Talking Points:

- USD/JPY Rally at Risk as G7 Opposes FX Intervention,Lacks Coordinated Action.

- USDOLLAR Continues to Threaten Resistance Ahead of Slew of Fed Speeches.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

Chart - Created Using FXCM Marketscope 2.0

- The near-term advance in USD/JPY stands at risk going into the Group of Seven (G7) meeting in Japan as the global community of central bankers & finance ministers want all members to stay committed in not intervening in the foreign exchange market; may see risk appetite also come under pressure should the group fail to take coordinated action to improve the outlook the outlook for global growth.

- Nevertheless, the Bank of Japan (BoJ) may come under increased pressure to further embark on its easing cycle especially as Japan’s Trade Balance surplus is anticipated narrow in April, while the Core Consumer Price Index (CPI) is anticipated to slow to an annualized 0.6% from 0.7% in March.

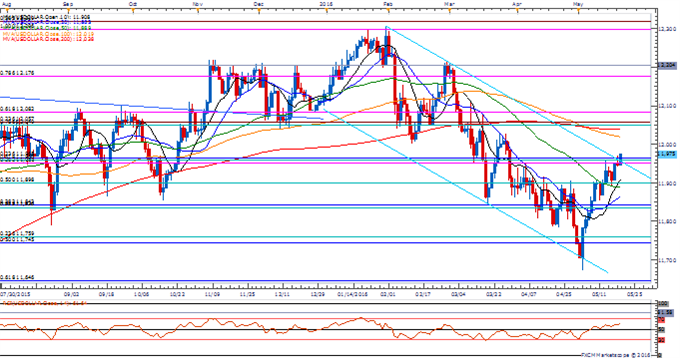

- Will keep a close eye on the downward trending carried over from March, with a topside break raising the risk for a move back towards 111.70 (50% retracement) to 111.80 (23.6% expansion).

- The DailyFX Speculative Sentiment Index (SSI) shows the FX crowd remains net-long USD/JPY since the BoJ’s January 29 interest-rate decision, with the ratio hitting an extreme reading back in April as it climbed to +3.50.

- The ratio currently sits at +1.50 as 60% of traders are long, with short positions 12.0% higher from the previous week even as open interest stands 3.6% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11975.79 | 11977.68 | 11944.64 | 0.22 | 62.36% |

Chart - Created Using FXCM Marketscope 2.0

- Despite the limited market reaction to the U.S. Existing Home Sales report, the USDOLLAR is making another attempt to break above near-term resistance around 11,951 (38.2% expansion) to 11,965 (23.6% retracement), with a break of the downward trending channel raising the risk for a larger recovery.

- With Fed Funds Futures still highlight a 30% probability for a June rate-hike, fresh comments from St. Louis Fed President James Bullard, San Francisco Fed President John Williams, Philadelphia Fed President Patrick Harker, Minneapolis Fed President Neel Kashkari, Dallas Fed President Robert Kaplan, Fed Governor Jerome Powell and Fed Chair Janet Yellen may boost the appeal of the greenback should the central bank officials show a greater willingness to implement higher borrowing-costs during the summer months.

- Break/close above the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) may open up the next topside target around 12,049 (78.6% retracement) to 12,057 (23.6% expansion).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

Gold Bulls Look to CPI, Fed Minutes for Solace

DailyFX Technical Focus: Short Term S&P and Gold Analysis

USD/CAD Technical Analysis: Time For Bulls To Prove Their Worth

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.