Talking Points:

- AUD/USD Outlook Mired by IMF- Argues Aussie ‘Looks Relatively High.’

- USD/CAD Bearish RSI Trigger to Foreshadow Larger Pullback.

- USDOLLAR Holds Tight Range Ahead of Federal Open Market Committee (FOMC) Rate Decision.

For more updates, sign up for David's e-mail distribution list.

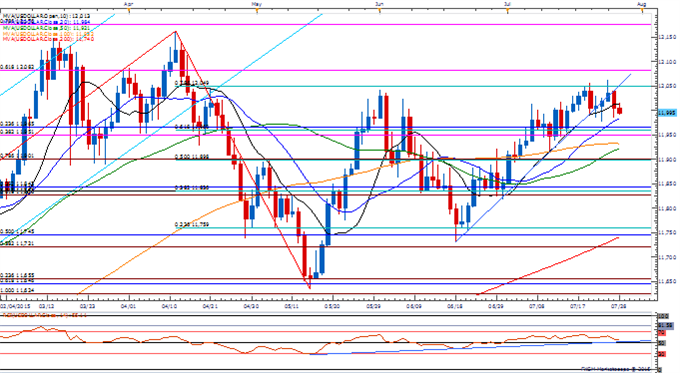

Chart - Created Using FXCM Marketscope 2.0

- AUD/USD remains at risk for a further decline as the International Monetary Fund (IMF) warns that the aussie ‘looks relatively high when set against the fall in the terms of trade’ and argues that ‘further monetary accommodation could be warranted’ as the region continues to grapple with below-trend growth.

- Will continue to favor the downside targets for AUD/USD as long as price & RSI retain the bearish formation from back in May, while the Reserve Bank of Australia (RBA) retains the verbal intervention on the local currency.

- Nevertheless, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long AUD/USD since May 15, but the ratio continues to come off of extremes as it sits at +2.64, with 73% of traders long.

USD/CAD

- Long-term outlook for USD/CAD remains bullish as the Bank of Canada (BoC) highlights a dovish outlook for monetary policy, but the pair may face a near-term pullback should the RSI push back below 70 and come off of overbought territory.

- With Canada’s Gross Domestic Product (GDP) report expected to show zero growth for May, signs of a slowing recovery may produce further headwinds for the loonie, while the BoC may pay increased attention to the renewed decline in energy prices as the central bank remains cautious on the economy.

- Break below near-term support around 1.2940 (78.6% retracement) to 1.2950 (50% expansion) may spur a move back towards former resistance around 1.2800 (38.2% expansion) to 1.2833 (March high).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD/JPY Waiting on the FOMC For Direction

Webinar: Key USD Scalp Levels For Month End- GBP Crosses in Focus

USDOLLAR(Ticker: USDollar):

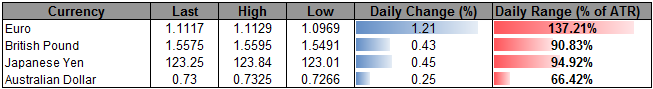

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11991.59 | 12042.48 | 11984.07 | -0.38 | 113.17% |

Chart - Created Using FXCM Marketscope 2.0

- The limited market reaction to the batch of U.S. data suggest the Dow Jones-FXCM U.S. Dollar may hold a tight range ahead of the Federal Open Market Committee (FOMC) interest rate decision; may see another unanimous vote to retain the current policy even as the central bank stays on course to normalize monetary policy in 2015.

- Will keep a close eye on the Fed’s outlook for price growth amid the recent decline in energy prices along with the disinflation environment across the major industrialized economies, but the committee may look to buy more time amid the ongoing mixed data prints coming out of the region.

- Will keep a close eye on the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) for soft support, while we still need a close above 12,049 (78.6% retracement) to favor a resumption of the long-term bullish trend.

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums