Talking Points:

- EUR/USD Holds Weekly Range Despite Growing Threat for Greek Default/Exit.

- USD/JPY Range Support in Focus as Bank of Japan (BoJ) Endorses Wait-and-See Approach.

- USDOLLAR to Consolidate Further as Subdued Price Growth Undermines September Fed Liftoff.

For more updates, sign up for David's e-mail distribution list.

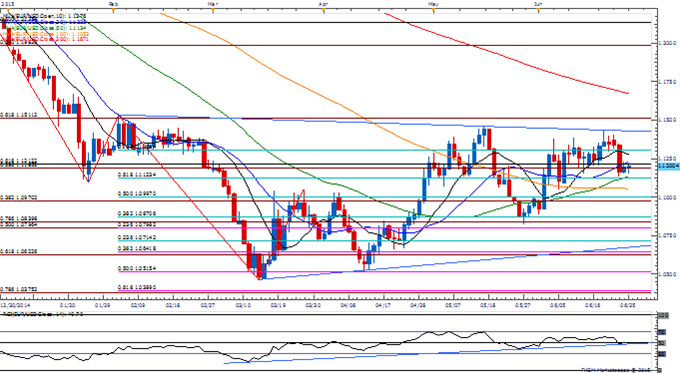

Chart - Created Using FXCM Marketscope 2.0

- Despite the growing threat for a Greek event, the failure to push back below 1.1120 (61.8% retracement) may continue to produce range-bound prices in EUR/USD; still waiting on a break of the bullish RSI momentum to favor a further decline in the exchange rate.

- Growing threat for contagion should weigh on the single currency, but the Euro remains at a risk for a relief bounce should Greece avoid default/exit; long-term outlook remains bearish as the European Central Bank (ECB) pledges to fully-implement the quantitative easing program.

- Nevertheless, DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short EUR/USD since March 9, but seeing the ratio holding near extremes as it sits at -1.96.

USD/JPY

- Failure to close above 124.30-40 (161.8% expansion) may continue to produce range-bound prices in USD/JPY especially as the Bank of Japan (BoJ) largely endorses a wait-and-see approach.

- Despite speculation of seeing a further expansion in the asset-purchase program in the months ahead, the Japanese Yen may face limited losses over the remainder of the year as Governor Haruhiko Kuroda appears to be softening the verbal intervention on the local currency & looks for stability in the exchange rate.

- Will keep a close eye on range support coming in around 122.30-40 (78.6% retracement) as the RSI retains the bullish momentum carried over from the previous year.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

USDJPY Runs Into Key Resistance- Short Scalps Favored Sub 124.35

Price & Time: EUR/USD Double Top or About to Breakout?

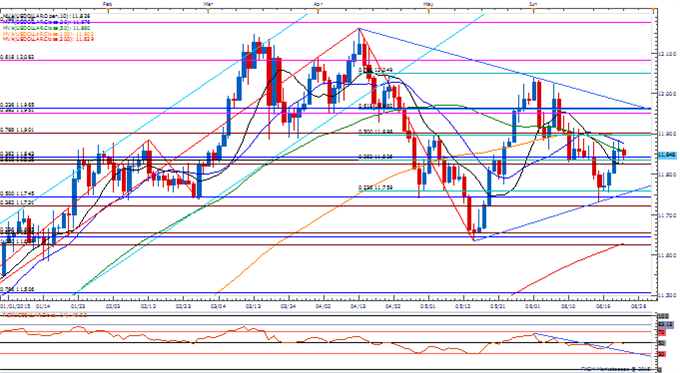

USDOLLAR(Ticker: USDollar):

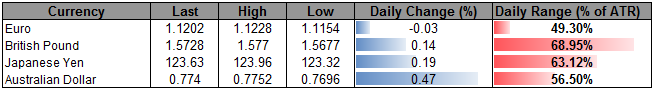

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11848.87 | 11866.61 | 11836.64 | -0.11 | 41.17% |

Chart - Created Using FXCM Marketscope 2.0

- Even though the Fed remains on course to normalize monetary policy later this year, the Dow Jones-FXCM U.S. Dollar may continue to consolidate in the days ahead as it struggles to push back above former support around 11,898 (50% retracement) to 11,901 (78.6% expansion).

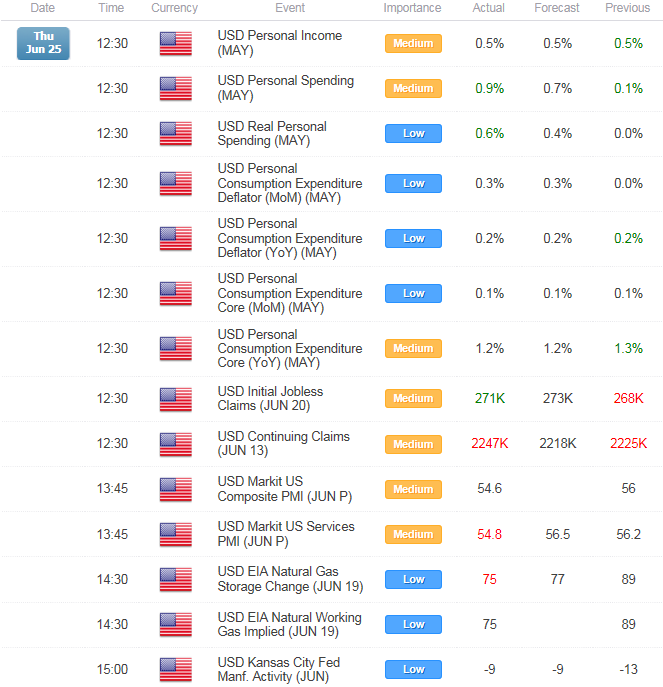

- The pickup in Personal Spending boosts the outlook for growth, but the ongoing weakness in the core Personal Consumption Expenditure (PCE) may become a growing concern for the Fed as it limits the scope to achieve the 2% target for inflation.

- Lack of momentum to close above the former support region may bring the 11,745 (50% retracement) to 11,759 (23.6% retracement) back on the rader.

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums