Talking Points:

- AUD/USD Manages to Hold Above 2015 Low (0.6906); Retail FX Remains Net-Long.

- USD/CAD Remains Overbought- Continues to Carve Bullish Pattern Ahead of BoC Meeting.

- USDOLLAR Strength to Gather Pace on Strong U.S. Retail Sales, U. of Michigan Confidence.

For more updates, sign up for David's e-mail distribution list.

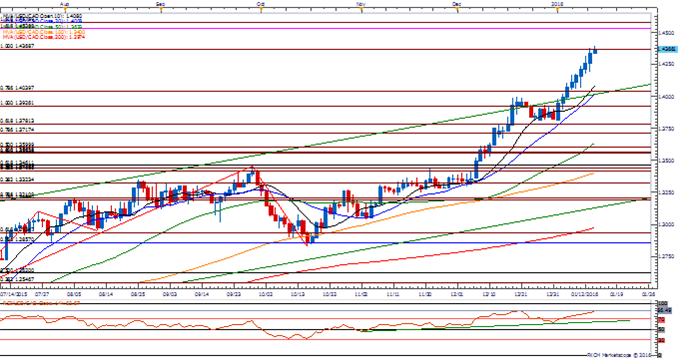

Chart - Created Using FXCM Marketscope 2.0

- Even though the long-term outlook for AUD/USD remains tilted to the downside, the failed attempts to test the 2015 low (0.6906) may encourage a near-term rebound especially as the Relative Strength Index (RSI) holds above oversold territory.

- With the Reserve Bank of Australia (RBA) sticking to a wait-and-see approach, AUD/USD may consolidate ahead of the next interest rate decision on February 2 as Australia’s Employment report continues to beat market expectations.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long AUD/USD since January 5, but the ratio appears to be working its way back towards recent extremes as it widens to +1.78, with 64% of traders now long.

USD/CAD

- USD/CAD remains at risk for a further advance as the pair continues to carve a series of higher highs & lows, while the RSI pushes back into overbought territory and preserves the bullish formation from back in November.

- Even though Canada emerges from the technical recession in 2015, there’s growing speculation that the Bank of Canada (BoC) will take additional steps at the January 20 policy meeting to insulate the ailing economy as it continues to adjust to weak oil prices.

- Waiting for a close above 1.4370 (100% expansion) to open up the next topside targets around 1.4530 (161.8% expansion) to 1.4580 (161.8% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

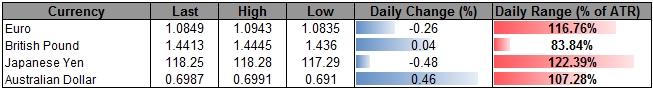

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12234.76 | 12245.04 | 12216.41 | 0.04 | 85.27% |

Chart - Created Using FXCM Marketscope 2.0

- With the USDOLLAR holding the weekly range, will keep a close eye on the slew of U.S. data coming out on Friday as U.S. Advance Retail Sales are projected to contract 0.1% following the 0.2% expansion in November, while the U. of Michigan Confidence survey is projected to increase to 92.9 from 92.6 in December.

- Mixed batch of data may drag on interest rate expectations and dampen the appeal of the greenback as St. Louis Fed President James Bullard, a 2016 voting-member on the Federal Open Market Committee (FOMC) scales back his hawkish tone and sees a risk of persistent weak energy prices potentially impacting the real economy.

- Nevertheless, will keep constructive view for the USDOLLAR as it holds above former channel resistance around 12,200, with 12,273 (161.8% expansion) to 12,296 (100% expansion) still on the radar.

Read More:

Price & Time: GBP/USD: Is this only getting started?

Bearish EUR/USD: Eyeing New 2016 Lows

COT-Large Speculators Flip to Net Long Japanese Yen Position

USD/CAD Technical Analysis: Multiple Major Targets Hit This Morning

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand