Talking Points:

- EUR/USD Rips as ECB Easing Package Disappoints; Retail Crowd Flips Net-Short.

- USD/CAD Range at Risk on Dismal Canada Employment Report.

- USDOLLAR to Recoup Losses on Strong U.S. Non-Farm Payrolls (NFP) Report.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- Even though the European Central Bank (ECB) reduces the deposit-rate by another 10bp and extends the duration as well as the scope of its asset-purchase program, the reaction to the interest rate decision suggests market participants were looking for a more aggressive easing program, with the pair at risk of facing a larger correction as it climbs back above former-support around 1.0800 (78.6% expansion).

- Long-term outlook for the Euro remains bearish as ECB President Mario Draghi keeps the door open to further embark on the easing cycle but, the topside targets remain in focus, with the key region of interest coming in around 1.1090 (50% retracement).

- Despite the spike in the exchange rate, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd has flipped net-short EUR/USD following the ECB announcement, with the ratio dipping to -1.58 as 39% of traders are now long.

USD/CAD

- USD/CAD may make a more meaning attempt to test the 2015 high (1.3456) as Canada’s Employment report is expected to contract 10.0K in November; will keep a close eye on the near-term range as the pair continues to close above 1.3280 (78.6% expansion) in December.

- Despite the limited market reaction to the Bank of Canada (BoC) interest rate decision, USD/CAD stands at risk for a move higher as the Relative Strength Index (RSI) continues to threaten the bearish formation carried over from back in September.

- The long-term outlook for USD/CAD remains bullish amid the deviating paths for monetary policy, but the pair may continue to face range-bound prices until it clears the key resistance zone around 1.3440 (50% expansion) to 1.3460 (61.8% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

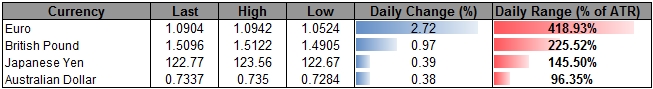

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12092.62 | 12201.06 | 12085.27 | -0.75 | 274.69% |

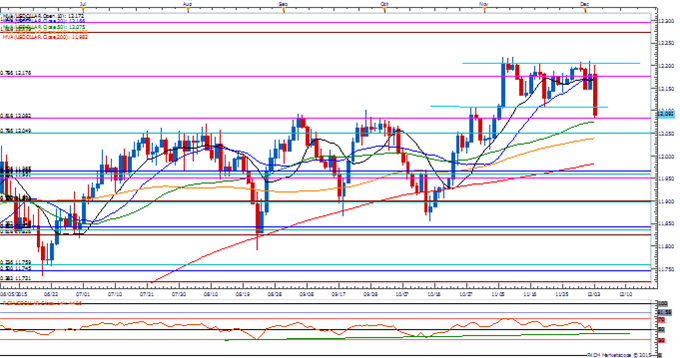

Chart - Created Using FXCM Marketscope 2.0

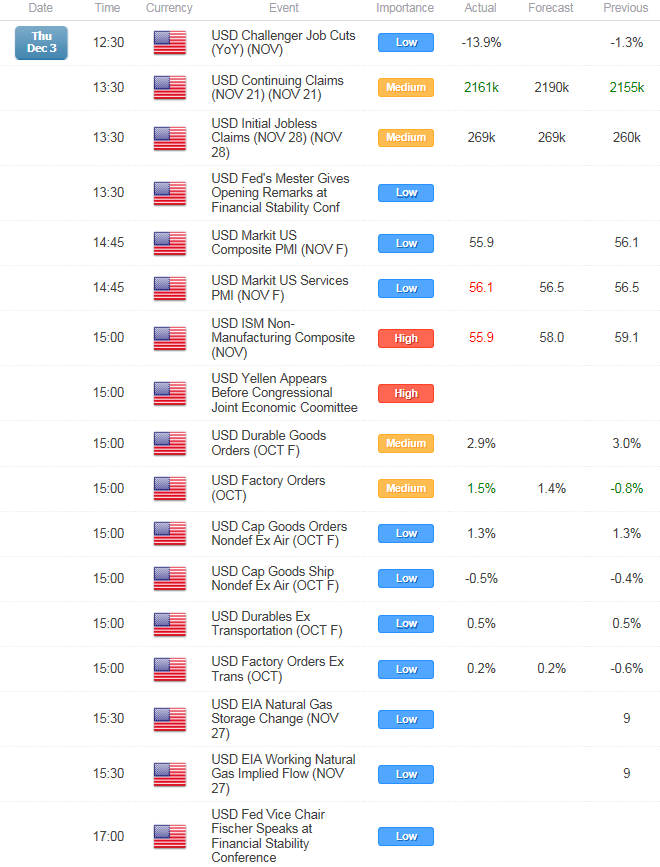

- The near-term pullback in the USDOLLAR may be short-lived as Fed Chair Janet Yellen largely endorses a 2015 liftoff, while U.S. Non-Farm Payrolls (NFP) are projected to increase another 200K in November.

- However, a further deterioration in the labor Participation Rate accompanied by a slowdown in Average Hourly Earnings may encourage the Federal Open Market Committee (FOMC) to carry the zero-interest rate policy (ZIRP) into 2016 amid the disinflationary environment.

- Failure to retain the near-term range raises the risk for a larger pullback in USDOLLAR, with the former-resistance around 12,049 (78.6% retracement) to 12,082 (61.8% expansion) in focus as the greenback searches for support.

*As we approach the holidays and thus illiquid markets, it's worth reviewing principles that help protect your capital. We call these principles the "Traits of Successful Traders."

Three Factors Warn of Perfect Storm in FX Markets - Caution Advised

Read More:

EUR/USD Takes a Nosedive as Near Zero CPI Fuels ECB bets

AUD/JPY Rally Approaching Initial Resistance Hurdle

COT - Gold Ownership Profile Similar to Prior Price Lows

US DOLLAR Technical Analysis: USD Set To Outperform On Center Stage?

USD/CAD Technical Analysis: Bearish Wedge Pattern Running Out of Real Estate

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand