Talking Points:

- Retail FX Flips Net-Long AUD/USD Ahead of Reserve Bank of Australia (RBA) Meeting.

- USDOLLAR Struggles to Retain Post-GDP Advance as Mixed Data Continues.

For more updates, sign up for David's e-mail distribution list.

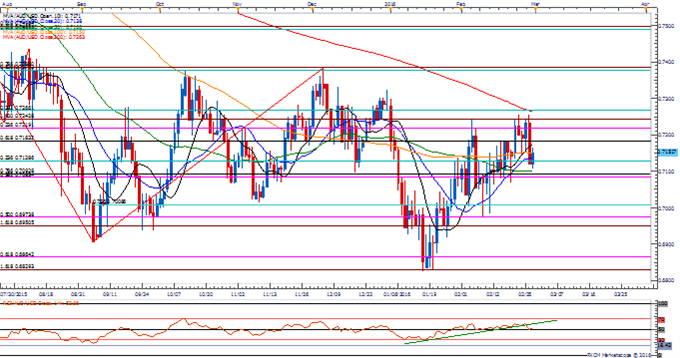

Chart - Created Using FXCM Marketscope 2.0

- With market attention turning to the Reserve Bank of Australia’s (RBA) March 1 policy meeting, may see AUD/USD retain the broad range from earlier this month should we get more of the same from Governor Glenn Stevens and Co. especially as the People’s Bank of China (PBoC) further reduces the reserve-requirement ratio (RRR) following the Group of 20 meeting.

- However, the pair may struggle to retain the advance from earlier this year should the RBA adopt a more dovish outlook for monetary policy & toughen the verbal intervention on the local currency in an effort to further insulate the Australian economy.

- Will keep a close eye around 0.7080 (38.2% expansion) to 0.7090 (78.6% retracement) for near-term support, with a break to the downside raising the risk for a move back towards 0.6950 (161.8% expansion) to 0.6970 (50% expansion).

- In light of the range-bound price action, the DailyFX Speculative Sentiment Index (SSI) continues to show increased volatility in retail positioning, with the FX crowd flipping net-long AUD/USD ahead of the RBA rate decision.

- The shift in position may be a larger function of month-end flows as short positions are 24.2% lower from the previous week, with the ratio climbing to +1.06 as 51% of traders are now long.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12186.91 | 12214.81 | 12177.34 | -0.16 | 65.86% |

Chart - Created Using FXCM Marketscope 2.0

- The USDOLLAR may continue to retrace the decline from earlier this year as the Relative Strength Index (RSI) appears to be carving a bullish formation, but the mixed data prints coming out of the world’s largest economy may keep the dollar capped ahead of the Federal Open Market Committee’s (FOMC) March 16 interest rate decision as market participants gauge the timing of the next rate-hike.

- Will keep a close eye on the fresh comments from New York Fed President William Dudley as central bank officials remain upbeat on the economy and talk down the risk for a recession even as the ISM Manufacturing survey is anticipated to highlight another contraction in February.

- As the USDOLLAR clears the near-term hurdle around 12,176 (78.6% expansion) to the 12,200 pivot, the next region of interest coming in around 12,241 (78.6% expansion) along with the 2016 high (12,306).

Read More:

US Dollar – Where the Rubber Meets the Road?

EUR/USD – Bullish Views Getting Put to the Test

Constructive Copper Pattern adds to AUD/USD Intrigue

Get our top trading opportunities of 2016 HERE

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand