Talking Points:

- USD/JPY Retail FX Sentiment Back at Extremes Post Wait-and-See BoJ.

- USDOLLAR Outlook Mired by Waning Interest-Rate Expectations.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

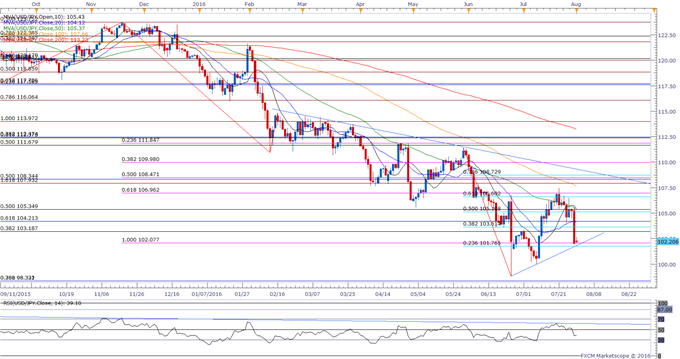

Chart - Created by David Song

- USD/JPY stands at risk of giving back the rebound from the June low (98.78) as it appears to have carved a lower-high during the previous month and preserves the downward trend from earlier this year; may see the pair carve a lower-low over the near to medium-term as the Bank of Japan (BoJ) continues to endorse a wait-and-see approach for monetary policy.

- Even though the BoJ keeps the door open to further embark on its easing cycle, recent headlines from local agencies suggest the central bank will remove its 2-year deadline to achieve the 2% target for inflation as Governor Haruhiko Kuroda and Co. continue to assess the impact of the negative-interest rate policy (NIRP); a shift in the policy guidance may boost the appeal of the Yen especially as Japan returns to its historical role as a net-lender to the world economy.

- A break/close below the Fibonacci overlap around 101.80 (23.6% retracement) to 102.10 (100% expansion) may lead to fresh 2016 lows in USD/JPY, with the next area of interest coming in around 98.30 (38.2% & 78.6% retracements).

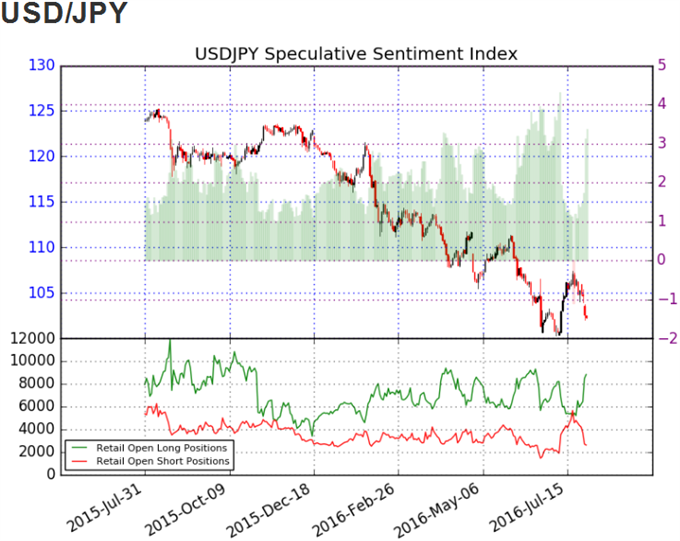

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long USD/JPY since July 22, with the ratio hitting an extreme during the previous month as it climbed to +5.28, marking the highest reading since 2012.

- The ratio currently sits at +3.46 as 78% of traders are long, with long positions 64.3% higher from the previous week, while open interest stands 14.5% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

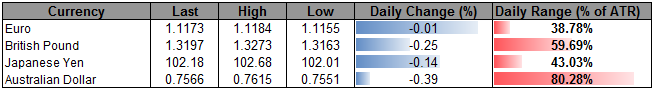

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 11957.48 | 11967.97 | 11937.08 | 0.13 | 57.57% |

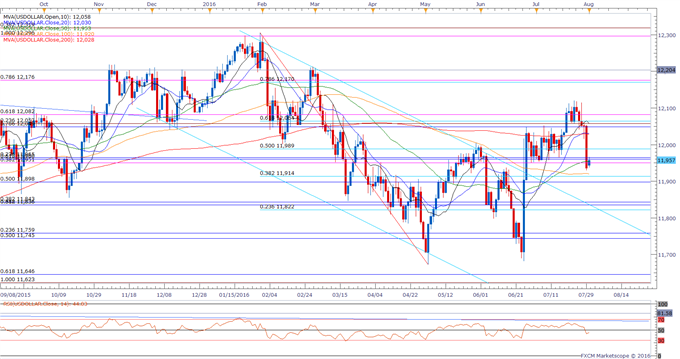

Chart - Created by David Song

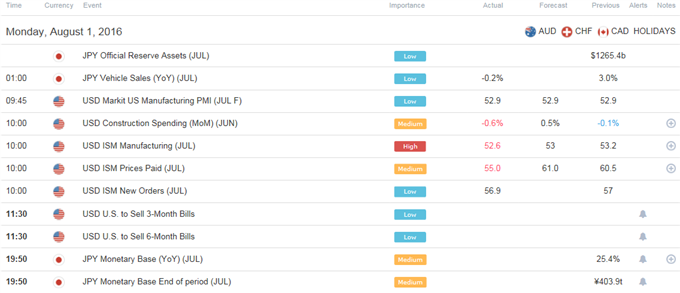

- The USDOLLAR pares the sharp decline following the disappointing 2Q Gross Domestic Product (GDP) report even though the ISM Manufacturing survey shows a larger-than-expected slowdown in July, with the Employment component contracting from the previous month as the figure slipped to 49.4 from 50.4 in June.

- Even though market participants forecast another 180K expansion in U.S. Non-Farm Payrolls, the greenback stands at risk of facing additional headwinds over the near to medium-term as Fed Funds Futures highlight narrowing expectations for a 2016 Fed rate-hike.

- The close below 11,951 (38.2% expansion) to 11,965 (23.6% retracement) raises the risk for a further decline in the USDOLLAR, with the next downside hurdle coming in around 11,898 (50% retracement) to 11,914 (38.2% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Sharply Unchanged, Consolidating or Topping?

COT-British Pound Ownership Profile Warns of a Bottom

Post-Brexit NZDUSD Support Vulnerable to Weak NZ Trade Balance

USD/JPY July Recovery at Risk on Wait-and-See FOMC/BoJ Policy

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.