Talking Points:

- Retail FX Cuts USD/JPY Longs- Positioning Continues to Fall Back From Recent Extremes.

- USDOLLAR Continues to Carve Higher Highs & Lows Despite Cautious FOMC Minutes.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

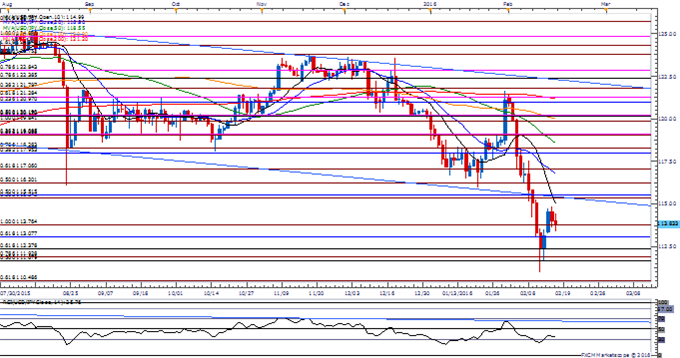

- Long-term outlook for USD/JPY remains tilted to the downside as the head-and-shoulders pattern from back in 2014 appears to be playing out, while the Relative Strength Index (RSI) preserves the bearish formation carried over from June.

- With Japan anticipated to post a trade deficit in January, may see the Bank of Japan (BoJ) come under increased pressure to implement additional monetary support ahead of its next interest rate decision on March 15.

- Despite growing interest around the 115.00 handle, will keep a close eye on former support around 116.20 (50% expansion) for new resistance.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long USD/JPY since January 29, with positioning hitting an extreme earlier this month as the ratio climbed to +3.00.

- In light of the near-term rebound in USD/JPY, the ratio continues to come off of recent extremes as it narrows to +1.88, with long positions down 15.6% from the previous week.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12092.94 | 12122.33 | 12081.83 | -0.09 | 63.77% |

Chart - Created Using FXCM Marketscope 2.0

- The USDOLLAR struggles to hold its ground as Federal Open Market Committee (FOMC) Minutes sounds more cautious this time around, with the central bank highlighting increased downside risks for growth and inflation.

- Even though the FOMC largely anticipates a ‘moderate’ recovery in the U.S., the central bank may endorse a wait-and-see approach at the next interest rate decision on March 16 as the economic outlook remains clouded with high uncertainty.

- The recent series of higher highs & lows may generate a larger rebound in the days ahead, but would like to see the RSI break out of the bearish formation from earlier this year to favor a further advance in the USDOLLAR.

Read More:

EUR/USD – Breakout Hangs in the Balance

USD/JPY Technical Analysis: Best 2-Week Run For JPY Since 1998

Crude Oil Turn in the Pipeline?

Get our top trading opportunities of 2016 HERE

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand