Talking Points:

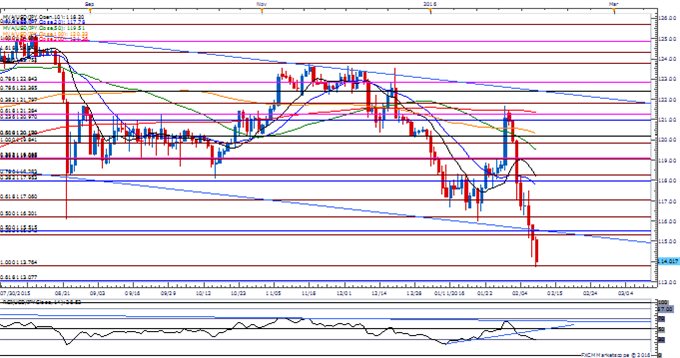

- USD/JPY Risks Further Losses as RSI Threatens Oversold Territory; Retail FX Remains Net-Long.

- Oil Fails to Preserve Opening Yearly-Range; 2002-03 Lows on Radar.

- USDOLLAR Sits at Support Following Fed Testimony- Retail Sales, U. of Michigan Confidence in Focus.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- Despite negative interest rates in Japan, USD/JPY stands at risk for a further decline as it carves a series of lower highs & lows, while the Relative Strength Index (RSI) pushes into oversold territory.

- Even though the Bank of Japan (BoJ) keeps the door open to further embark on its easing cycle, the Yen may continue to benefit from its ‘funding-currency’ status as market participants scale back their appetite for risk.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long USD/JPY since January 29, but the ratio appears to be moving back towards recent extremes as it climbs to +2.79, with 74% of traders now long.

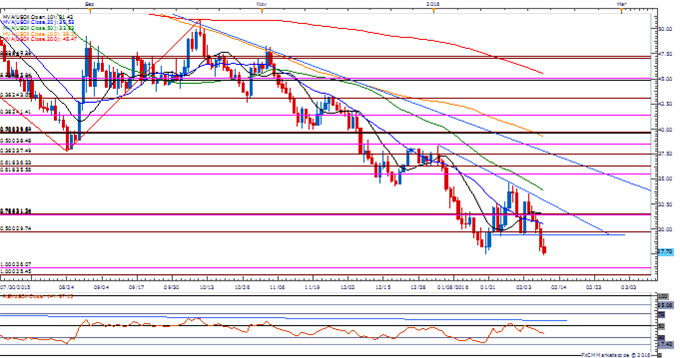

US Oil

- Even though the U.S. Department of Energy announced an unexpected 725K drop in oil inventories, crude remain at risk for a further decline as it fails to preserve the opening yearly-range, with prices breaking down from the descending triangle formation carried over from January.

- Long-term outlook remains tilted to the downside amid the slowdown in global demand; will keep a close eye on hard commodity prices as Copper looks poised to follow suit.

- Failure to hold above the January low ($27.53) may open up the next downside target around 26.10 (100% expansion), which coincides with the key support from back in 2002-03.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

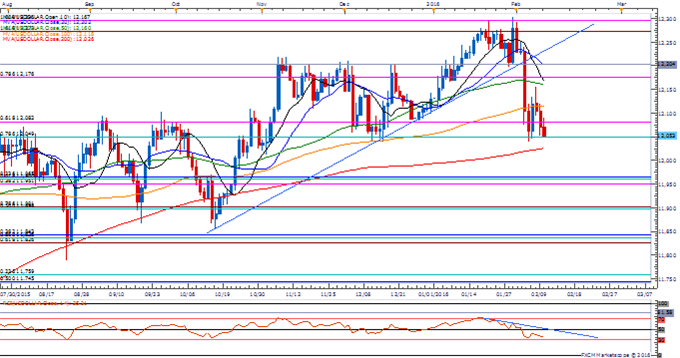

USDOLLAR(Ticker: USDollar):

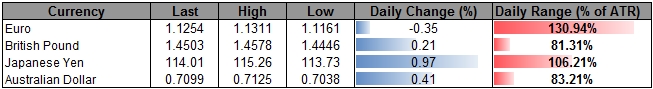

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12053.71 | 12090.85 | 12047.96 | -0.19 | 74.63% |

Chart - Created Using FXCM Marketscope 2.0

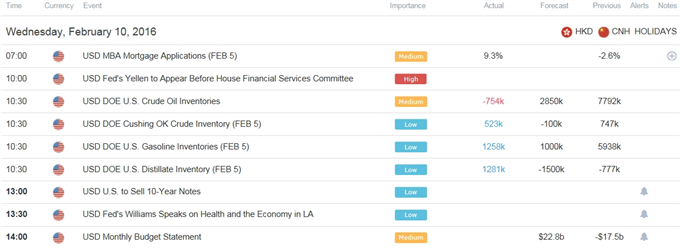

- Despite the mixed market reaction to the semi-annual Humphrey-Hawkins testimony, the USDOLLAR may stage a larger rebound in the days ahead should the greenback continue to hold/close above near-term support around 12,049 (78.6% retracement).

- Seems as though the Federal Open Market Committee (FOMC) will stay on course to normalize monetary policy as Chair Janet Yellen remains upbeat on the economy and sees the central bank achieving the 2% inflation target over the policy horizon; a rebound in U.S. Retail Sales accompanied by a pickup in the U. of Michigan Confidence survey may boost the appeal of the dollar should the data reinforce Fed expectations for a ‘consumer-led’ recovery in 2016.

- USDOLLAR may mimic the price action from December, with the first topside region of interest coming in around 12,176 (78.6% expansion) to the 12,200 pivot.

Read More:

US Crude Oil – Global Inflection Point?

EUR/USD Bullish Interpretation is Valid While above 1.1050

USD/JPY Technical Analysis: 14-Month Low Revives Reversal Focus

Get our top trading opportunities of 2016 HERE

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand