Talking Points:

- Gold Bounces Off of Former-Resistance; Retail Crowd Remains Net-Long.

- EUR/JPY Risks Larger Rebound as RSI Threatens Bearish Formation.

- USDOLLAR Holds Narrow Range Following Mixed Fed Commentary.

For more updates, sign up for David's e-mail distribution list.

XAU/USD

Chart - Created Using FXCM Marketscope 2.0

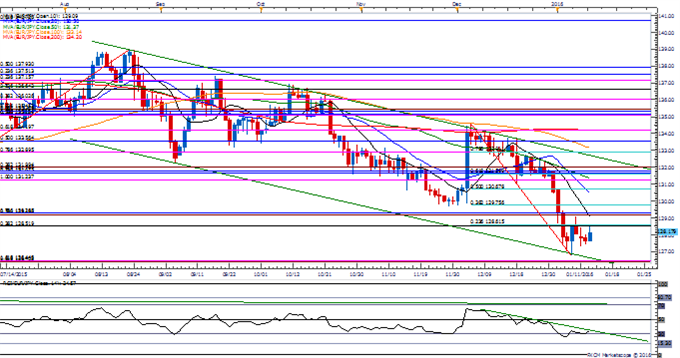

- Gold prices stand at risk of extending the rebound from the end of 2015 as the precious metal comes off of former resistance around $1,080 (23.6% retracement), while the Relative Strength Index (RSI) largely retains the bullish formation from back in November.

- Despite the failure to break below $1,045 (61.8% expansion), the longer-term outlook remains tilted to the downside as gold prices come off of a lower-lower, and the precious metal may continue to lose its appeal in 2016 amid rising U.S. interest rate expectations paired with the disinflationary environment across the major industrialized economies.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long XAU/USD coming into 2016, but the ratio appears to be moving back towards recent extremes as it climbs to +2.25, with 69% of traders now long.

- Despite the easing cycle in the euro-area & Japan, the near-term decline in EUR/JPY appears to be getting exhausted as the RSI comes off of oversold territory and threatens the bearish formation carried over from the previous month.

- With the euro-yen carving out a lower-low at the beginning of the month, a near-term correction may give way to a lower-high over the coming days/weeks as the pair preserves the descending channel formation from back in August.

- Waiting for a close above 128.50 (38.2% retracement) to 128.60 (23.6% retracement) along with a bullish break in the RSI in order to favor a larger recovery.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

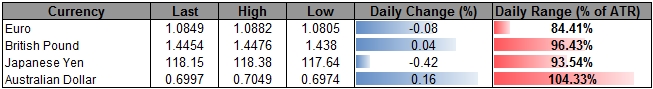

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12224.32 | 12235.42 | 12216.69 | 0.04 | 55.77% |

Chart - Created Using FXCM Marketscope 2.0

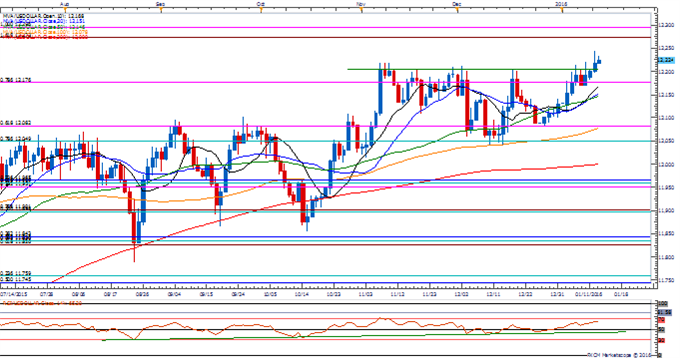

- Long-term outlook for the USDOLLAR remains bullish as it breaks the November range while Richmond Fed President Jeffrey Lacker and Dallas Fed President Robert Kaplan anticipate higher U.S. borrowing-costs in 2016.

- However, recent comments from Boston Fed President Eric Rosengren may point to a growing dissent within the committee as the 2016 FOMC voting-member sees ‘downside risks’ to the central bank outlook.

- Will keep a close eye on the topside targets around 12,273 (161.8% expansion) to 12,296 (100% expansion) as the dollar breaks out of the range-bound price action carried over from back in November.

Read More:

USD/CAD Technical Analysis: Multiple Major Targets Hit This Morning

Price & Time: NZD/USD: Starting Down or Bullish Backtest?

WTI Crude Oil Price Forecast: The Unthinkable $30 Level Approaches

Bearish EURUSD: Eyeing New 2016 Lows

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand