coming out of the U.S. economy may produce additional headwinds for the USDOLLAR as the Atlanta Fed’s GDP model cut its third-quarter forecast to 3.5% from the 3.7% reading on August 9; may see the fresh comments from Atlanta Fed President Dennis Lockhart, St. Louis Fed President James Bullard, New York Fed President William Dudley and San Francisco Fed President John Williamsdrag on the greenback should the central bank officials endorse a wait-and-see approach for monetary policy.

- Even though the headline reading for the U.S. Consumer Price Index (CPI) is projected to slow to an annualized 0.9% from 1.0% in June, stickiness in the core rate of inflation may keep the USDOLLAR within the current range as Fed Funds Futures continue to highlight a 12% probability for a September rate-hike.

- With the USDOLLAR largely capped around 11,989 (50% retracement) will keep a close eye on the bottom of the recent range, with a break/close below 11,898 (50% retracement) opening up the next downside region of interest around 11,822 (23.6% retracement) to 11,843 (38.2% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

USD/CAD Technical Analysis: Macro Now Favoring a Breakdown?

Gold Prices Wedging into Consolidation Near Resistance

USDOLLAR Short Term Technical Update

S&P 500: Notches New Record High, Short-term Techs in Focus

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.