Talking Points:

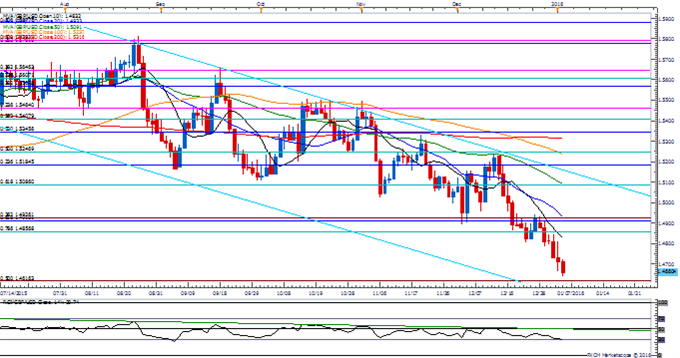

- GBP/USD Retail FX Crowd Remains Heavily Net-Long as Pair Slips to Fresh Monthly Low.

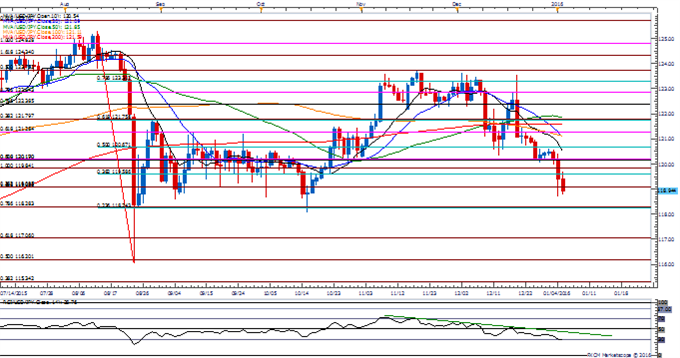

- USD/JPY October Low (118.05) on Radar as BoJ Continues to Endorse Wait-and-See Approach.

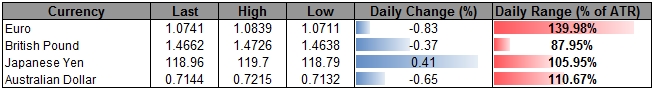

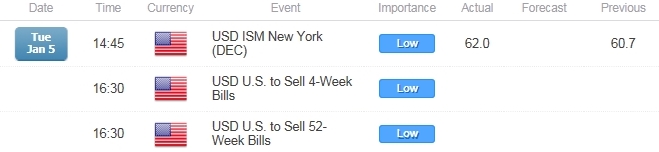

- USDOLLAR Approaches Range Resistance Ahead of FOMC Meeting Minutes.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD may continue to give back the rebound from the April low (1.4565) as the pair retains the downward trend from back in August; will keep a close eye on the Relative Strength Index (RSI) as it flirts with oversold territory for the first time since September.

- With the Markit U.K. Purchasing Manager Index (PMI) highlighting a faster expansion in building activity, signs of a stronger recovery may spur a larger dissent at the Bank of England’s (BoE) January 14 interest rate decision as Governor Mark Carney continues to prepare households and businesses for higher borrowing-costs.

- Despite the ongoing decline in the exchange rate, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long GBP/USD since November 19, while the ratio approaches near-term extremes as it climbs to +2.82, with 74% of traders now long.

USD/JPY

- USD/JPY stands at risk for a further decline as the RSI retains the bearish formation from November, with the oscillator pushing into oversold territory for the first time since August as market participants appear to be scaling back their appetite for risk.

- Despite bets for additional monetary easing, the Bank of Japan (BoJ) may continue to endorse a wait-and-see approach at the January 29 rate decision as Governor Haruhiko Kuroda remains sees the region achieving the 2% inflation goal over the policy horizon.

- May see USD/JPY work its way back towards the October low (118.05) should the risk-adverse market continue to take shape,with a break/close below 118.20 (23.6% retracement) to 118.30 (78.6% expansion) raising the risk for a test of the August low (116.07).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12186.59 | 12201.05 | 12148.7 | 0.24 | 125.24% |

Chart - Created Using FXCM Marketscope 2.0

- Long-term outlook for the USDOLLAR remains bullish as the Federal Open Market Committee (FOMC) remains on course to implement higher borrowing-costs in 2016 but, the greenback may continue to face range-bound prices ahead of the Non-Farm Payrolls (NFP) report as market participants anticipate another 200K expansion in December.

- Will keep a close eye fresh comments from St Louis Fed President James Bullard, Kansas City Fed President Esther George, Cleveland Fed President Loretta Mester and Boston Fed President Eric Rosengren as they rotate into the 2016 FOMC; may need a marked pickup in price/wage growth to spur a more hawkish central bank especially as the U.S. economy approaches full-employment.

- Near-term support stands around 12,049 (78.6% retracement) to 12,082 (61.8% expansion), with 12,273 (161.8% expansion) to 12,296 (100% expansion) on the radar.

Read More:

Price & Time: EURUSD - Still In No Man’s Land

China Securities Regulator Guarantees No Extended Sell-off in January

Bearish NZDUSD As Double-Topping Pattern Develops on Divergence Into 200-DMA

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand