Talking Points:

- USD/JPY Retail FX Remains Net-Long; Interest Wanes Ahead of Japan CPI Report, BoJ Meeting.

- USDOLLAR Weakness to Persist on Wait-and-See FOMC, Lackluster GDP Report

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

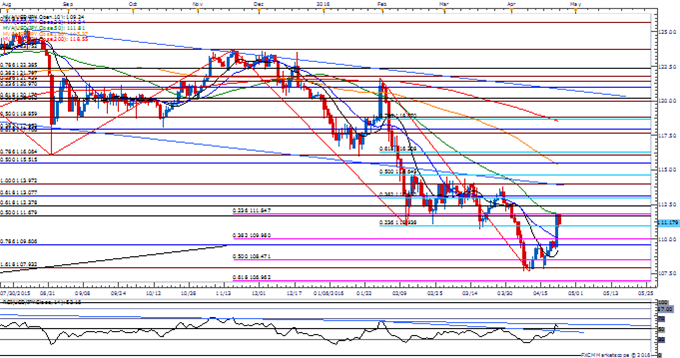

Chart - Created Using FXCM Marketscope 2.0

- USD/JPY struggles to hold its ground ahead of the Bank of Japan (BoJ) interest-rate as risk sentiment appears to be abating; may see a dollar-yen continue to give back the advance from earlier this month should the global benchmark equity indices come under increased pressure.

- Despite speculation for more BoJ-easing, Japan’s Consumer Price Index (CPI) report may prompt Governor Haruhiko Kuroda and Co. to endorse a wait-and-see approach as the core-core rate of inflation, which strips out food and energy costs, is expected to hold steady at an annualized 0.8% in March.

- Even though the Relative Strength Index (RSI) fails to preserve the bearish formation from earlier this year, the downside remains in focus as the oscillator remains stuck within the downward trend carried over from June 2015.

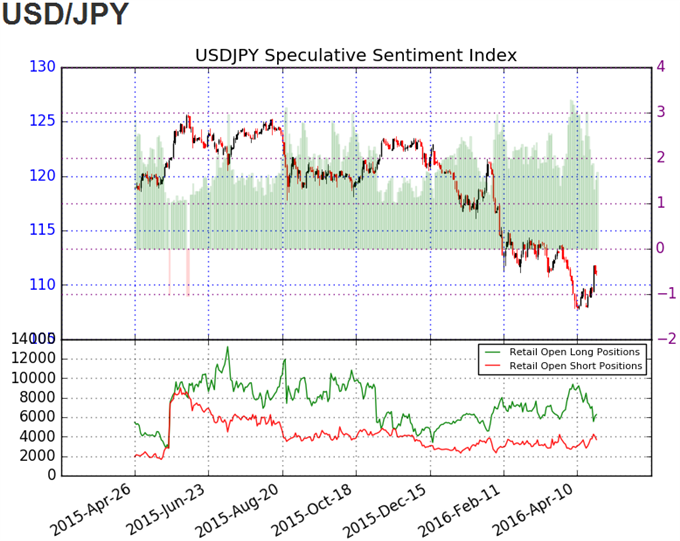

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long USD/JPY since the BoJ introduced the negative-interest rate policy (NIRP) on January 29, with the ratio hitting the most extreme reading since 2014 earlier this month as it advanced to +3.50.

- The ratio currently stands at +1.78 as 64% of traders are long, while open interest stands 8.4% below the monthly average heading into the end of the month.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

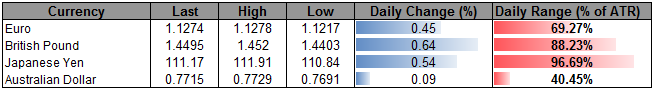

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11854.91 | 11883.39 | 11846.16 | -0.28 | 66.42% |

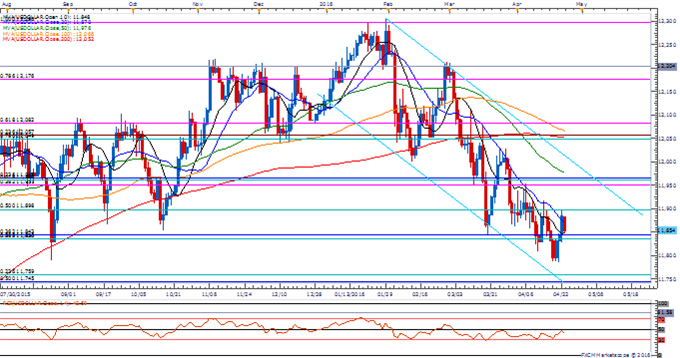

Chart - Created Using FXCM Marketscope 2.0

- The USDOLLAR stands at risk of facing additional headwinds over the near-term as the economic developments coming out of the world’s largest economy continues to disappoint; will see if the U.S. Durable Goods Orders report will buck the trend as demand for large-ticket items are anticipated to rebound 1.9% in March.

- There seems to be little excitement surrounding the Federal Open Market Committee’s (FOMC) April 27 interest-rate decision as the central bank is widely anticipated to retain its current policy; may see more of the same from Chair Janet Yellen and Co. drag on the greenback as it dampens rate-expectations.

- Failure to test the April opening monthly range may open up the downside risk, with the next region of interest coming in around 11,745 (50% retracement) to 11,759 (23.6% retracement).

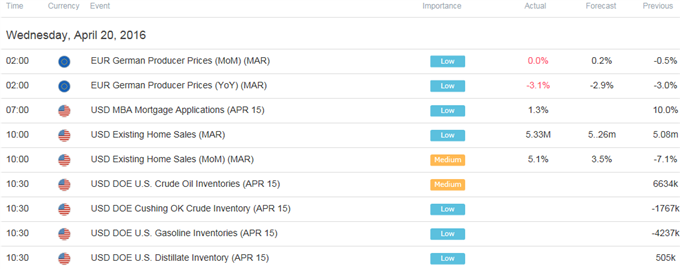

Click Here for the DailyFX Calendar

Read More:

US DOLLAR Technical Analysis: Retesting 2016 Lows

EUR/JPY Technical Analysis: The Negative Rate Trend Line is Back

EUR/USD and USD/CHF Outside Weeks at Well-Defined Levels

Big Test For Spoos, Big Test For the Markets

Get our top trading opportunities of 2016 HERE

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand