Talking Points:

- USD/CAD Slips to Fresh Monthly Low; Retail FX Remains Net-Long Ahead of BoC Meeting.

- USDOLLAR Extends Decline Amid Slowing U.S. Wage Growth; Fed’s Fischer & Brainard in Focus.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

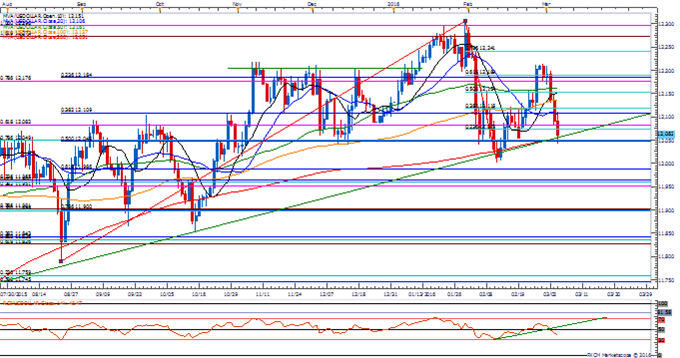

- Despite the slowdown in Canada’s Ivey Purchasing Manger Index (PMI), USD/CAD stands at risk for a further decline as the pair dips below former resistance around 1.3420 (38.2% expansion) to 1.3460 (61.8% retracement), while the Relative Strength Index (RSI) retains the bearish formation from earlier this year and flirts with oversold territory.

- Even though the Bank of Canada (BoC) is widely anticipated to preserve its current policy at the March 10 interest rate decision, fresh comments from Governor Stephen Poloz may boost the appeal of the loonie should the central bank show a greater willingness to move away from its easing cycle.

- Will keep a close eye on the downside targets as the near-term bearish formations continue to take shape, with the next region of interest coming in around 1.3190 (23.6% expansion) to 1.3230 (78.6% retracement).

- The DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long USD/CAD since February 25, with the ratio hitting a near-term extreme in March as it climbed towards +1.50.

- Retail sentiment has come off of recent extremes as the ratio narrows to +1.16, with 54% of traders now long.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12062.88 | 12112.98 | 12042.19 | -0.26 | 129.89% |

Chart - Created Using FXCM Marketscope 2.0

- Despite the 242K expansion in U.S. Non-Farm Payrolls (NFP) accompanied by the in the Labor Force Participation Rate, the USDOLLAR struggles to hold its ground following an unexpected slowdown in wage growth as Average Hourly Earnings narrowed to an annualized 2.2% from 2.5% in January.

- Even though the U.S. economic docket remains fairly light for the week ahead, key speeches by Fed Vice-Chair Stanley Fischer and Governor Lael Brainard may spark increased volatility in the greenback as market participants continue to mull the next Fed rate-hike.

- Failure to hold above the 12,050 (78.6% & 50% retracement) region raises the risk for a further decline, with the 2016 low (12,001) on the radar following by 11,986 (61.8% retracement).

Read More:

Another Big Test Awaits USD/CAD

DailyFX Technical Focus: Nikkei 225 at Resistance

USD/JPY Technical Analysis: The Core FX Pair In The Risk ParadigmUSDOLLAR: Key Levels to Know Heading into NFPs, March Open

Get our top trading opportunities of 2016 HERE

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand